Mereo BioPharma Group Leads The Charge Among 3 Prominent Penny Stocks

Major stock indexes in the United States have kicked off the new year on a mostly positive note, with the Dow Jones Industrial Average and S&P 500 snapping four-session losing streaks. In such a market climate, investors often look beyond established giants to explore opportunities in smaller or newer companies. Penny stocks, despite their somewhat outdated moniker, continue to hold potential for those seeking value and growth outside of mainstream investments. This article will explore three penny stocks that stand out for their financial strength and potential long-term promise.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.66 | $570.05M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8438 | $144.31M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.235 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.32B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.32 | $560.81M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.66 | $381.59M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.9891 | $7.18M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $88.13M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Mereo BioPharma Group (MREO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mereo BioPharma Group plc is a biopharmaceutical company focused on developing and commercializing therapeutics for oncology and rare diseases across the United Kingdom, the United States, and internationally, with a market cap of $81.22 million.

Operations: No revenue segments have been reported for this biopharmaceutical company.

Market Cap: $81.22M

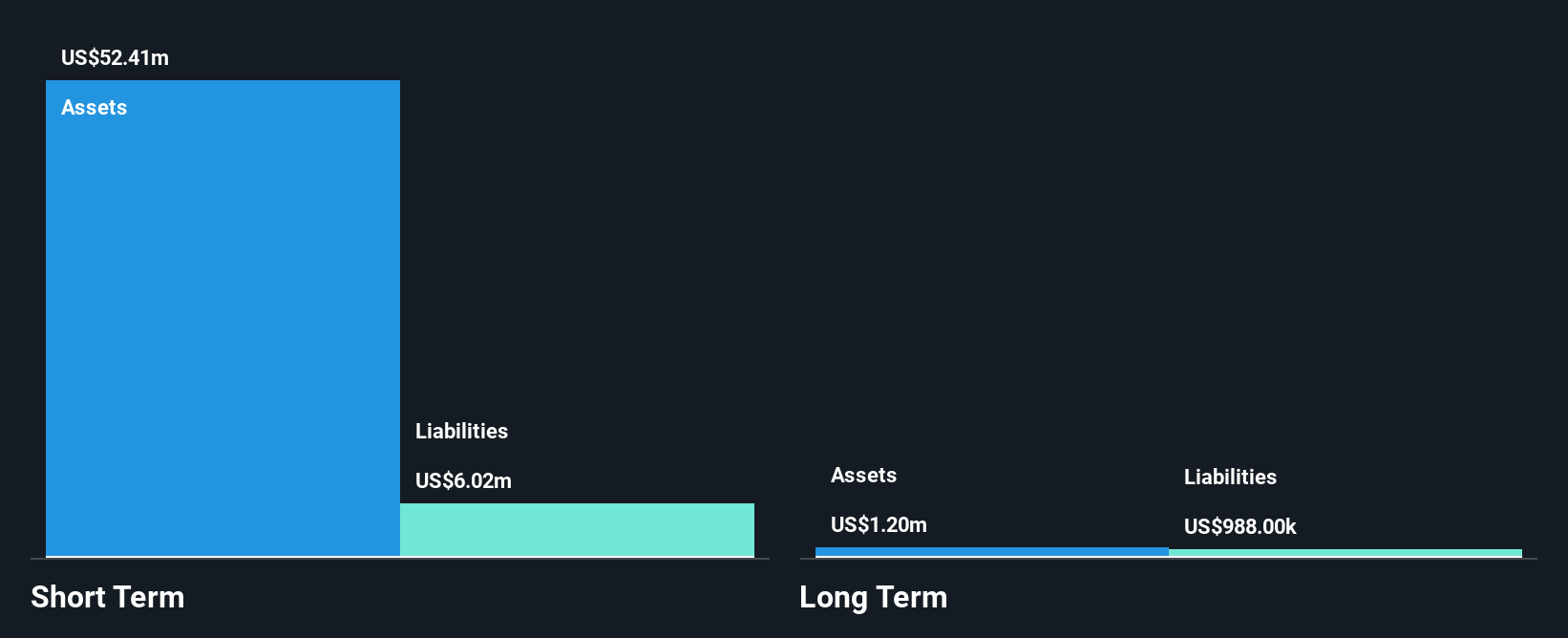

Mereo BioPharma Group, with a market cap of US$81.22 million, is pre-revenue, generating less than US$1 million annually. Despite being unprofitable, it has reduced losses by 30.4% annually over the past five years and maintains a debt-free status with sufficient cash runway exceeding one year. The management team is experienced with an average tenure of 9.2 years. Recent announcements include Phase 3 study results for setrusumab in osteogenesis imperfecta and partnerships for other drug developments, highlighting potential future revenue streams amidst high share price volatility and ongoing clinical uncertainties.

- Jump into the full analysis health report here for a deeper understanding of Mereo BioPharma Group.

- Gain insights into Mereo BioPharma Group's future direction by reviewing our growth report.

Microvast Holdings (MVST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $920.72 million.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, totaling $444.50 million.

