A Look At Lululemon Athletica (LULU) Valuation As Chip Wilson Challenges Board Structure

Founder Chip Wilson’s push to nominate three new directors and declassify the board at lululemon athletica (LULU) has put corporate governance in focus for shareholders evaluating the stock’s medium term risk and oversight profile.

See our latest analysis for lululemon athletica.

At a share price of $210.81, lululemon’s 30-day share price return of 10.95% and 90-day share price return of 21.74% suggest momentum has picked up recently, even as the 1-year total shareholder return of 46.67% decline points to a tougher longer term picture. This frames the current governance push as a potential catalyst for reassessing risk and expectations.

If this governance debate has you reassessing your watchlist, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With lululemon trading at $210.81, close to its implied analyst target and a value score of 3, the question is whether recent activism and modest revenue growth of 4.6% signal a mispricing or if the market already reflects expected growth.

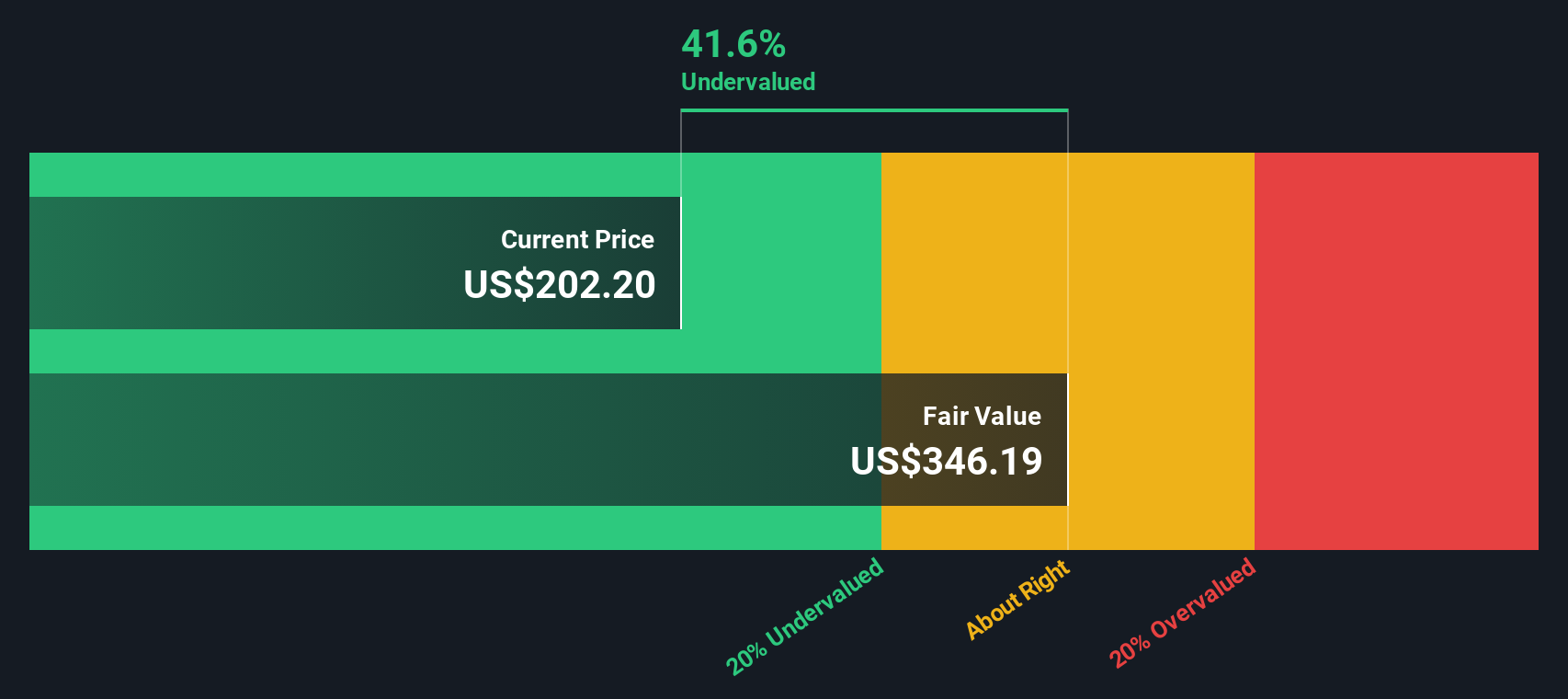

Most Popular Narrative Narrative: 37% Undervalued

Compared with lululemon athletica’s last close of $210.81, the narrative’s fair value of $334.88 points to a very different price anchor for the stock.

Positive Analyst Ratings: Recent analyst upgrades and positive ratings reflect growing confidence in Lululemon’s future prospects. Analysts have highlighted the company’s strong growth trajectory, innovative product offerings, and effective management as key reasons for their bullish outlook.

Curious what supports such a large gap between fair value and today’s price? Revenue, margins and a premium future earnings multiple all play a part. The exact mix might surprise you.

Result: Fair Value of $334.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower annual revenue growth of 4.6% and flat net income growth, together with the current governance dispute, could challenge confidence in that undervalued narrative if they persist.

Find out about the key risks to this lululemon athletica narrative.

Another View: Simply Wall St DCF Suggests Overvaluation

That 37% undervalued narrative sits against our DCF model, which points in the opposite direction. With lululemon at $210.81 versus an estimated fair value of $191.18, the shares screen as overvalued on this framework, not cheap. So which anchor should you trust more right now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out lululemon athletica for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own lululemon athletica Narrative

If you look at these numbers and come to a different conclusion or simply prefer to test your own assumptions, you can build a fresh lululemon view in just a few minutes, starting with Do it your way.

A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready To Scout Your Next Investment Idea?

If lululemon has sharpened your thinking, do not stop here, use the Simply Wall St screener to quickly spot other ideas that could fit your goals.

- Target potential bargains by scanning these 868 undervalued stocks based on cash flows that may be trading below what their cash flows imply.

- Ride powerful tech trends by checking out these 25 AI penny stocks that are building businesses around artificial intelligence.

- Boost your income focus by filtering for these 14 dividend stocks with yields > 3% that can contribute meaningful yield to a diversified portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com