Assessing AECOM (ACM) Valuation After Scottish Water Enterprise Alliance Win

AECOM’s Scottish Water role and why it matters for shareholders

AECOM (ACM) recently said it has been selected as a preferred bidder for Scottish Water’s multi billion dollar Enterprise Alliance, a long term program to upgrade Scotland’s water and wastewater infrastructure.

The company is one of two Primary Designers on this investment program, which could run for up to 13 years, with contracted work expected to start in 2026 and continue through 2033, and a possible six year extension.

See our latest analysis for AECOM.

AECOM’s selection for Scottish Water’s Enterprise Alliance comes after a mixed stretch for shareholders, with a 90 day share price return of 25.52% decline and a 1 year total shareholder return of 9.47% loss. However, the 5 year total shareholder return of 83.49% points to stronger longer term compounding, suggesting recent momentum has been fading even as long term holders remain ahead.

If projects like Scottish Water’s Enterprise Alliance have caught your attention, it could be a good moment to widen your watchlist with aerospace and defense stocks as another source of infrastructure linked ideas.

With AECOM trading at US$96.40 and sitting at a reported discount to analyst targets and some intrinsic value estimates, the key question is whether the recent share price weakness signals an opportunity or if the market already reflects its future growth.

Most Popular Narrative Narrative: 32.5% Undervalued

The most followed narrative compares AECOM’s fair value of US$142.83 to the last close at US$96.40, framing a sizeable valuation gap that rests on long term earnings and margin forecasts.

Analysts are assuming AECOM's revenue will grow by 5.4% annually over the next 3 years. Analysts assume that profit margins will increase from 4.2% today to 5.1% in 3 years time.

Curious what kind of revenue runway and margin shift can support that higher value, even with a lower future earnings multiple baked in? The narrative lays out a detailed earnings path, specific profitability targets, and a required valuation multiple that all have to line up. If you want to see exactly how those moving parts fit together, the full story is worth a look.

Result: Fair Value of $142.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those assumptions could be challenged if government infrastructure budgets soften or if rising labor and compliance costs compress the 7.25% net margin analysts are using.

Find out about the key risks to this AECOM narrative.

Another View: Market Price vs SWS DCF

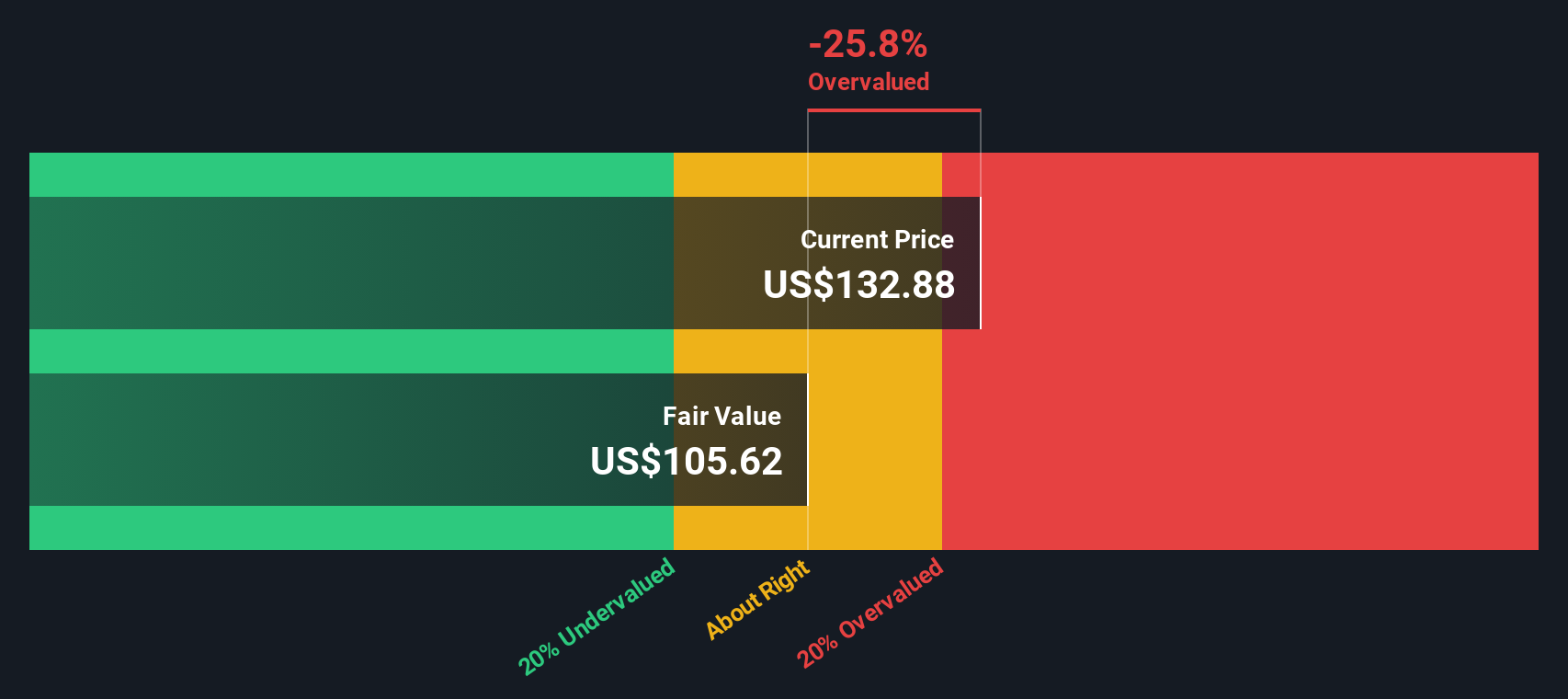

Our DCF model points to a fair value of about US$83.70 per share for AECOM, which is below the current price of US$96.40, flagging the stock as overvalued on this approach. That sits in clear tension with the narrative fair value of US$142.83. Which set of assumptions do you find more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you look at the numbers and come to a different conclusion, or prefer to build your own view from scratch, you can put together a personalised narrative in just a few minutes with Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding AECOM.

Looking for more investment ideas?

If AECOM has sharpened your focus, do not stop here. The screener can quickly surface other opportunities that might fit your approach just as well.

- Target potential value candidates by checking out these 868 undervalued stocks based on cash flows that may offer price tags below what their cash flows suggest.

- Spot companies at the crossroads of healthcare and machine learning by filtering for these 29 healthcare AI stocks, where data and diagnostics meet.

- Lean into digital assets through these 79 cryptocurrency and blockchain stocks, focusing on businesses tied to blockchain infrastructure and payment rails rather than individual tokens.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com