Market Cap: $920.72M

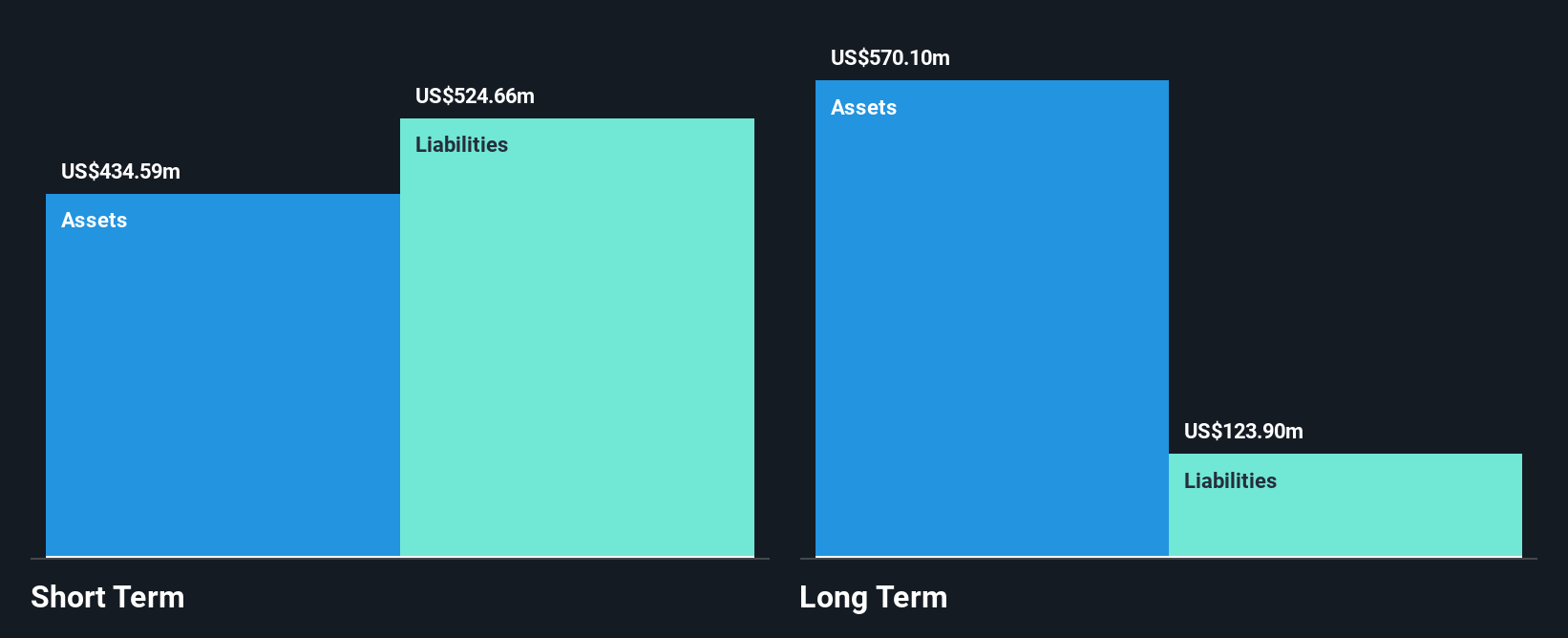

Microvast Holdings, Inc., with a market cap of approximately US$920.72 million, focuses on battery technologies and reported revenues of US$444.50 million from its Batteries/Battery Systems segment. Despite being unprofitable, the company has reduced losses over five years and maintains a positive free cash flow with a cash runway exceeding three years. Its short-term assets surpass long-term liabilities but fall short against short-term liabilities. Recent earnings showed increased sales but resulted in a net loss compared to the previous year's net income, while maintaining revenue growth guidance between 18% and 25% for 2025 amidst high share price volatility.

- Click here to discover the nuances of Microvast Holdings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Microvast Holdings' future.

Valens Semiconductor (VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd. and its subsidiaries develop semiconductor products for the audio-video and automotive industries, with a market cap of approximately $159.69 million.

Operations: The company generates revenue through its Automotive segment, which accounts for $18.41 million, and the Cross Industry Business (CIB) segment, contributing $49.48 million.

Market Cap: $159.69M

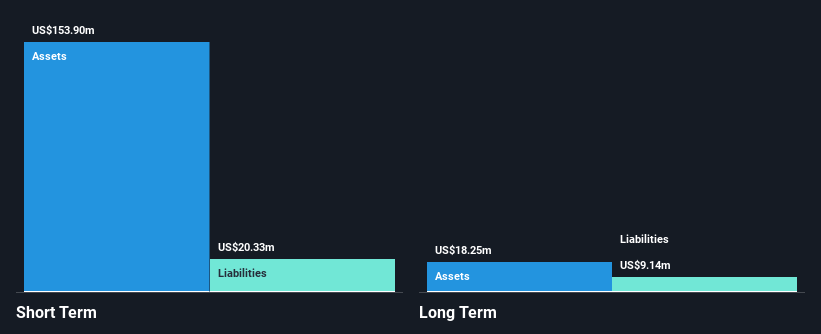

Valens Semiconductor, with a market cap of US$159.69 million, is gaining attention due to its strategic alliances and innovative product developments in machine vision and medical imaging. The company recently reported third-quarter revenues of US$17.34 million, showing year-over-year growth despite remaining unprofitable with a net loss of US$7.32 million. Valens has no debt and maintains a strong cash position, covering both short-term and long-term liabilities comfortably. Although it trades below estimated fair value, the company's management team is relatively new and lacks extensive tenure experience, which may impact future strategic execution amidst ongoing industry challenges.

- Get an in-depth perspective on Valens Semiconductor's performance by reading our balance sheet health report here.

- Evaluate Valens Semiconductor's prospects by accessing our earnings growth report.

Make It Happen

- Click this link to deep-dive into the 345 companies within our US Penny Stocks screener.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com