High Growth Tech Stocks In The US Market January 2026

As 2026 begins, the U.S. stock market is showing signs of optimism with major indexes like the Dow and S&P 500 snapping recent losing streaks, although the Nasdaq continues to face challenges. In this environment of mixed signals and evolving economic indicators, identifying high-growth tech stocks requires careful consideration of their innovation potential and adaptability to current market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 26.25% | 30.13% | ★★★★★★ |

| Workday | 11.14% | 32.11% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 15.16% | 31.60% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Cellebrite DI | 15.29% | 20.24% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Circle Internet Group | 20.75% | 84.58% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $35.17 billion.

Operations: The company generates revenue primarily from the sales of subscription services to its cloud platform and related support services, totaling $2.83 billion.

Zscaler, reflecting robust growth trends, is poised to become profitable within the next three years with earnings projected to surge by 45.94% annually. This growth trajectory is underscored by a strategic partnership with Peraton, enhancing Zscaler's cybersecurity offerings through advanced threat protection and Zero Trust enforcement across complex IT architectures. Additionally, collaborations with Orca Security and TPx underline Zscaler's integration of AI-powered risk intelligence and cloud-delivered security solutions into broader digital transformation strategies. These partnerships not only expand its service capabilities but also solidify its position in the high-stakes cybersecurity domain where innovation leads market competitiveness.

- Get an in-depth perspective on Zscaler's performance by reading our health report here.

Assess Zscaler's past performance with our detailed historical performance reports.

Fabrinet (FN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabrinet offers optical packaging and precision optical, electro-mechanical, and electronic manufacturing services across North America, the Asia-Pacific, and Europe, with a market cap of $17.18 billion.

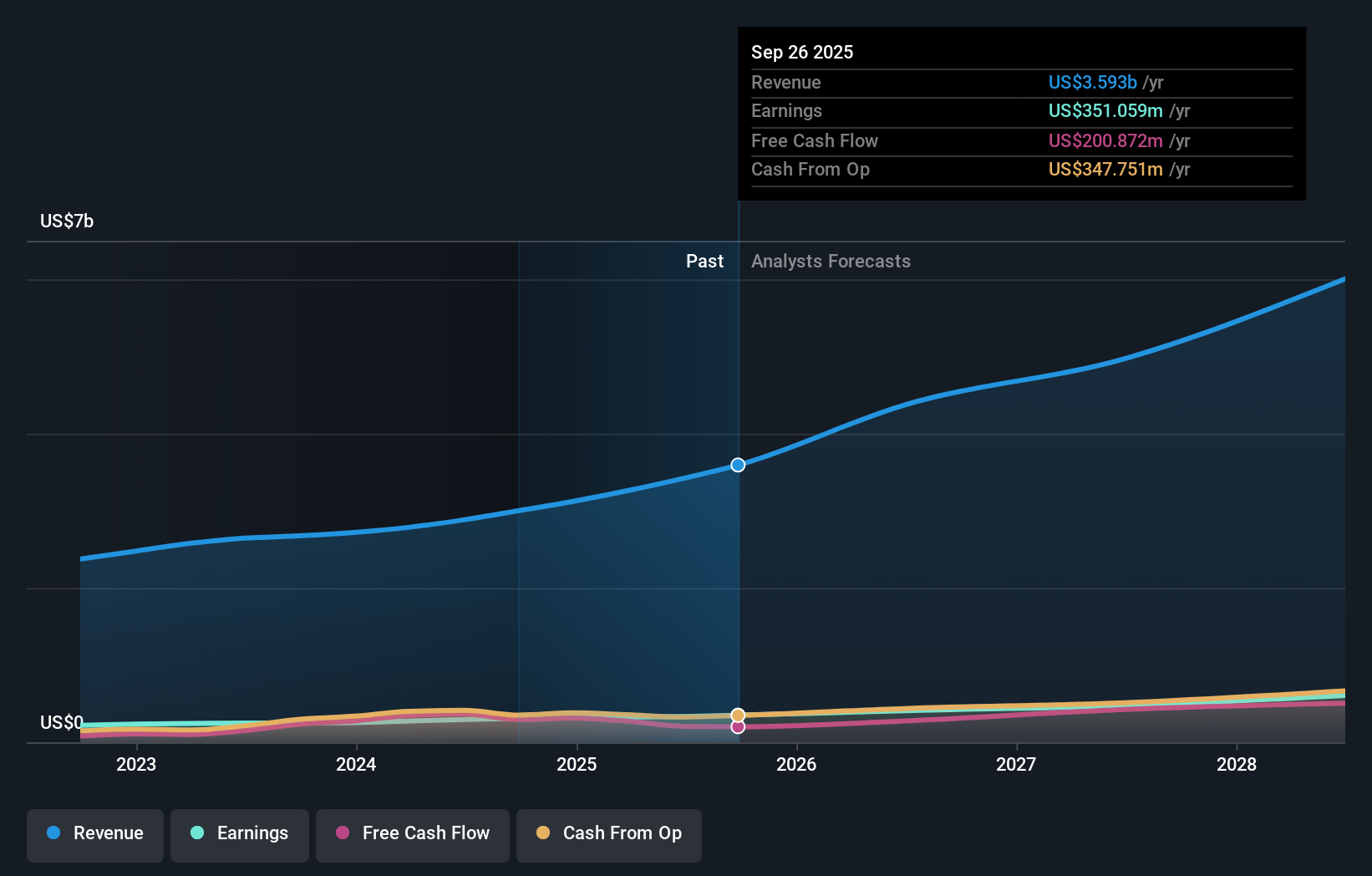

Operations: Fabrinet's primary revenue stream is from Optical Networking Equipment, generating approximately $3.59 billion. The company operates in North America, the Asia-Pacific, and Europe, providing specialized manufacturing services.

Fabrinet, demonstrating a solid trajectory in the tech sector, reported a significant 13.9% earnings growth over the past year, surpassing the electronic industry's average of 10.9%. With annual revenue growth forecasted at 17.3%, Fabrinet is set to outpace the US market prediction of 10.4%. This performance is bolstered by strategic share repurchases totaling $360.28 million, reflecting confidence in its financial health and future prospects. The company's robust R&D investment aligns with its commitment to innovation, crucial for sustaining long-term growth in its high-tech manufacturing niche.

- Dive into the specifics of Fabrinet here with our thorough health report.

Understand Fabrinet's track record by examining our Past report.

Vishay Precision Group (VPG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vishay Precision Group, Inc. operates in the precision measurement and sensing technologies sector across the United States, Europe, Israel, Asia, and Canada with a market capitalization of $521.60 million.

Operations: VPG's revenue streams are primarily derived from Sensors ($112.64 million), Weighing Solutions ($109.66 million), and Measurement Systems ($79.14 million). The company focuses on precision measurement and sensing technologies across multiple regions, including the United States, Europe, Israel, Asia, and Canada.

Vishay Precision Group's recent inclusion in the S&P Technology Hardware Select Industry Index underscores its strategic positioning within the tech sector. With a robust annual earnings growth forecast of 43.5%, VPG outstrips the broader US market projection of 15.9%. This growth is supported by significant leadership changes aimed at enhancing operations and product strategy, potentially catalyzing further innovation and market penetration. Despite a modest revenue growth rate of 5.8% compared to the industry, VPG's focused R&D investments and operational adjustments are pivotal for its sustained competitiveness in precision technologies.

- Click here to discover the nuances of Vishay Precision Group with our detailed analytical health report.

Learn about Vishay Precision Group's historical performance.

Summing It All Up

- Delve into our full catalog of 71 US High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com