Axon Enterprise (AXON) Valuation Check After Recent Share Price Pullback

Axon Enterprise: recent performance snapshot

Axon Enterprise (AXON) has drawn investor attention after a mixed stretch in its share performance, with a small 1 day decline, a modest gain over the past month, and a sharper pullback over the past 3 months.

See our latest analysis for Axon Enterprise.

Despite the recent 21.15% 3 month share price decline, Axon Enterprise’s current share price of $563.45 sits against a backdrop of a very large 5 year total shareholder return of more than 3x. This suggests momentum has cooled and investors are reassessing growth and risk.

If Axon’s recent pullback has you thinking about where else capital could work harder, it might be a good time to look at high growth tech and AI names through high growth tech and AI stocks.

With Axon growing revenue and net income at roughly 23% a year and trading at $563.45, the key question is simple: Are you looking at an undervalued public safety leader, or a stock where the market already prices in years of future growth?

Most Popular Narrative: 31.5% Undervalued

With Axon Enterprise last closing at $563.45 against a narrative fair value of $822.50, the current setup leans firmly toward a premium growth story being underappreciated.

The analysts have a consensus price target of $884.692 for Axon Enterprise based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1000.0, and the most bearish reporting a price target of just $800.0.

Curious what kind of revenue trajectory, margin profile, and future P/E multiple need to line up to support that fair value and price target gap? The narrative lays out a detailed earnings path, specific profitability assumptions, and a required valuation multiple that is far above the sector norm. If you want to see exactly how those moving pieces fit together, the full breakdown is where the numbers start to get interesting.

Result: Fair Value of $822.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story can crack if government budgets tighten, or if privacy and regulatory pushback slows adoption of Axon’s AI, drones, and evidence tools.

Find out about the key risks to this Axon Enterprise narrative.

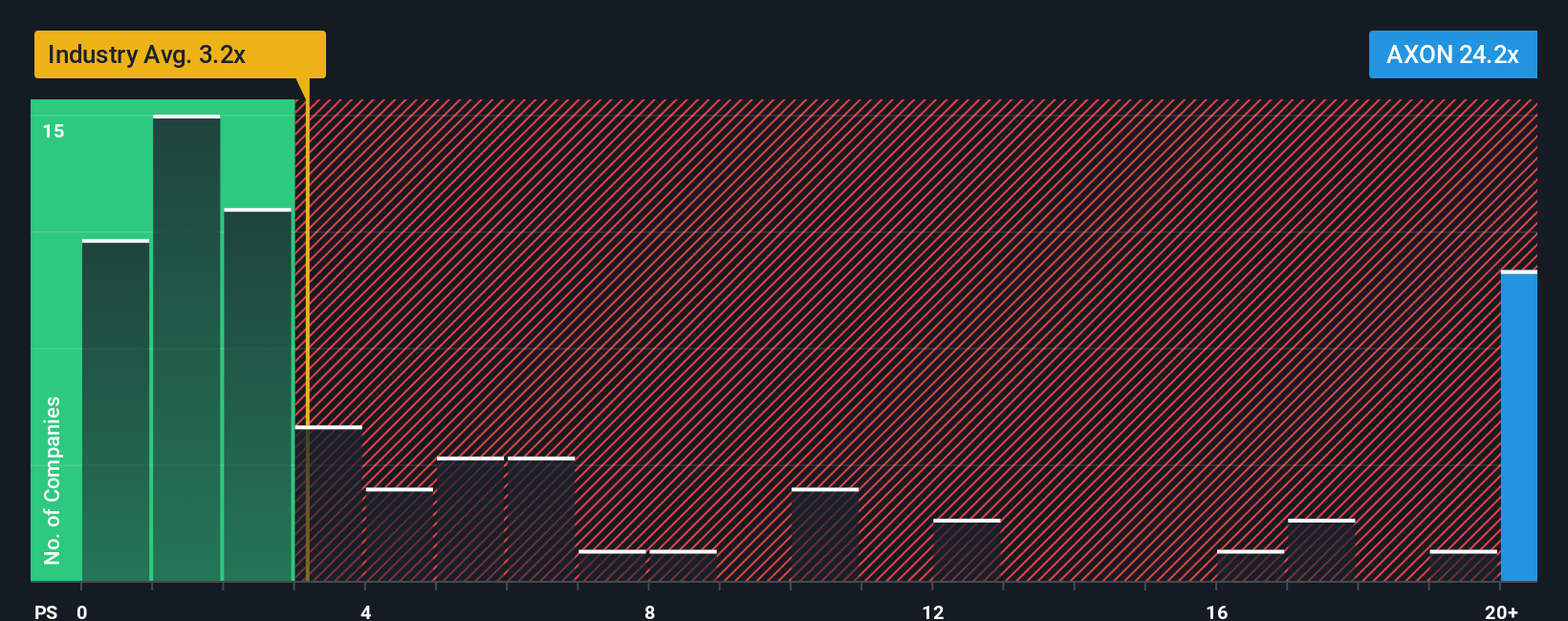

Another Angle: What The Multiples Are Saying

So far, the fair value work has leaned on Axon’s growth and long term earnings potential. Yet on a simple P/S basis, the picture looks tougher: Axon trades around 17.5x sales versus 8x for peers and a fair ratio of 15.5x. This points to a richer price and less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axon Enterprise Narrative

If you see the numbers differently, you can stress test your own assumptions against the same data and spin up a personalised Axon story in minutes: Do it your way.

A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Axon has your attention but you want a broader watchlist, widen your scope now so you do not miss opportunities sitting in plain sight.

- Spot potential bargains early by scanning these 867 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Ride the next wave of automation and data by zeroing in on these 25 AI penny stocks that are building core AI capabilities.

- Tap into fast moving themes in digital assets with these 79 cryptocurrency and blockchain stocks that are tied to cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com