Assessing Millicom (NasdaqGS:TIGO) Valuation After Earnings Beat And Expansion In Uruguay And Ecuador

Millicom’s earnings beat and expansion move TIGO into focus

Millicom International Cellular (NasdaqGS:TIGO) has drawn fresh attention after quarterly results came in ahead of analyst forecasts, alongside JPMorgan’s improved outlook tied to the company’s acquisitions in Uruguay and Ecuador.

See our latest analysis for Millicom International Cellular.

The recent earnings beat and acquisitions in Uruguay and Ecuador come on top of a 12.65% 1 month share price return and a very large 1 year total shareholder return of about 1.5x, which suggests that momentum has been building rather than fading.

If Millicom’s move has caught your eye, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Millicom trading at $56.55 versus an analyst target of $52.35, but with an estimated intrinsic value suggesting a 36% discount, the key question is whether there is still a buying opportunity or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 8% Overvalued

Compared with Millicom’s last close at $56.55, the most followed narrative anchors on a fair value of $52.35, framing the recent rally as ahead of that mark.

The analysts have a consensus price target of $44.511 for Millicom International Cellular based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $36.0.

Curious what earnings path could justify a higher multiple on lower profits and only modest revenue growth? The narrative leans on shrinking margins, shifting share count, and a specific discount rate to connect today’s price to its fair value line. Want to see exactly how those moving parts fit together in the model?

Result: Fair Value of $52.35 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained organic growth in key markets and rising equity free cash flow could still push earnings and valuation above the cautious consensus path outlined here.

Find out about the key risks to this Millicom International Cellular narrative.

Another View On TIGO’s Value

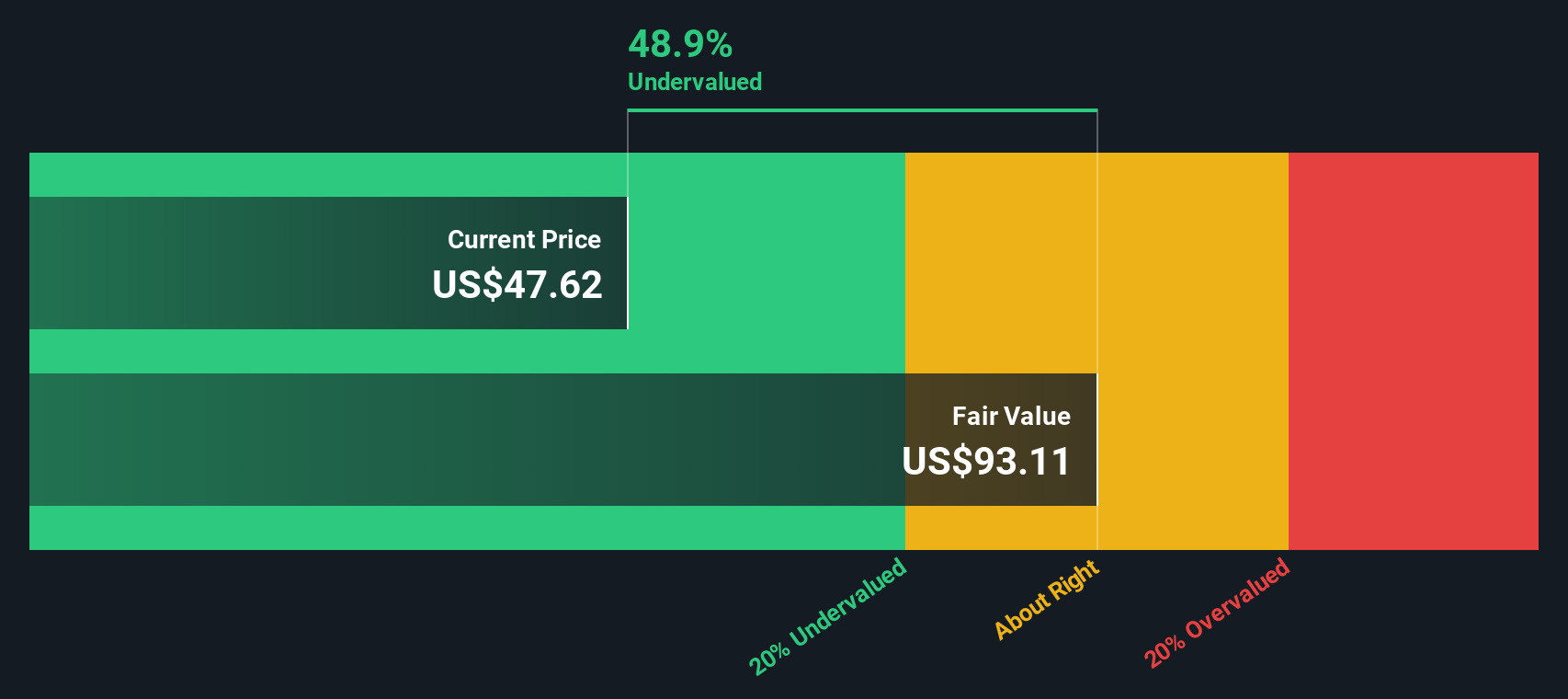

While the most followed narrative points to an 8% premium to its fair value line, our DCF model lands in a very different place. With that approach, Millicom’s estimated fair value is US$88.81 per share, which is above the current price of US$56.55. So which story do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Millicom International Cellular Narrative

If you see the numbers differently or prefer testing your own assumptions, you can build a custom Millicom story in minutes: Do it your way.

A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Millicom has sharpened your focus, do not stop here. The wider market holds plenty of other angles that could suit your goals just as well.

- Target potential mispricings by scanning these 870 undervalued stocks based on cash flows that the market may not be paying full attention to yet.

- Consider the momentum of digital assets by checking out these 79 cryptocurrency and blockchain stocks linked to cryptocurrency trends and blockchain adoption.

- Strengthen your income stream by reviewing these 14 dividend stocks with yields > 3% offering yields above 3% that might fit an income-focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com