A Look At Keysight Technologies (KEYS) Valuation After Recent Share Price Strength And Long Term Returns

Keysight Technologies (KEYS) is back in focus after recent trading left the stock around $206.59, with the move coming against a mix of short term weakness and stronger multi year total returns.

See our latest analysis for Keysight Technologies.

At the current share price of $206.59, Keysight’s recent 1 day share price gain sits against a softer 1 month share price return of 1.85% and a stronger 90 day share price return of 21.47%. The 1 year total shareholder return of 25.02% and 5 year total shareholder return of 37.59% point to momentum that has been building over longer periods rather than fading.

If Keysight has you thinking about where else capital might work hard in tech, this could be a good moment to scout high growth tech and AI stocks for other potential ideas.

With Keysight trading near $206.59, annual revenue of about $5.4b and net income of $869.0m, the key question is whether that combination still leaves room for upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 6% Undervalued

With Keysight closing at $206.59 against a narrative fair value of about $220, the storyline leans modestly positive and hinges on specific growth drivers and margin expectations.

Expansion of software and recurring service offerings, now comprising 36% and 28% of total revenue respectively, increases gross and net margins by enhancing revenue stability, improving product mix, and reducing cyclicality from traditional hardware segments.

Want to see what kind of revenue growth, margin uplift, and future earnings multiple are embedded in that fair value? The full narrative lays out an earnings ramp, a richer mix of software and services, and a premium P/E that all have to line up. Curious which assumptions matter most if this price target is to hold up?

Result: Fair Value of $219.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story can quickly look different if new tariffs bite harder than planned, or if AI infrastructure spending cools faster than analysts currently expect.

Find out about the key risks to this Keysight Technologies narrative.

Another Angle On Value

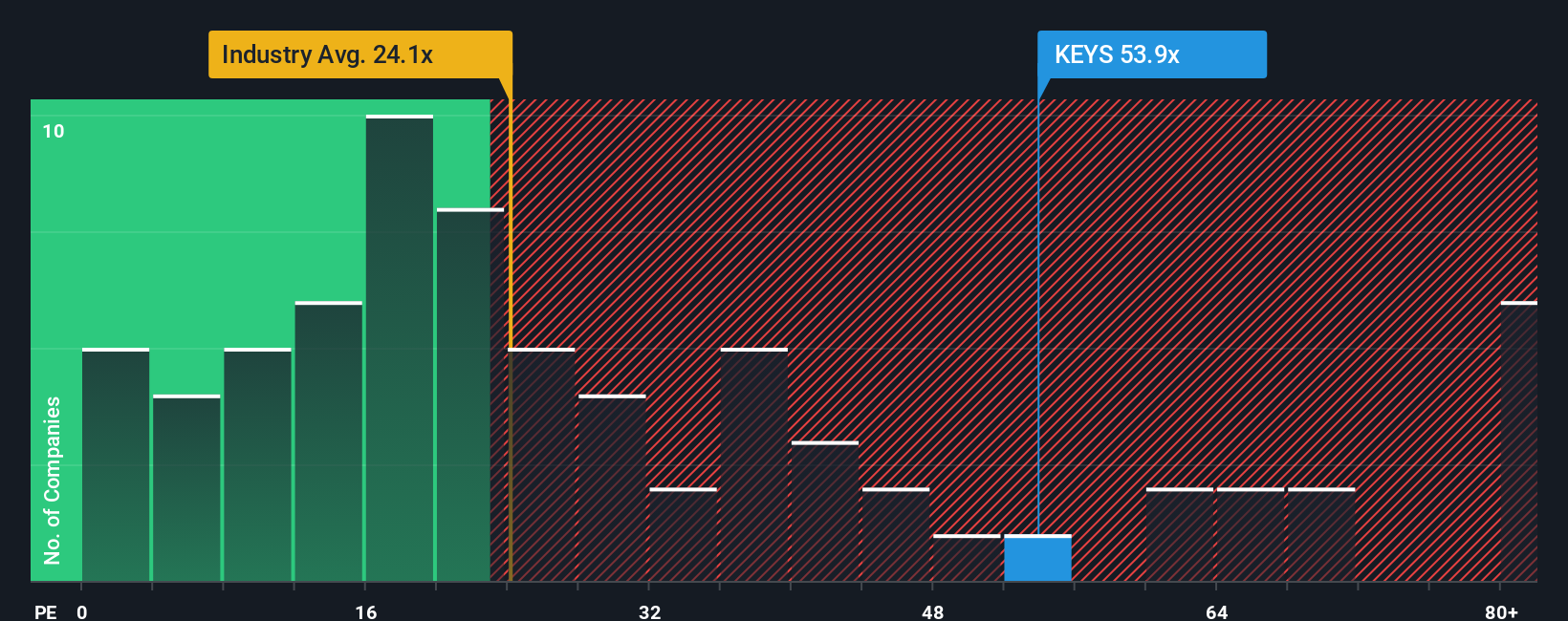

While the fair value narrative points to about $220 as a reasonable anchor, the earnings multiple sends a cooler signal. At a P/E of 40.8x versus an industry average of 24.7x and a fair ratio of 28x, the gap suggests valuation risk if expectations ease. Which signal do you weigh more heavily?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keysight Technologies Narrative

If this storyline does not quite fit how you see Keysight, you can stress test the numbers yourself and build a version that matches your view: Do it your way.

A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Hunt for More Ideas?

If Keysight has sharpened your interest, do not stop here. Widen your watchlist now or you could miss opportunities sitting in plain sight.

- Spot potential mispricing early by scanning these 867 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride major tech shifts by zeroing in on these 25 AI penny stocks positioned around artificial intelligence themes.

- Tap into potential income ideas with these 14 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com