Evaluating Martin Marietta Materials (MLM) Valuation After Recent Steady Share Performance

With no specific news headline driving Martin Marietta Materials (MLM) today, investors may be looking instead at how its recent share moves and fundamentals compare with its longer term return figures and current earnings profile.

See our latest analysis for Martin Marietta Materials.

At a share price of $634.44, Martin Marietta Materials has seen relatively modest near term moves, with a 1 day share price return of 1.89%. Its 1 year total shareholder return of 23.34% and 3 year total shareholder return of 87.14% suggest that longer term momentum has been stronger than the recent price action.

If this kind of steady compounding interests you, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership as potential next ideas.

So with the share price not far from analyst targets and recent returns already strong, is Martin Marietta Materials still offering value at today’s levels, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 4.8% Undervalued

With Martin Marietta Materials last closing at $634.44 versus a narrative fair value of $666.29, the current price sits slightly below that estimate, which rests on specific assumptions about future growth, profitability and valuation multiples.

The analysts have a consensus price target of $648.227 for Martin Marietta Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $725.0, and the most bearish reporting a price target of just $440.0.

Curious what kind of earnings path, margin profile and future P/E multiple are built into that fair value? The narrative leans on specific growth, profitability and discount rate assumptions that you might or might not agree with.

Analysts in this narrative are effectively tying together expected revenue expansion, higher profit margins and a future P/E that sits above the current industry level, all discounted back using an 8.20% rate. Their view implies that today’s price already reflects a meaningful portion of those expectations, with only a modest gap to the consensus target and to the $666.29 fair value estimate.

Result: Fair Value of $666.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on construction demand and government infrastructure funding remaining stable. Prolonged weakness or delays in these areas could quickly challenge those fair value assumptions.

Find out about the key risks to this Martin Marietta Materials narrative.

Another View: Market Pricing Sends A Different Signal

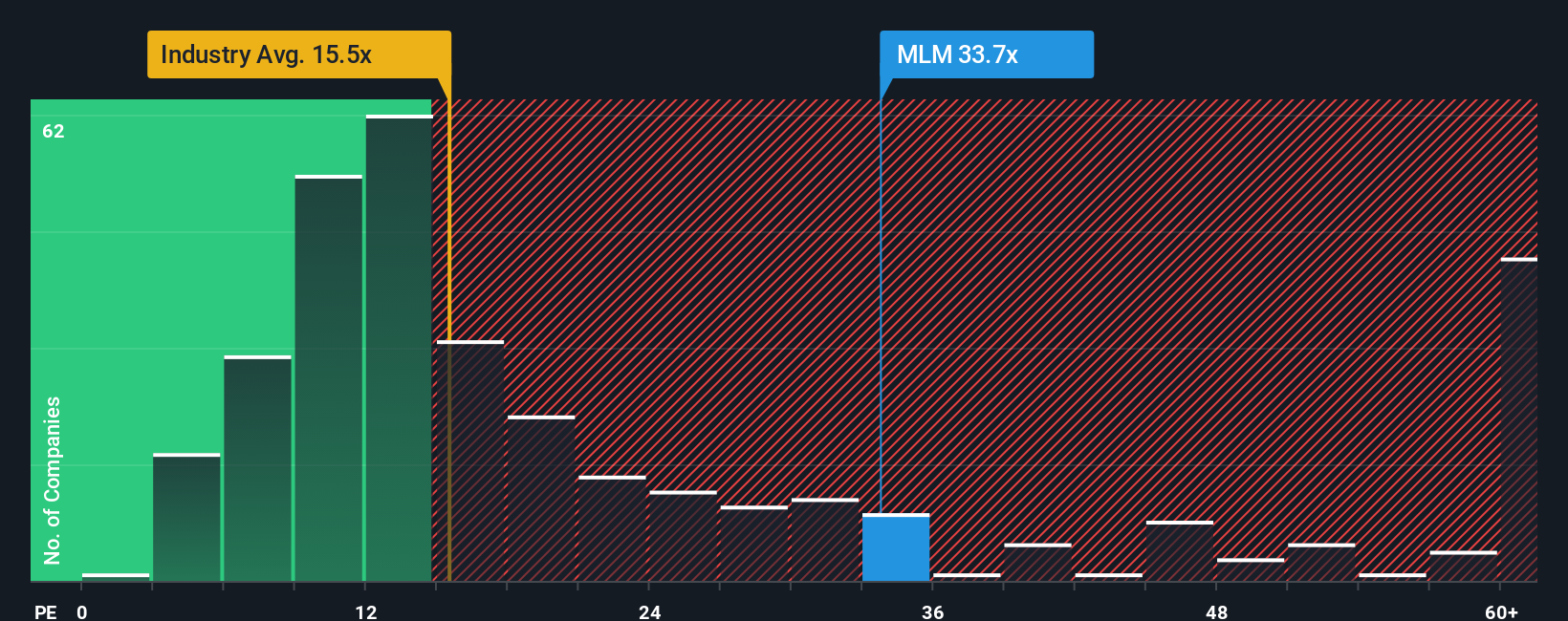

The fair value narrative suggests Martin Marietta Materials is about 4.8% undervalued, but the current P/E of 32.3x tells a tougher story. It is higher than the estimated fair ratio of 23.2x, above the peer average of 25.6x, and well ahead of the global Basic Materials average of 15.4x.

That kind of premium can reflect quality, but it also increases the risk that any disappointment in earnings or sector demand hits the share price harder. The question for you is whether this gap feels like justified confidence or a margin of safety that has already been used up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If parts of this view do not sit right with you, or you would rather lean on your own work, you can shape a full Martin Marietta Materials story yourself in just a few minutes, starting with Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with one company. Use the screener to spot opportunities that others might miss.

- Target dependable income by scanning for companies in these 14 dividend stocks with yields > 3% that may complement a long term, cash flow focused approach.

- Tap into potential mispricing by reviewing these 874 undervalued stocks based on cash flows that could offer a wider margin between market price and fundamentals.

- Position yourself for long term trends by checking out these 29 healthcare AI stocks where technology and medicine intersect in listed companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com