Assessing Coeur Mining (CDE) Valuation After Strong Long Term Returns And Higher Earnings Multiple

With no single fresh headline driving attention today, Coeur Mining (CDE) has drawn interest as investors weigh its recent share performance, profitability figures, and value metrics within the broader precious metals sector.

See our latest analysis for Coeur Mining.

Recent trading reflects mixed momentum, with a 10.66% 1 month share price return contrasting with weaker 7 day and 90 day share price returns. At the same time, the 1 year total shareholder return of 187.23% and 3 year total shareholder return of about 4x highlight how strongly longer term holders have fared.

If Coeur Mining has you looking across the precious metals space, it can also be a useful time to broaden your watchlist with fast growing stocks with high insider ownership.

With revenue of about $1.7b, net income of roughly $408.8m and indications of a possible intrinsic discount of around 41%, Coeur’s valuation raises the key question: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 15.9% Undervalued

With Coeur Mining last closing at US$17.55 versus a narrative fair value of US$20.86, the valuation hinges heavily on ambitious growth assumptions and margin expansion.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production, positioning Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

Curious how higher production, wider margins and a re-rated earnings multiple combine to reach that fair value? The narrative leans on assertive top line growth, rising profitability and a lower future P/E than many peers assume. The exact mix of those inputs may surprise you.

Result: Fair Value of $20.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story can quickly be challenged if higher regulatory hurdles slow projects like Silvertip, or if exploration at key assets fails to replace depleted reserves.

Find out about the key risks to this Coeur Mining narrative.

Another View: Valuation Looks Tight On Earnings

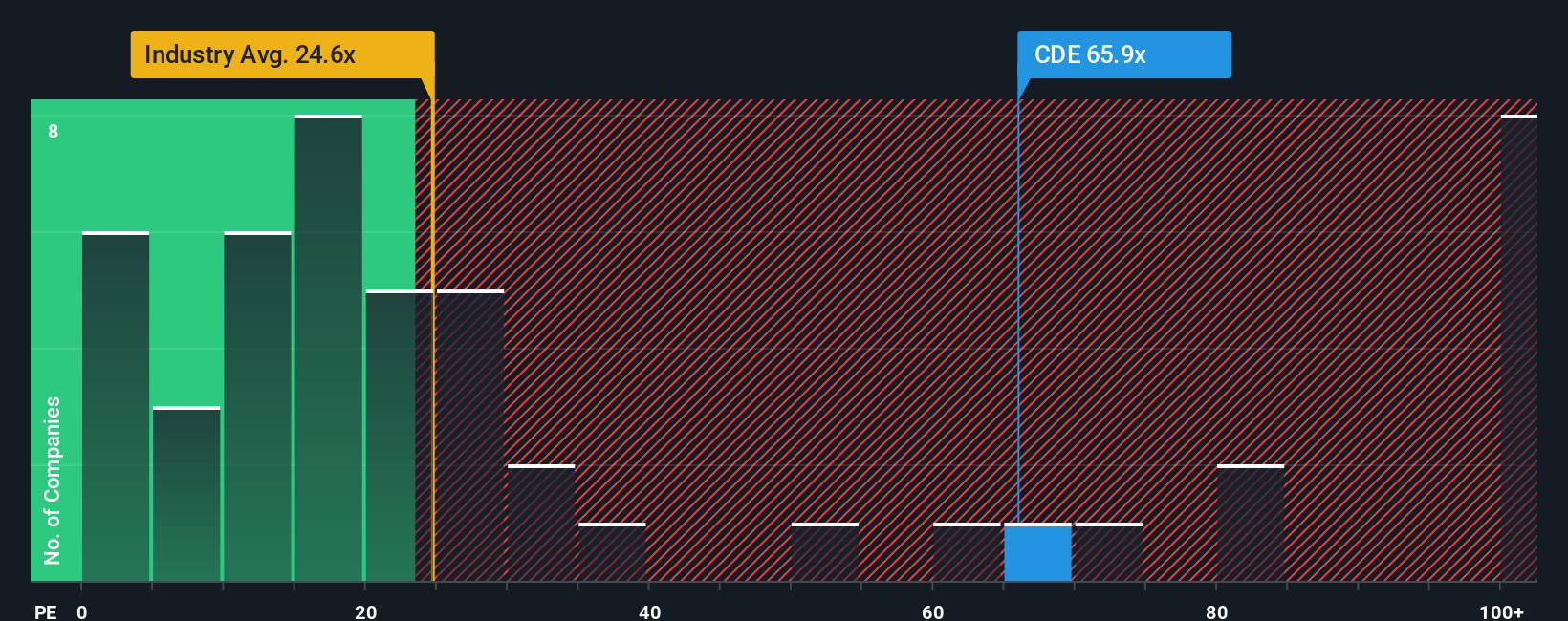

That 15.9% discount to fair value hinges on strong growth and margin expansion, but the earnings multiple tells a more cautious story. Coeur trades on a P/E of 27.6x, above both the US Metals and Mining industry at 24.8x and peers at 23.5x, and even above its own fair ratio of 26.4x. If the share price moved closer to that fair ratio, today’s upside case could look much slimmer. Which signal do you put more weight on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coeur Mining Narrative

If you see the numbers differently or would rather build your own view from the ground up, you can test your assumptions and Do it your way in just a few minutes.

A great starting point for your Coeur Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Coeur Mining is on your radar, do not stop there. The real edge often comes from comparing a few different opportunities side by side.

- Scan for potential value setups by checking out these 867 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Zero in on income opportunities by reviewing these 14 dividend stocks with yields > 3% offering yields above 3% that could support a regular payout stream.

- Get ahead of theme driven moves by researching these 79 cryptocurrency and blockchain stocks linked to blockchain and digital assets before the next big narrative builds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com