AeroVironment And 2 Other Stocks That May Be Priced Below Estimated Value

As the new year begins, major stock indexes in the United States have mostly risen, with the Dow Jones Industrial Average and S&P 500 snapping recent losing streaks, while the Nasdaq continues to face pressure. In this fluctuating market environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking value amid broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VTEX (VTEX) | $3.63 | $7.12 | 49% |

| Varonis Systems (VRNS) | $32.04 | $63.28 | 49.4% |

| Valley National Bancorp (VLY) | $11.69 | $22.99 | 49.2% |

| Perfect (PERF) | $1.73 | $3.44 | 49.7% |

| Investar Holding (ISTR) | $26.21 | $52.36 | 49.9% |

| Heritage Financial (HFWA) | $23.70 | $46.41 | 48.9% |

| Fifth Third Bancorp (FITB) | $47.71 | $93.83 | 49.2% |

| CNB Financial (CCNE) | $25.74 | $50.61 | 49.1% |

| Clearfield (CLFD) | $29.49 | $58.19 | 49.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $20.16 | $39.94 | 49.5% |

Underneath we present a selection of stocks filtered out by our screen.

AeroVironment (AVAV)

Overview: AeroVironment, Inc. designs, develops, produces, delivers, and supports robotic systems and related services for government agencies and businesses globally, with a market cap of approximately $12.73 billion.

Operations: AeroVironment generates revenue through its portfolio of robotic systems and services catering to both government agencies and commercial enterprises worldwide.

Estimated Discount To Fair Value: 19.2%

AeroVironment's recent delivery of advanced laser weapon systems to the U.S. Army and a $4.8 million contract with the Coast Guard highlight its robust defense capabilities, enhancing cash flow potential. Despite reporting a net loss, AeroVironment's revenue surged to US$472.51 million in Q2 2025 from US$188.46 million last year, indicating strong operational growth. Trading at approximately 19% below estimated fair value (US$317.2), it presents an opportunity for investors seeking undervalued stocks based on cash flows.

- In light of our recent growth report, it seems possible that AeroVironment's financial performance will exceed current levels.

- Navigate through the intricacies of AeroVironment with our comprehensive financial health report here.

