How Investors Are Reacting To Baxter (BAX) Debt Tender Offers And Smart Infusion EMR Data

- In December 2025, Baxter International Inc. completed the final settlement of its cash tender offers, retiring its 2.600% senior unsecured notes due 2026 and purchasing a portion of its 1.915% senior unsecured notes due 2027 for up to US$600 million in aggregate, while separately reporting new data with The University of Texas Medical Branch on smart infusion pump integration with hospital electronic medical records.

- The collaboration’s data showing fewer patient safety alerts and faster infusion programming highlights how connected infusion therapy could enhance clinician productivity and patient safety in hospital settings.

- We’ll now examine how Baxter’s smart infusion pump EMR integration, and its impact on clinician productivity and safety, influences its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Baxter International Investment Narrative Recap

To own Baxter today, you need to believe its core hospital therapies and infusion technologies can translate into sustainable profitability while it strengthens its balance sheet. The tender offer that retired 2026 notes and reduced 2027 debt looks helpful but does not materially change the near term focus on stabilizing margins and resolving operational pressures; the biggest risk still sits with execution on costs and product quality rather than this specific refinancing step.

The new data with The University of Texas Medical Branch on smart infusion pump integration with hospital EMRs ties directly into Baxter’s innovation catalyst, where connected infusion therapy could support higher value, software enabled offerings. Evidence of fewer safety alerts and quicker programming may help underpin the investment case that digital, integrated devices can play a larger role in Baxter’s mix, even as the company works through weaker volumes in some hospital therapies and ongoing cost restructuring.

Yet beneath Baxter’s progress on connected infusion therapy, investors should also be aware of the ongoing quality and field action risk around its infusion pumps, which could...

Read the full narrative on Baxter International (it's free!)

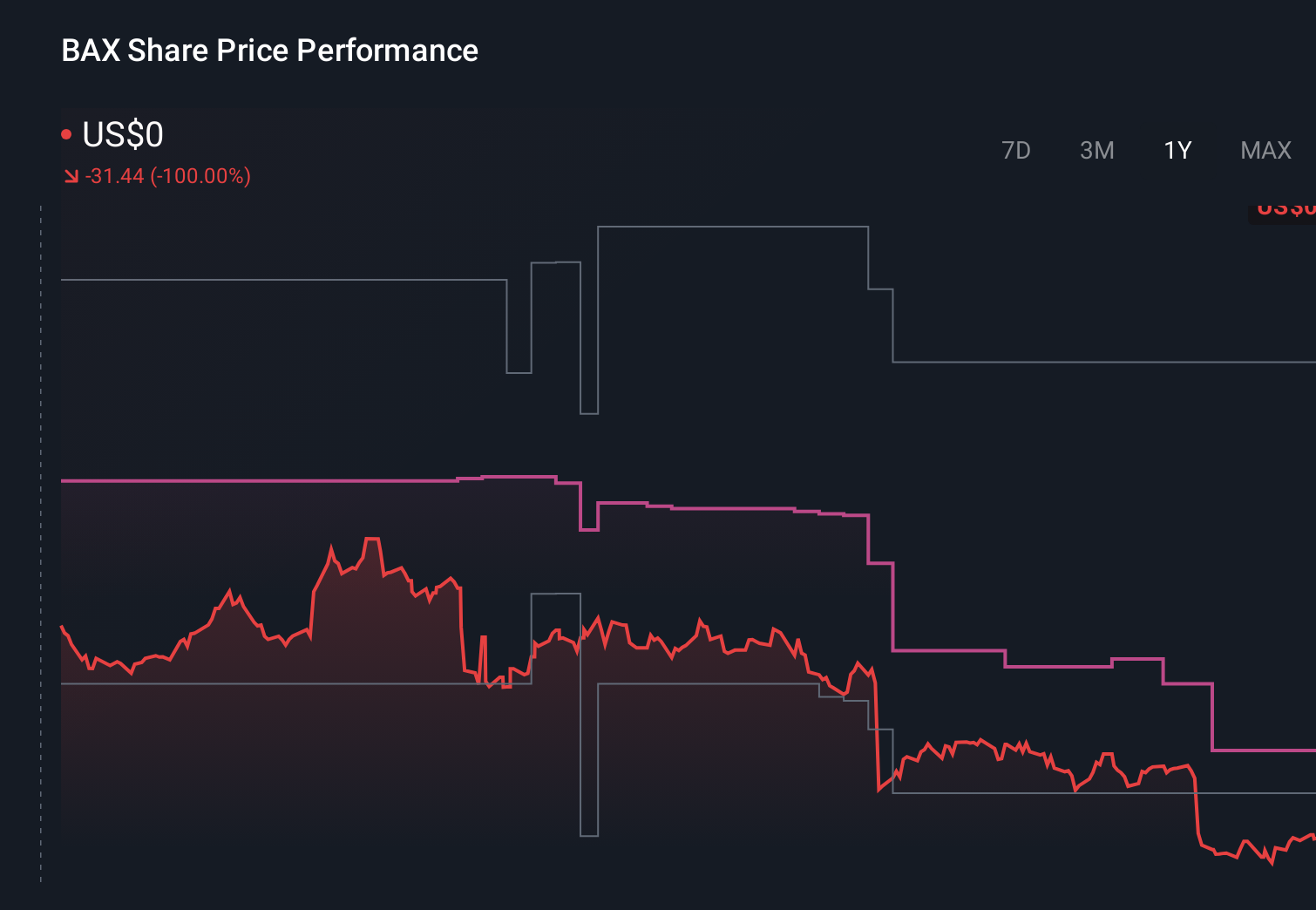

Baxter International's narrative projects $12.1 billion revenue and $913.6 million earnings by 2028. This requires 3.7% yearly revenue growth and a $1,160.6 million earnings increase from -$247.0 million today.

Uncover how Baxter International's forecasts yield a $23.80 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate Baxter’s fair value between US$14.80 and US$20,500.83, underscoring how far opinions can stretch. When you set those views against ongoing margin pressure from product mix and manufacturing absorption issues, it becomes even more important to compare multiple perspectives before deciding how Baxter might fit into your portfolio.

Explore 7 other fair value estimates on Baxter International - why the stock might be a potential multi-bagger!

Build Your Own Baxter International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baxter International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baxter International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baxter International's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com