A Look At Bitmine Immersion Technologies (BMNR) Valuation As It Seeks A Major Authorized Share Increase And Ethereum Focus

Bitmine Immersion Technologies (BMNR) is back in focus after management urged shareholders to approve an increase in authorized shares from 500 million to 50 billion, a move the company has closely linked to its Ethereum-centered treasury plans.

See our latest analysis for Bitmine Immersion Technologies.

The push to expand authorized shares comes after a sharp 14.88% 1 day share price return to US$31.19. At the same time, the 90 day share price return of 47.31% and 30 day share price return of 8.43% highlight fading short term momentum compared with a very large 1 year total shareholder return of 345.70% and 3 year total shareholder return of 122.85%.

If Bitmine’s crypto linked story has caught your eye, this could be a good moment to look at high growth tech and AI stocks as other potential high growth ideas.

With BMNR trading at US$31.19 and a very large 1 year return already on the board, the key question now is simple: is this Ethereum heavy story still mispriced, or is the market already baking in years of future growth?

Price-to-Earnings of 40.5x: Is it justified?

On a P/E of 40.5x at a last close of US$31.19, BMNR screens as expensive compared with both its peer group and the broader US software space.

The P/E ratio tells you how much investors are currently paying for each dollar of earnings, which can be particularly relevant for a newly profitable, crypto linked software business like Bitmine Immersion Technologies. With BMNR only recently moving into profitability, a high P/E indicates that the market is attaching a strong value to its current earnings stream rather than treating it like a mature, slow growing company.

Compared with its direct peers, BMNR trades on a P/E of 40.5x against a peer average of 18.2x, so the market is paying more than double the going rate for similar earnings. Relative to the wider US Software industry, where the average P/E is 31.7x, BMNR also sits on a premium, which suggests investors are accepting a higher entry price than both peer and sector benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 40.5x (OVERVALUED)

However, the huge jump in authorized shares and heavy reliance on Ethereum and broader digital asset activity could quickly challenge today’s premium valuation story.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

Another View on Value: Our DCF Estimate

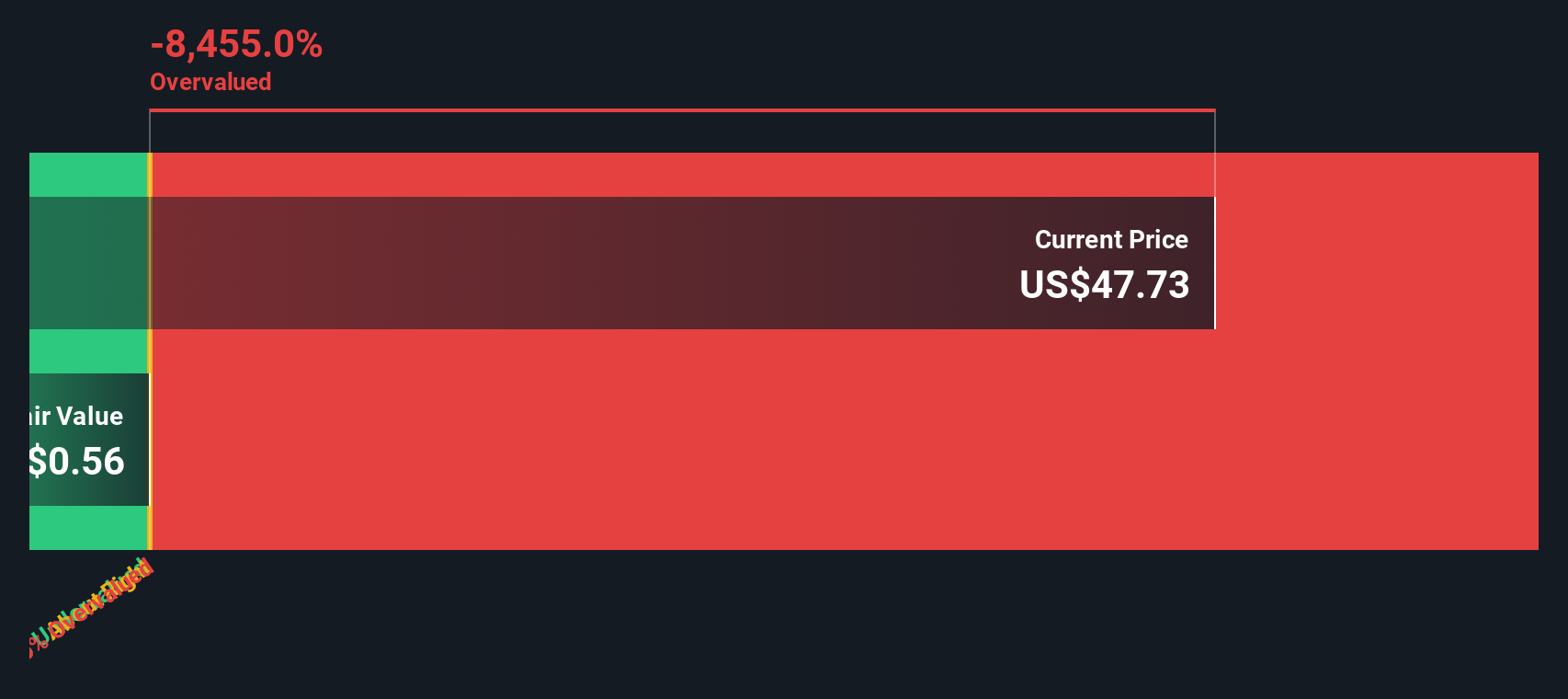

While the 40.5x P/E points to an expensive stock, our DCF model goes even further. It estimates fair value at about US$0.18 per share compared with the current US$31.19, which flags a very large valuation gap that could matter if sentiment on Ethereum or crypto assets cools.

Put simply, the DCF suggests the current price includes a lot of optimism, and perhaps more than the underlying cash flows can presently support. This means you have to ask yourself how much of that story you are comfortable paying for.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 867 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you see the numbers differently or simply prefer to work from your own assumptions, you can build a complete Bitmine story yourself in minutes by starting with Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bitmine has you thinking harder about risk and reward, do not stop here. Widen your scope and line up a few fresh contenders.

- Spot potential value gaps by scanning these 867 undervalued stocks based on cash flows that may be pricing in less optimism than the market story suggests.

- Tap into growth themes by checking out these 25 AI penny stocks tied to real business models rather than headline hype.

- Round out your watchlist with income ideas using these 14 dividend stocks with yields > 3% to focus on companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com