A Look At Archer Aviation’s Valuation After Olympic Air Taxi Role And Saudi Expansion Talks

Olympic air taxi role puts Archer in the spotlight

Archer Aviation (ACHR) drew fresh attention after being selected as the air taxi provider for the 2028 Summer Olympics in Los Angeles, a high profile contract that highlights investor focus on its urban air mobility plans.

At the same time, Archer’s talks with Saudi Arabia about deploying air taxi services introduce a potential international avenue for its eVTOL model and give investors a concrete set of milestones to watch in the coming years.

See our latest analysis for Archer Aviation.

The recent Olympic contract news came alongside a sharp 8.11% 1 day share price return and a 5.58% 7 day share price return. However, the 90 day share price return of 34.86% decline and 1 year total shareholder return of 29% decline show that momentum has been fading over a longer period, despite a very large 3 year total shareholder return.

If Archer’s air taxi plans have caught your attention, it could be a good moment to broaden your watchlist with high growth tech and AI stocks that are shaping the next wave of transport and automation.

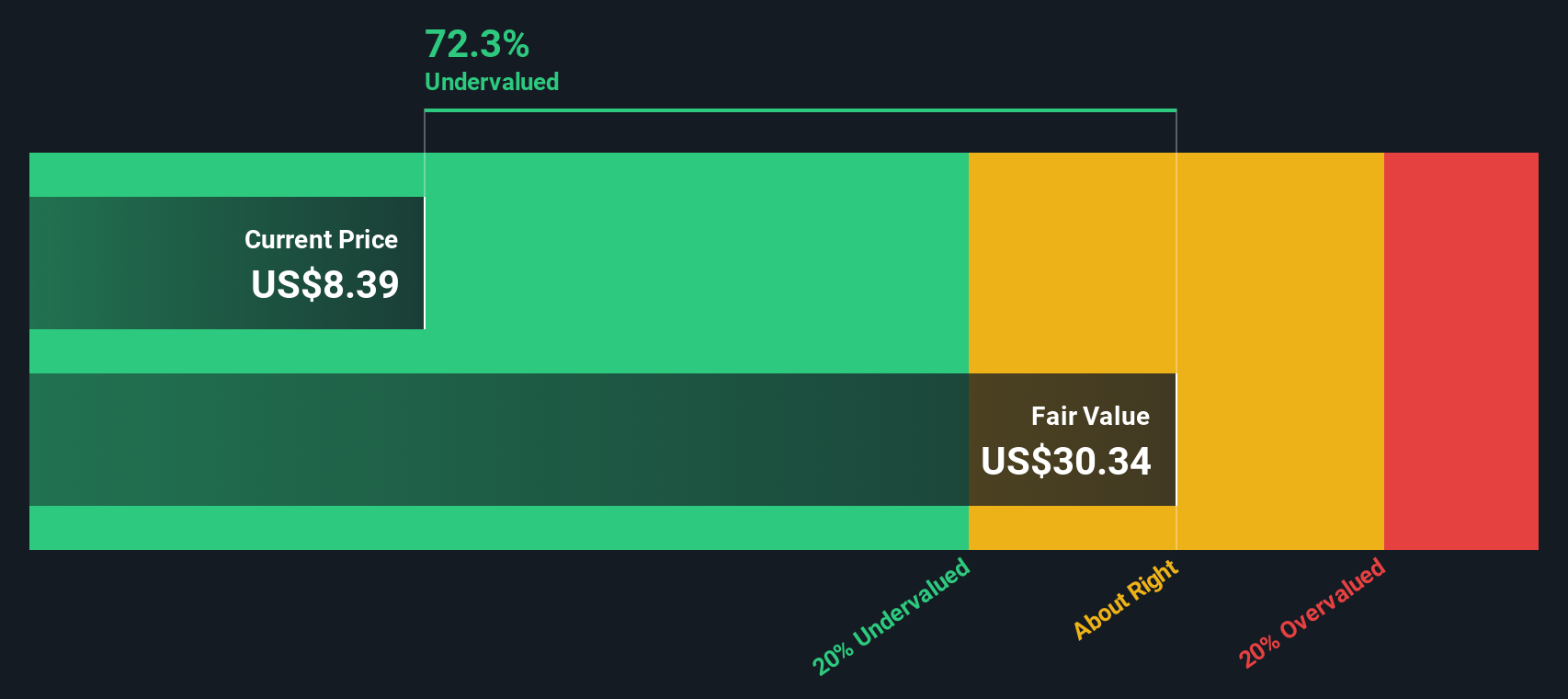

With Archer still loss making, trading at US$8.13 and sitting at a discount to both analyst targets and some intrinsic estimates, you have to ask: is this a genuine entry point, or is future growth already priced in?

Price to Book of 3.6x, is it justified?

On a P/B of 3.6x at the last close of US$8.13, Archer screens cheaper than both peers and the wider US Aerospace & Defense sector on this metric.

P/B compares the company’s market value to its accounting net assets, which matters for asset heavy names like aircraft developers where current earnings are not yet available. For a pre revenue, loss making business, this ratio is often used as a rough yardstick of what investors are paying for the balance sheet and underlying technology platform.

Here, Archer’s P/B of 3.6x sits below the peer average of 4.2x, which suggests investors are paying a lower price for each dollar of book value than they are for comparable companies. It also comes in under the wider US Aerospace & Defense industry average of 3.8x, a further signal that the market is pricing Archer’s assets at a discount to many sector names, despite the focus on high growth urban air mobility.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 3.6x (UNDERVALUED)

However, you still have to weigh execution risk associated with bringing a pre-revenue, loss-making eVTOL platform to market, as well as the possibility that expectations already outpace fundamentals.

Find out about the key risks to this Archer Aviation narrative.

Another view on Archer’s valuation

While the 3.6x P/B suggests Archer looks cheap next to peers, our DCF model points in the same direction but with a much stronger signal. At a share price of US$8.13 versus an estimated fair value of US$83.05, Archer screens as heavily undervalued. The real question is whether the cash flows ever catch up to that gap.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a tailored Archer thesis in just a few minutes, Do it your way.

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Archer has you thinking about what else might be on your radar, this can be a good moment to widen your search using focused stock ideas on Simply Wall St.

- Target potential value by scanning these 868 undervalued stocks based on cash flows that line up with your own view on quality, price and future prospects.

- Spot emerging themes in artificial intelligence with these 25 AI penny stocks that could influence how software, automation and data driven services develop.

- Strengthen your income watchlist by reviewing these 14 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com