RBC Bearings (RBC) Valuation Check As Margin Expansion And Aerospace Demand Support A Premium Rating

RBC Bearings (RBC) stayed in focus after its latest quarterly update highlighted firm margins, steady aerospace and industrial demand, and support from a solid balance sheet. Together, these factors help explain the stock’s valuation premium.

See our latest analysis for RBC Bearings.

RBC Bearings’ share price has moved to $458.79, with a 90-day share price return of 22.85% and a 1-year total shareholder return of 52.77%, pointing to firm momentum backed by its margin and aerospace narratives.

If RBC’s recent strength has caught your attention, this could be a good moment to see what else is moving in aerospace and defense stocks.

With the shares up strongly over the past year and trading only about 5% below the average analyst price target, the key question now is whether RBC Bearings still offers upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 4.8% Undervalued

The most followed narrative suggests a fair value of about $482 per share versus the last close of $458.79, anchoring a modest undervaluation call that leans heavily on growth and margin assumptions.

Ongoing capacity expansions and selective CapEx in key growth businesses (notably aerospace and defense) are aligned with rising OEM build rates and new long-term contracts, positioning the company to capture increased content per aircraft/engine and strengthen gross margins and earnings as OEM production ramps up.

Curious what kind of revenue runway and margin step up need to line up to justify that price tag? The narrative leans on compound growth, expanding profitability, and a rich future earnings multiple that is usually associated with faster growing sectors. Want to see exactly how those moving parts stack together to arrive at this fair value?

Result: Fair Value of $482 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on supply chains keeping specialty materials flowing and key aerospace customers maintaining current sourcing and production plans without unexpected slowdowns.

Find out about the key risks to this RBC Bearings narrative.

Another Take: High Multiple Signals Valuation Risk

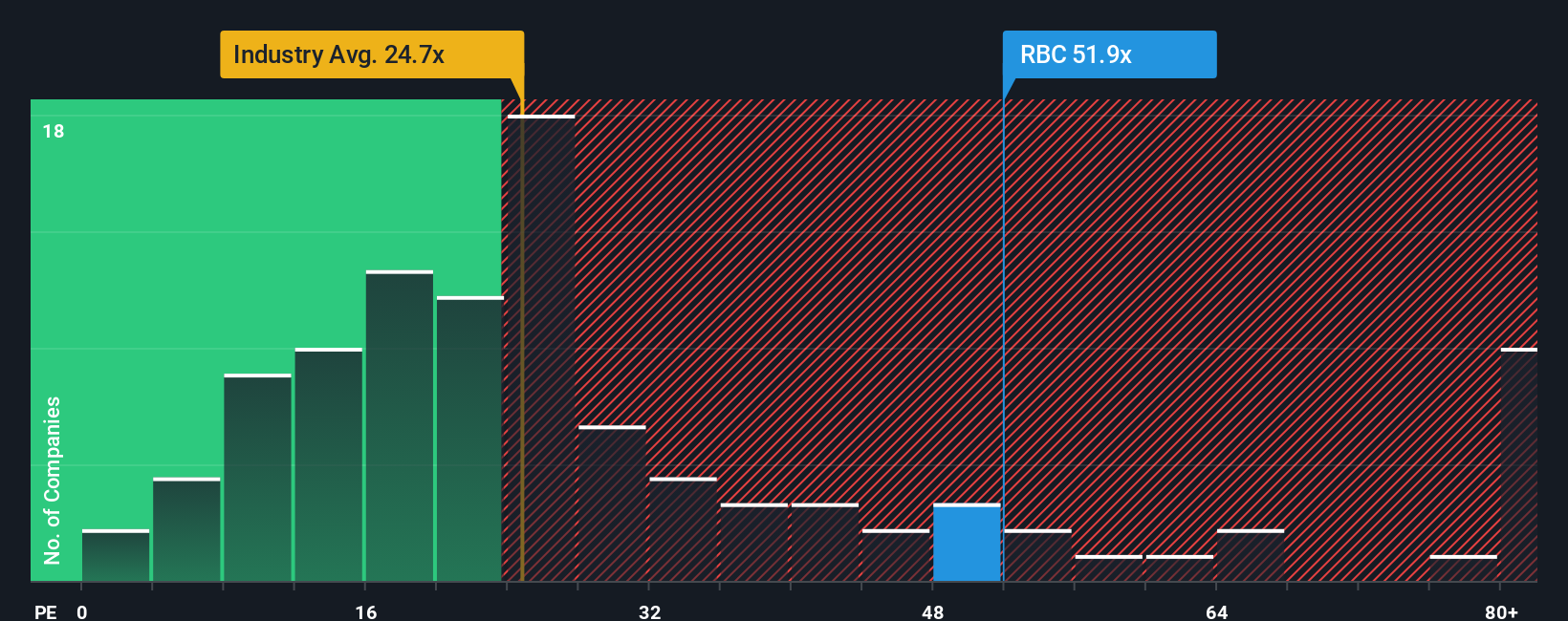

That 4.8% undervaluation narrative sits uncomfortably next to how the market is actually pricing RBC Bearings today. The shares trade on a P/E of 56x, compared with 25.1x for the US Machinery industry, 28.1x for peers, and a fair ratio of 29.9x suggested by our model.

Put simply, the current P/E is almost double where the fair ratio points, and well above sector and peer levels. This raises the question of how much execution risk investors may be taking on for that extra growth story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RBC Bearings Narrative

If you see the assumptions differently or would rather test the numbers yourself, you can build a custom view of RBC Bearings in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RBC Bearings.

Looking for more investment ideas?

If RBC Bearings has sharpened your interest, do not stop here. Use the same tools to spot other opportunities that could fit your portfolio goals.

- Target income-focused ideas by scanning these 14 dividend stocks with yields > 3% that may suit investors who want yields above 3% with room for company specific stories.

- Spot potential mispricings by reviewing these 875 undervalued stocks based on cash flows that screen on cash flow based value rather than headline excitement.

- Get ahead of the next big theme by checking out these 79 cryptocurrency and blockchain stocks where equity stories tie into digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com