Spotlighting 3 Prominent Growth Companies With Significant Insider Stakes

As the new year kicks off with major stock indexes mostly rising, investors are keenly observing market trends and economic indicators that could influence their portfolios. In this climate, growth companies with high insider ownership often attract attention, as significant insider stakes can signal confidence in a company's long-term potential and align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| Similarweb (SMWB) | 14.4% | 100.3% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 32.2% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.6% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Let's take a closer look at a couple of our picks from the screened companies.

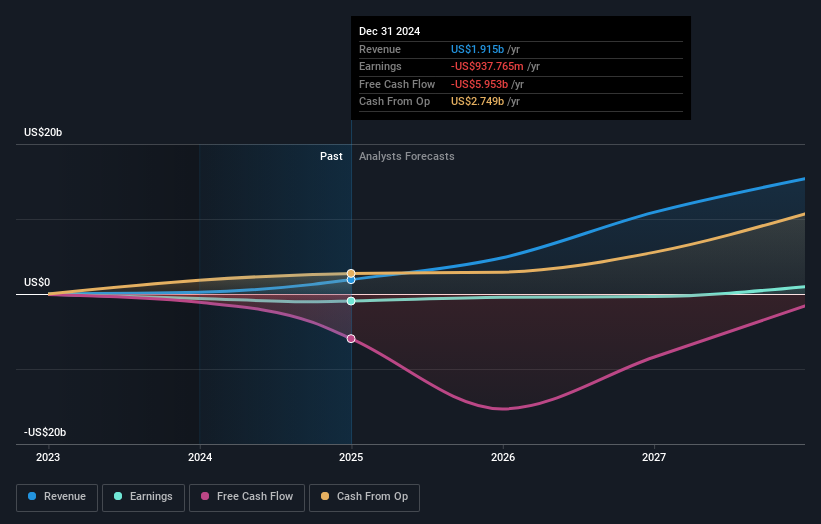

CoreWeave (CRWV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $39.53 billion.

Operations: The company generates revenue of $4.31 billion from its data processing segment.

Insider Ownership: 25.5%

Earnings Growth Forecast: 72.8% p.a.

CoreWeave's growth trajectory is bolstered by significant insider ownership and impressive revenue expansion, with forecasts predicting a 35.1% annual increase, surpassing market averages. Despite recent insider selling, the company remains focused on innovation and public sector engagement, as evidenced by its involvement in the Genesis Mission and CoreWeave Federal initiatives. However, financial challenges persist with less than a year of cash runway and ongoing losses despite considerable sales growth to US$3.56 billion over nine months in 2025.

- Click here to discover the nuances of CoreWeave with our detailed analytical future growth report.

- According our valuation report, there's an indication that CoreWeave's share price might be on the expensive side.

Super Micro Computer (SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and sells server and storage solutions based on modular and open-standard architecture globally, with a market cap of approximately $18.48 billion.

Operations: The company's revenue primarily comes from developing and providing high-performance server solutions, amounting to $21.05 billion.

Insider Ownership: 13.9%

Earnings Growth Forecast: 50.7% p.a.

Super Micro Computer's growth outlook is strong, with earnings and revenue expected to grow faster than the US market. Despite a recent dip in profit margins, the company remains undervalued by 38.4% compared to its fair value estimate. Recent developments include a new $2 billion credit facility for expansion and innovative product launches like the SuperBlade server, enhancing compute density and efficiency. Insider activity shows more buying than selling recently, indicating confidence in future prospects.

- Unlock comprehensive insights into our analysis of Super Micro Computer stock in this growth report.

- Our comprehensive valuation report raises the possibility that Super Micro Computer is priced lower than what may be justified by its financials.

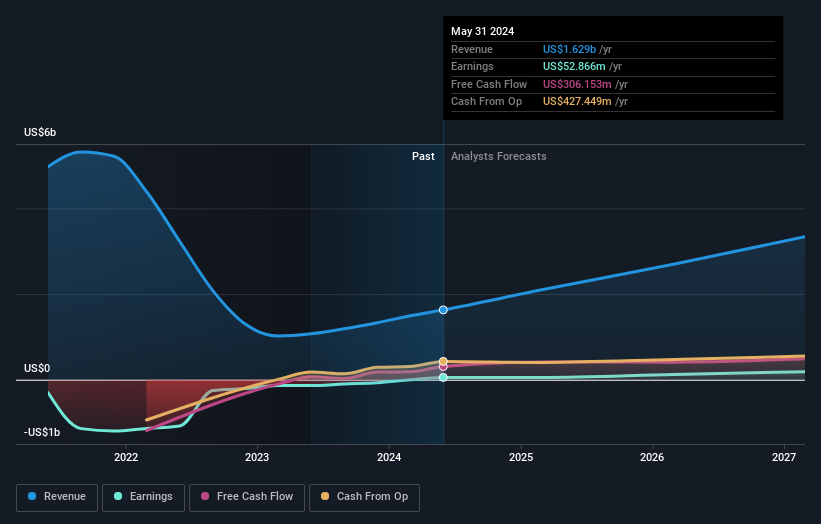

TAL Education Group (TAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TAL Education Group offers K-12 after-school tutoring services in China and has a market cap of approximately $6.99 billion.

Operations: The company's revenue is primarily derived from its K-12 after-school tutoring services, totaling $2.65 billion.

Insider Ownership: 31.6%

Earnings Growth Forecast: 25% p.a.

TAL Education Group's earnings are projected to grow significantly at 25% annually, outpacing the US market. Despite a low future return on equity forecast of 9.4%, it trades at a substantial discount, 63.5% below its estimated fair value. Recent earnings showed robust growth with net income more than doubling year-on-year for Q2 2025, alongside a completed share buyback worth $134.7 million, reflecting strategic capital management amidst steady revenue expansion forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of TAL Education Group.

- The valuation report we've compiled suggests that TAL Education Group's current price could be quite moderate.

Next Steps

- Embark on your investment journey to our 214 Fast Growing US Companies With High Insider Ownership selection here.

- Want To Explore Some Alternatives? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com