The surge in renewable energy output sweeps through the European grid, and the frequency of negative electricity prices reached a record high in 2025

The Zhitong Finance App notes that Europe's surge in renewable energy output in 2025 overwhelmed the region's power grid, driving electricity prices below zero more times than ever before.

Negative electricity prices highlight the conflict between rapid growth in renewable energy generation in Europe and stagnant demand and ongoing grid restrictions. Germany recorded 573 hours of negative electricity prices in 2025, an increase of 25% over the previous year. However, after Spain experienced negative electricity prices for the first time in 2024, the frequency has now doubled year-on-year.

Negative electricity prices in Europe hit a record high

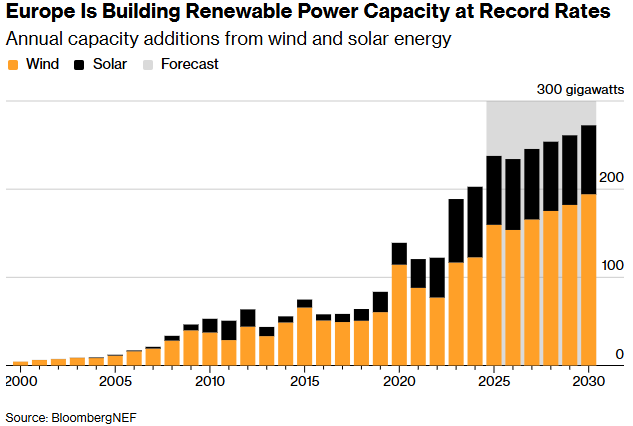

When strong winds or plenty of sunlight fill the system with renewable electricity, demand is often insufficient to absorb excess electricity, driving electricity prices into negative areas. According to BloombergNEF, this model is expected to continue in 2026 as renewable energy production capacity continues to expand faster than power grids, energy storage, and consumption.

The increase in the frequency of negative electricity prices is reshaping the European electricity market. While squeezing the revenue of renewable energy developers, it is also creating new opportunities for other sectors. Trade institutions, in particular, are increasingly betting on battery energy storage — buying electricity when prices fall below zero and selling when electricity is scarce. This strategy allows them to benefit from increasingly sharp price fluctuations due to weather-driven renewable energy supplies.

At the same time, the upgrading of power grids to deliver electricity to places of demand and the construction of battery energy storage to store surplus electricity for later use are still lagging behind the expansion of new power generation facilities.

Despite the rapid expansion of renewable energy, fossil fuels are still an important part of the power system, providing backup support when wind and solar output fluctuates. Prices are likely to soar significantly during these times. Limited transmission capacity, insufficient energy storage, and lack of flexible demand mean that the dependence of renewable energy on the weather is being transformed into more frequent negative electricity prices during oversupply, and more drastic price spikes when supply is tight.

“This spread is likely to continue in 2026,” said Florence Schmidt, energy strategist at Rabobank. “Efforts to promote more renewable energy will face the challenge of a slow recovery in electricity demand, and in some markets, the potential for gas and coal to meet the additional load will increase.”

Europe is building renewable energy generation capacity at record speed