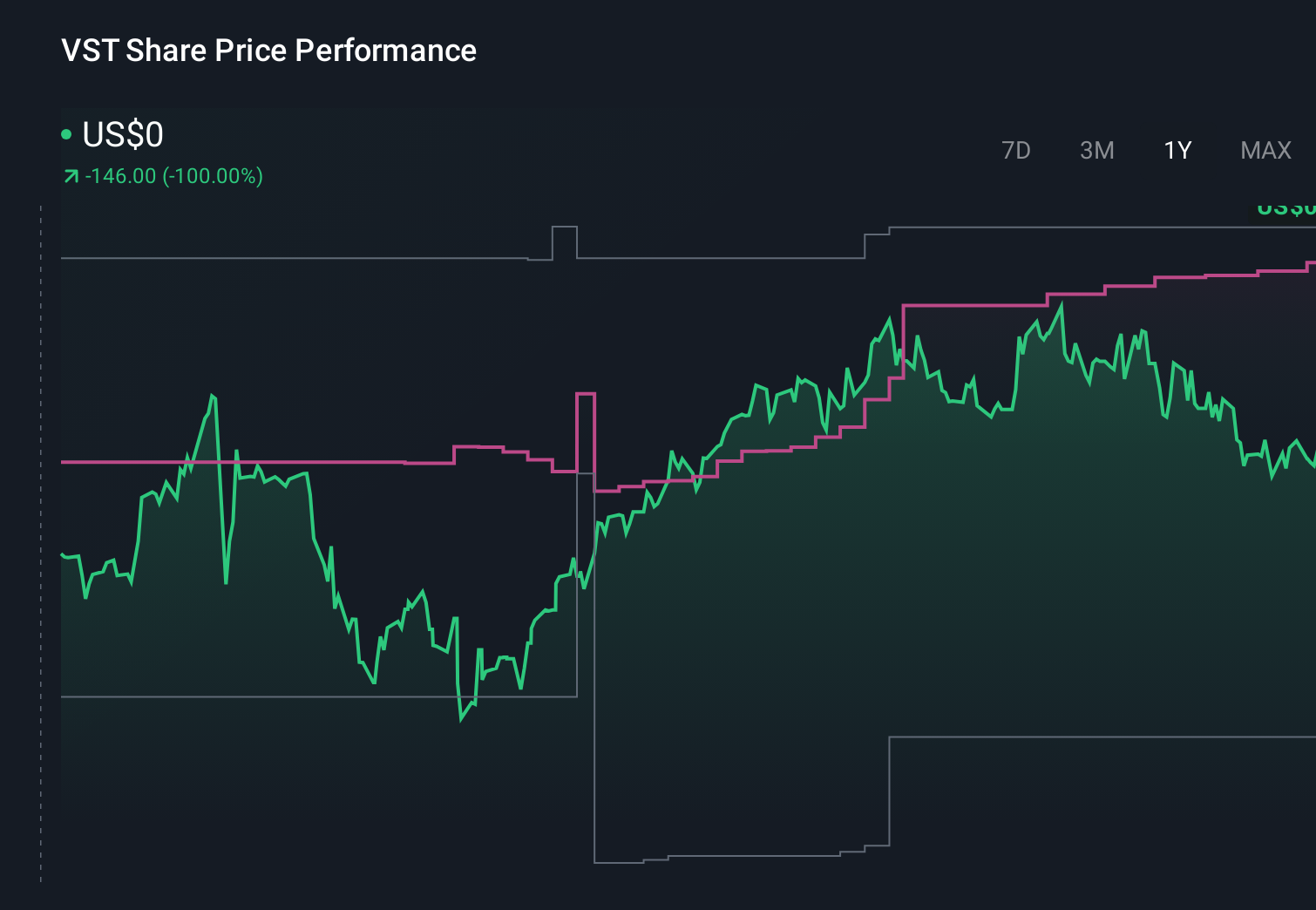

Vistra’s Data Center-Focused Gas Deals And Carbon-Free Contract Might Change The Case For Investing In Vistra (VST)

- Vistra recently expanded its generation footprint by acquiring seven natural gas plants from Lotus Infrastructure Partners and signed a 20-year agreement to supply 1,200 MW of carbon-free power, moves aimed at serving rising electricity needs from data centers and other power-intensive customers.

- By pairing additional gas-fired capacity in high-demand regions with long-duration contracted carbon-free output, Vistra is reshaping its portfolio mix toward more secure, long-term cash flows tied to data center growth.

- We’ll now examine how Vistra’s acquisition of seven gas plants and long-term carbon-free contract could reshape its broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Vistra Investment Narrative Recap

To own Vistra, you need to believe that large scale power generation and retail supply can convert data center demand into steadier, long term cash flows, without overextending the balance sheet. The Lotus gas plant acquisition and 20 year carbon free contract support the current data center driven catalyst, but they also lean into the biggest near term risk: higher leverage and refinancing exposure as the company layers on more capital intensive assets.

Among recent developments, the board’s decision to lift the quarterly common dividend to US$0.2270 per share in late 2025 is especially relevant here, because it reinforces Vistra’s commitment to returning cash to shareholders even as it spends heavily on acquisitions and long duration power contracts. That combination keeps the spotlight on how comfortably future cash flows can cover rising interest costs, project spending and growing capital returns.

However, investors also need to be aware that if credit conditions tighten or refinancing becomes more expensive, then...

Read the full narrative on Vistra (it's free!)

Vistra's narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028.

Uncover how Vistra's forecasts yield a $233.29 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community place Vistra’s fair value between US$142.31 and US$363.26, highlighting very different expectations. You should weigh those views against Vistra’s growing reliance on debt funded expansion and what that could mean for future flexibility and returns.

Explore 13 other fair value estimates on Vistra - why the stock might be worth over 2x more than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com