How Gedatolisib’s Phase 3 Outcomes At Celcuity (CELC) Have Changed Its Investment Story

- In 2025, Celcuity reported past phase 3 trial results showing its breast cancer candidate gedatolisib, combined with palbociclib and fulvestrant, extended cancer control to about 12.4 months versus 1.9 months with fulvestrant alone, with mouth sores as the most common side effect.

- Patients on the gedatolisib regimens also experienced nearly two years of delayed deterioration in well-being, underscoring a potentially meaningful quality-of-life benefit alongside the clinical outcomes.

- Next, we’ll examine how gedatolisib’s progression-free survival and quality-of-life profile could reshape Celcuity’s investment narrative following recent share price moves.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Celcuity's Investment Narrative?

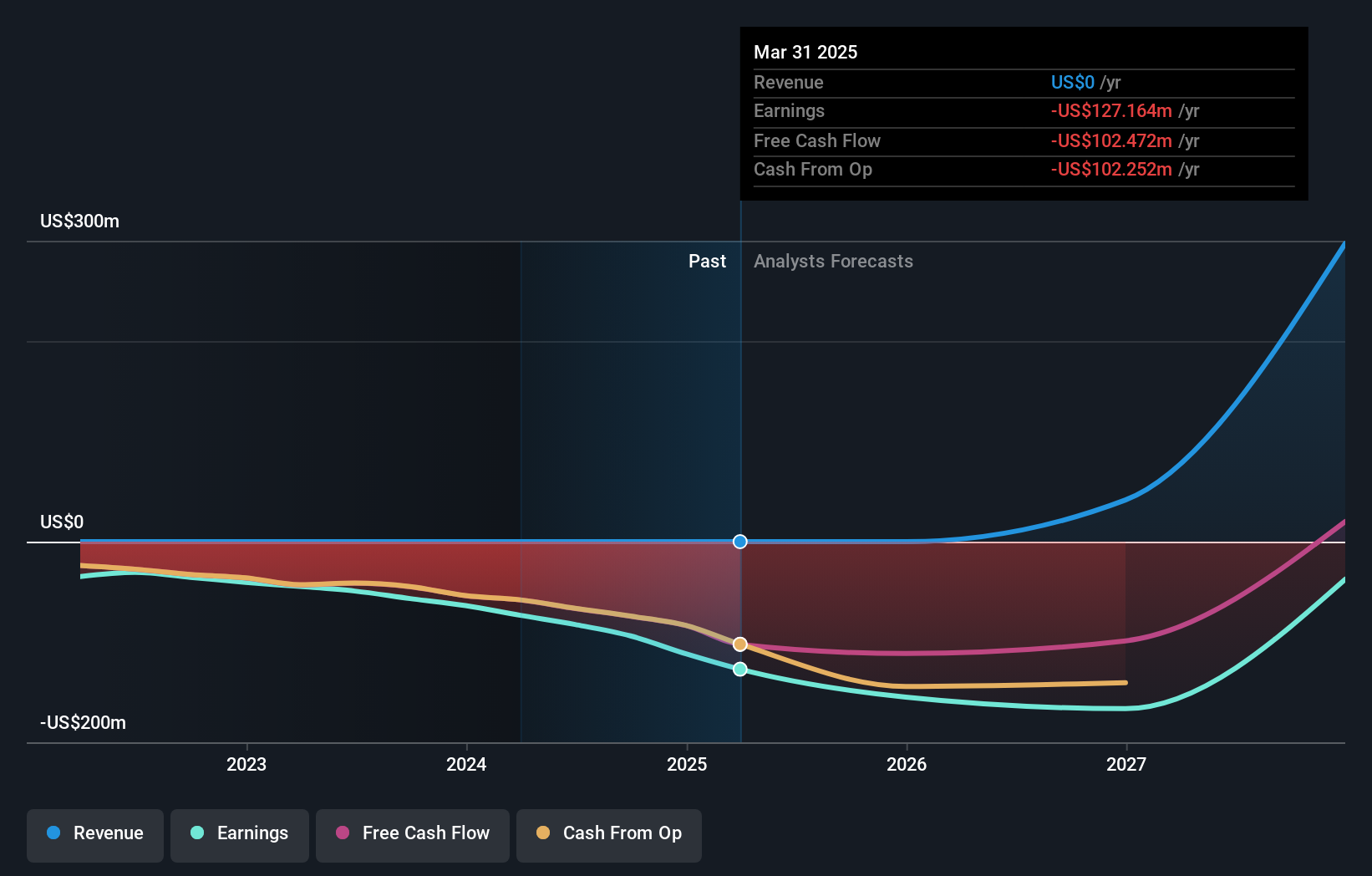

To own Celcuity today, you have to believe gedatolisib can move from strong trial data to real-world use in a focused breast cancer setting, while the company manages funding and execution risk as a still pre-revenue biotech. The recent VIKTORIA-1 updates, showing markedly longer progression-free survival and delayed quality-of-life deterioration, are now the core of the story and have already driven a very large share price move. In the near term, the key catalyst is the ongoing FDA review under Real-Time Oncology Review and how regulators weigh efficacy, safety and patient-reported outcomes. At the same time, Celcuity’s enlarged credit facility and recent equity raises highlight that further capital needs and potential dilution remain front and center, especially given its high valuation versus book value and continuing losses.

However, one issue could catch new shareholders off guard if they have not looked closely. Despite retreating, Celcuity's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth over 5x more than the current price!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com