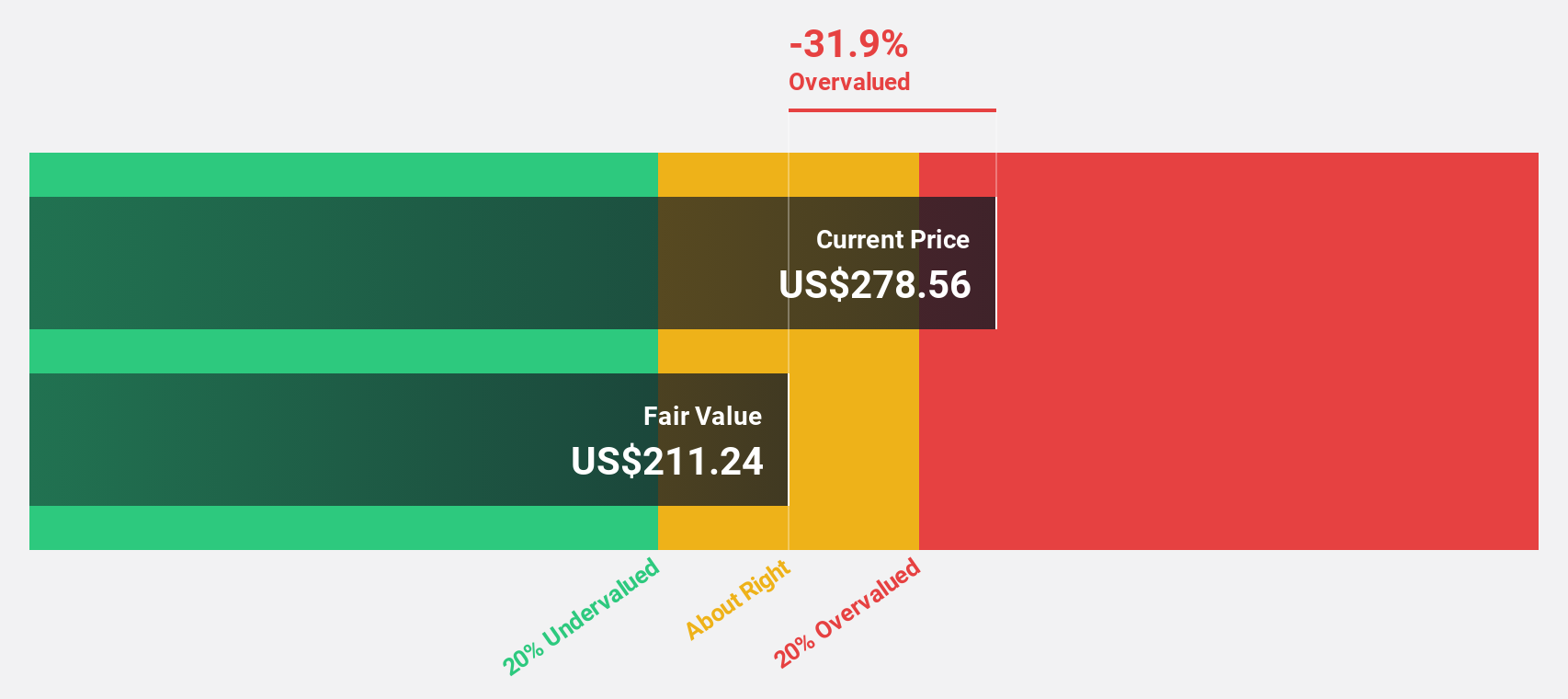

Super Micro Computer (SMCI)

Overview: Super Micro Computer, Inc. develops and sells modular and open-standard architecture server and storage solutions globally, with a market cap of approximately $18.48 billion.

Operations: The company generates revenue of approximately $21.05 billion from its high-performance server solutions.

Estimated Discount To Fair Value: 38.4%

Super Micro Computer's recent $2 billion revolving credit facility supports its liquidity and operational flexibility, enhancing cash flow potential. The company's raised guidance to at least $36 billion in net sales for fiscal 2026 reflects strong revenue growth expectations. Trading significantly below estimated fair value, it offers an opportunity for investors focused on undervalued stocks based on cash flows. However, recent profit margins have declined compared to last year, warranting cautious optimism.

- Our expertly prepared growth report on Super Micro Computer implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Super Micro Computer with our detailed financial health report.

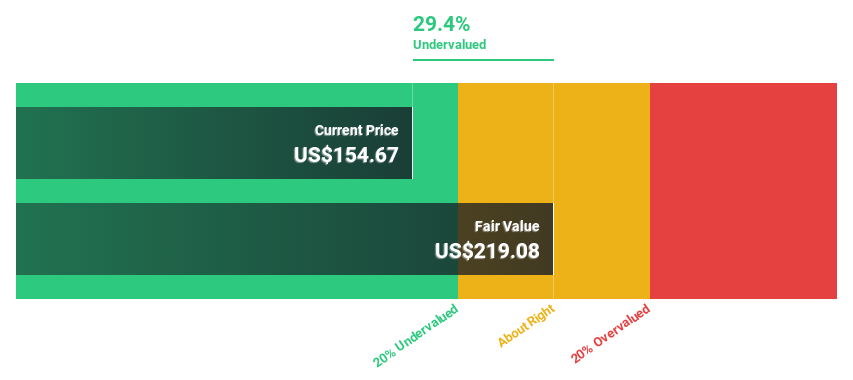

Capital One Financial (COF)

Overview: Capital One Financial Corporation is a financial services holding company that offers a range of financial products and services in the United States, Canada, and the United Kingdom, with a market cap of approximately $157.62 billion.

Operations: Capital One generates revenue through its Credit Card segment ($17.46 billion), Consumer Banking segment ($8.43 billion), and Commercial Banking segment ($3.52 billion).

Estimated Discount To Fair Value: 17.3%

Capital One Financial is trading at US$247.93, below its estimated fair value of US$299.92, indicating potential undervaluation based on cash flows. Despite recent shareholder dilution and lower profit margins compared to last year, the company's earnings are forecast to grow significantly over the next three years, outpacing market averages. Recent initiatives like the T-Mobile Visa partnership enhance its product offerings and customer engagement, potentially supporting future revenue growth above 20% annually.

- Our growth report here indicates Capital One Financial may be poised for an improving outlook.

- Dive into the specifics of Capital One Financial here with our thorough financial health report.

Where To Now?

- Discover the full array of 186 Undervalued US Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com