How Investors Are Reacting To Air Products (APD) Boosted Hydrogen Offtake Visibility And Project Funding Progress

- Recently, Bernstein SocGen Group reaffirmed its Outperform rating on Air Products and Chemicals after the company announced progress on its Louisiana Clean Energy Complex and the NEOM Green Hydrogen Project, including a collaboration intended to fund around 25% of the Darrow facility’s costs.

- The update was interpreted as strengthening long-term demand visibility for both blue and green hydrogen, easing earlier concerns about offtake risk for these megaprojects.

- Next, we’ll examine how this renewed confidence in long-term hydrogen offtake could influence Air Products and Chemicals’ investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Air Products and Chemicals Investment Narrative Recap

To own Air Products and Chemicals, you need to believe in the long-term buildout of low carbon hydrogen and ammonia while the company manages heavy capital spending and currently thin earnings. The latest NEOM and Louisiana updates slightly ease near term worries about offtake risk, but the main swing factor in the short term still looks like execution on these megaprojects, with the biggest risk being cost overruns and delays that keep capital tied up and pressure free cash flow.

The recent announcement that Yara may fund around 25% of the Louisiana Clean Energy Complex in Darrow, in exchange for long term low carbon ammonia offtake, is particularly relevant. It directly links a large share of project output to a committed buyer, addressing demand visibility and potentially supporting returns on Air Products’ substantial capital in process, while still leaving investors exposed to timing, cost, and competitive pressures in clean hydrogen.

Yet investors should be aware that if project costs rise or timelines slip, the impact on free cash flow and dividend cover could...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' narrative projects $14.9 billion revenue and $3.8 billion earnings by 2028. This requires 7.4% yearly revenue growth and a roughly $2.2 billion earnings increase from $1.6 billion today.

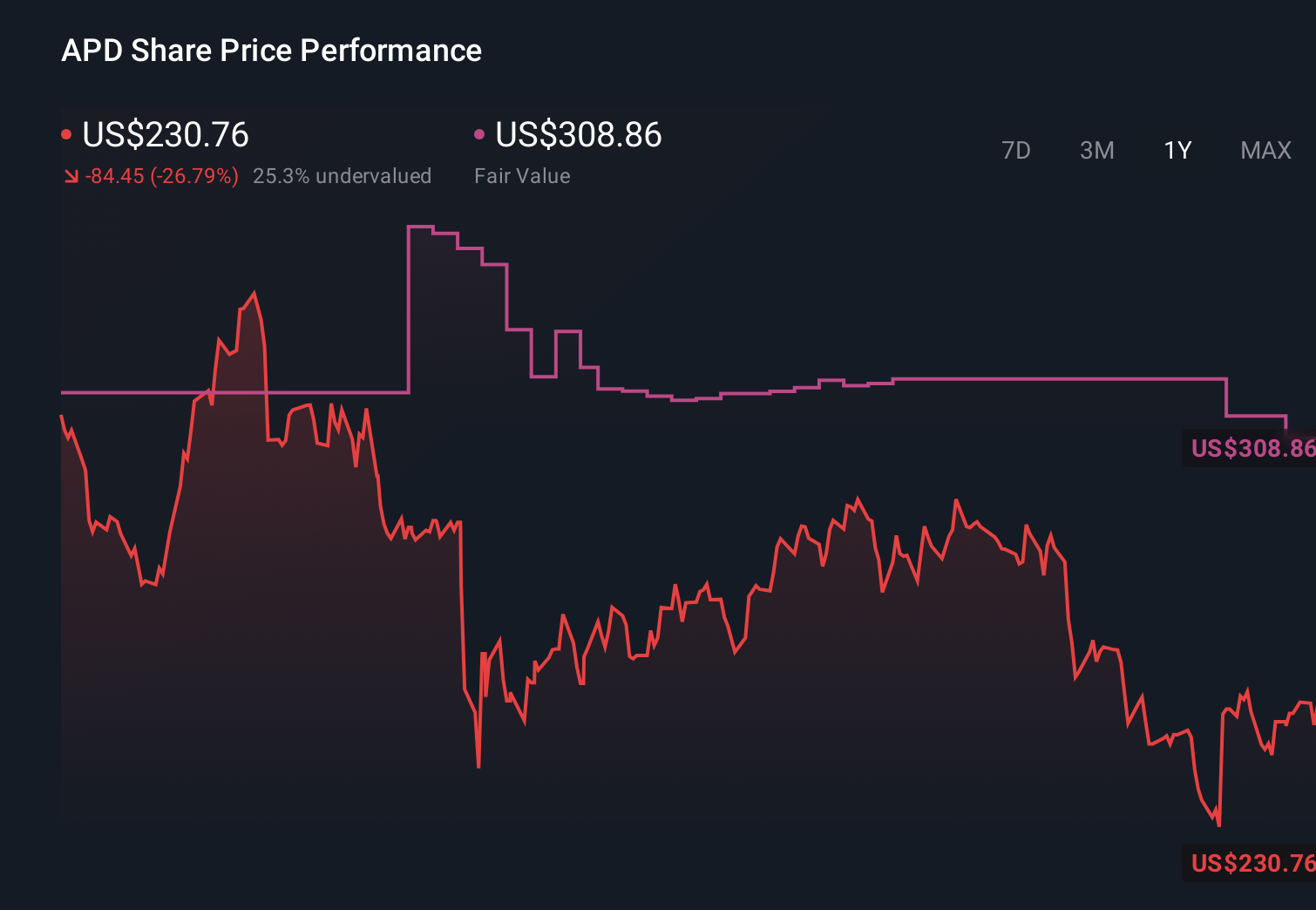

Uncover how Air Products and Chemicals' forecasts yield a $292.86 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$258.99 to US$292.86, underscoring how differently individuals view Air Products’ potential. You are weighing those varied opinions against a business still committing large sums to hydrogen megaprojects where delays, cost inflation, or weaker returns could materially affect future performance and shareholder outcomes.

Explore 4 other fair value estimates on Air Products and Chemicals - why the stock might be worth as much as 17% more than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com