High Growth Tech Stocks Including Optowide Technologies And Two More

As global markets closed out 2025 with mixed performances, the U.S. saw a decline in stocks during a holiday-shortened week, despite achieving double-digit gains for the third consecutive year. In this environment of fluctuating indices and economic indicators such as rising pending home sales and lower unemployment claims, investors often look towards high growth tech stocks like Optowide Technologies for their potential to capitalize on innovation and market expansion.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.87% | 37.08% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| CD Projekt | 33.20% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. focuses on the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥21.82 billion.

Operations: Optowide Technologies generates revenue through the development and sale of precision optics and fiber components. The company operates both domestically in China and internationally, leveraging its expertise in optical technology to serve various markets.

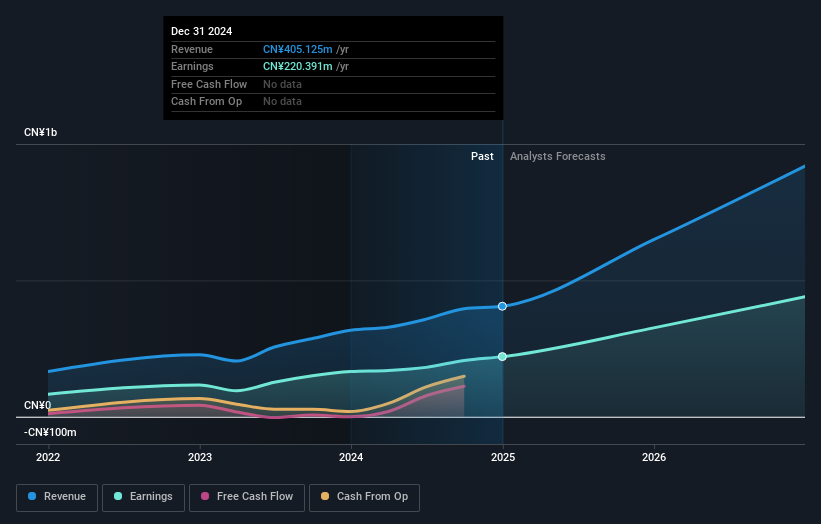

Optowide Technologies has demonstrated robust growth with a 29.5% annual increase in revenue, outpacing the CN market's 14.5%. This growth is complemented by a significant earnings expansion of 35% per year, surpassing industry norms. Notably, R&D investment remains a cornerstone of their strategy, fostering innovation and maintaining competitive advantage in the fast-evolving tech landscape. Recent financials reveal a surge in sales to CNY 425.13 million from CNY 331.85 million year-over-year, alongside an uplift in net income to CNY 63.8 million, evidencing strong operational execution and market responsiveness.

- Delve into the full analysis health report here for a deeper understanding of Optowide Technologies.

Evaluate Optowide Technologies' historical performance by accessing our past performance report.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui XDLK Microsystem Corporation Limited focuses on the research, development, testing, and sale of sensors in China with a market capitalization of approximately CN¥26.56 billion.

Operations: Anhui XDLK Microsystem Corporation Limited generates revenue primarily from its electronic test and measurement instruments segment, which contributed approximately CN¥534.08 million. The company's focus on sensor technology underpins its business operations in China.

Anhui XDLK Microsystem has achieved remarkable growth, with revenue soaring by 39.2% annually and earnings expanding by 31.8% per year, outstripping the CN market's average growth rates of 14.5% and 27.5%, respectively. This performance is underpinned by their aggressive R&D investment strategy, which has not only fueled innovation but also positioned them well ahead of industry norms in terms of product development and market adaptation. Their recent financials from Q3 2025 underscore this trajectory, reporting a revenue jump to CNY 401.03 million from CNY 271.46 million in the previous year and a robust increase in net income to CNY 238.76 million from CNY 138.08 million, reflecting strong operational efficiency and market penetration.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and artificial intelligence cloud data sectors both in China and internationally, with a market cap of CN¥124.48 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diverse operations in auto parts manufacturing, Internet gaming, and AI cloud data services. The company leverages its presence in both domestic and international markets to drive its business activities across these sectors.

Zhejiang Century Huatong Group has demonstrated robust financial agility, with a notable annual revenue growth of 14.8% and an even more impressive earnings surge of 38.3%. This growth trajectory is further accentuated by their aggressive share repurchase initiatives, totaling CNY 999.9 million in recent buybacks, reflecting confidence in the company's future prospects. Their commitment to innovation is underscored by substantial R&D investments which are pivotal in maintaining their competitive edge within the tech sector. These strategic moves not only enhance shareholder value but also solidify Huatong's position in a rapidly evolving industry landscape.

Next Steps

- Unlock our comprehensive list of 245 Global High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com