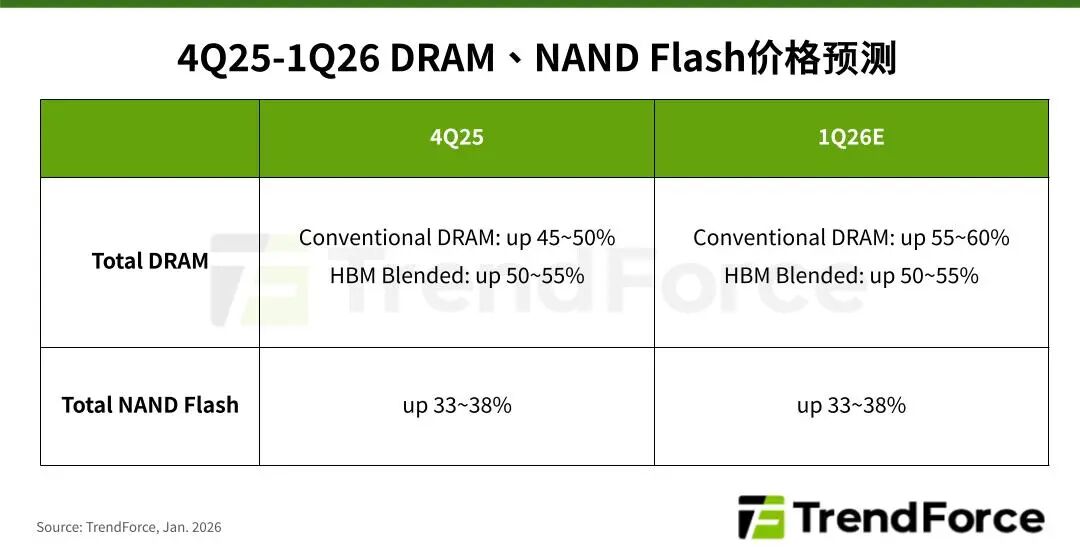

TrendForce Jibang Consulting: Prices of various memory products are expected to continue to rise in the first quarter of 2026

Zhitong Finance App learned that according to the latest survey by TrendForce Jibang Consulting, it is estimated that overall conventional DRAM (conventional DRAM) contract prices will increase 55-60% quarterly in the first quarter of 2026 due to large-scale transfer of advanced manufacturing processes and new production capacity to server and HBM applications in other markets to meet AI server demand. NAND Flash, on the other hand, is expected to continue to rise 33-38% in contract prices for various products due to the original factory's production capacity control and the server's strong cargo handling and crowding out other applications.

Although PC DRAM in the first quarter faced a slowdown in memory demand growth due to downgrades in unit shipments and possible regulatory cuts, original DRAM manufacturers simultaneously tightened supply to PC OEMs and module manufacturers, causing some PC OEMs to purchase at a higher price from module manufacturers. It is expected that it will cushion the module market in plateau factories and significantly boost PC DRAM prices.

Meanwhile, server construction driven by AI reasoning continues to drive US CSP (cloud service provider) procurement, and operators will continue to pull in (pull in) or add server DRAM requirements from the original factory in advance from the end of 2025. Furthermore, due to past transaction records and better demand prospects, there has been a large annual increase in the supply of original factory bits. With the original factory inventory level bottoming out, the growth in the scale of shipments can only be relied on by fabs to increase output and exacerbate the shortage of supply. It is expected that the original factory will actively raise the server DRAM price in the first quarter, with a quarterly increase of more than 60%.

Even though demand for memory is weak during the off-season, the brand maintained a strong pull of goods in the first quarter due to the tight supply of mobile DRAM, which is difficult to improve in the short term, and contract prices may rise again in the next few quarters. It is expected that both LPDDR4X and LPDDR5X will show a situation where supply is in short supply, uneven resource allocation, and prices will strengthen.

Graphics DRAM demand momentum has become conservative due to lower sales targets for the NVIDIA RTX 6000 series and the downsizing of shipping plans by some PC OEMs. However, its production capacity is being squeezed out by DDR5, which has a highly overlapping process, and prices are rising due to tight supply.

In a situation where the overall DRAM supply is tight, consumer DRAM customers are willing to exchange higher prices for priority supply in the first quarter of the original factory in order to reduce the risk of future shortages. However, due to the cautious attitude of some suppliers to expand production and must retain a certain amount of output for high-capacity products in the future, supply is still lower than demand in the short term, supporting price increases.

AI is leading the growth of the NAND Flash market, and it is estimated that in 2026 enterprise SSD (enterprise SSD) demand will surpass mobile applications for the first time

TrendForce Jibang Consulting said that in the first quarter, due to the expected decline in laptop shipping season, and SSD capacity downgraded in some low- and middle-end models to reduce BOM costs, affecting client SSD demand. However, due to the original manufacturer's pursuit of maximizing profits, the supply of client SSDs was excluded by Data Center (data center) SSDs, and the supply of cost-effective high-capacity QLC products was the tightest. It is estimated that Client SSD contract prices for the first quarter will still increase by at least 40% per quarter, the biggest increase among all types of NAND Flash products.

As the North American CSP industry increases AI infrastructure, the global server market will usher in a peak of growth in 2026, driving demand for enterprise SSDs, and is expected to become the largest application of NAND Flash. However, due to limited production capacity, suppliers have adopted strategies to prioritize profits and control shipments, deepening the supply tightening pattern and boosting Enterprise SSD prices.

In the eMMC/ UFS section, it is estimated that mobile phone shipments will drop significantly from season to quarter due to the fact that the mobile phone promotion in the first half of 2025 has consumed buying gas ahead of schedule, and the market is currently in the inventory adjustment period for the first quarter. Even though shipments of another major application, Chromebook, bucked the trend and benefited from government tenders, demand for eMMC/ UFS was still slightly weak. The supply side continues to shrink as the share of original production capacity continues to shrink. Although some module manufacturers can relieve some of the pressure, overall supply is still in short supply.

Demand for NAND Flash Wafer is expected to weaken in the first quarter of 2026 due to sluggish performance in the consumer products and retail markets and an aggressive increase in the fourth quarter of 2025. However, prices continued to rise as the original manufacturer prioritized putting production capacity into high-margin product lines and reducing the supply of wafers to module manufacturers.