A Look At PepsiCo (PEP) Valuation As North America Supply Chain Review Targets Multi Year Cost Savings

PepsiCo (PEP) is in focus after a comprehensive review of its North America supply chain. The review was launched following discussions with activist investor Elliott Investment Management and is centered on automation, digital tools, and multi year cost cuts.

See our latest analysis for PepsiCo.

The supply chain review comes as PepsiCo’s share price, last closing at US$142.23, shows modest near term softness alongside a small 1 year total shareholder return of 1.12% and a weaker 3 year total shareholder return, suggesting momentum has cooled recently.

If this kind of cost focused reset catches your attention, it can be a good moment to broaden your watchlist with fast growing stocks with high insider ownership for fresh ideas beyond large consumer staples names.

With PepsiCo trading around US$142.23, carrying a value score of 2 and an estimated 42% intrinsic discount, the key question is whether this reset indicates genuine undervaluation or if the market already reflects its future growth.

Most Popular Narrative Narrative: 8.8% Undervalued

With PepsiCo trading at US$142.23 against a widely followed fair value estimate of US$155.91, the narrative frames the gap around earnings power and margins rather than short term sentiment.

“Operational efficiencies from technology investments, including AI, ERP systems, and the integration of North American businesses, are enabling ongoing multiyear productivity gains, lowering fixed and variable costs, and supporting net margin improvement. (Expected impact: Operating margins and long-term earnings.)”

Curious what kind of revenue trajectory, margin lift, and future earnings multiple are baked into that valuation gap? The full narrative spells out the growth algorithm and payback expectations behind that US$155.91 figure.

Result: Fair Value of $155.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative can change quickly if cost cuts weigh on future capacity or if higher agricultural and packaging costs pressure margins more than expected.

Find out about the key risks to this PepsiCo narrative.

Another Way To Look At The Valuation

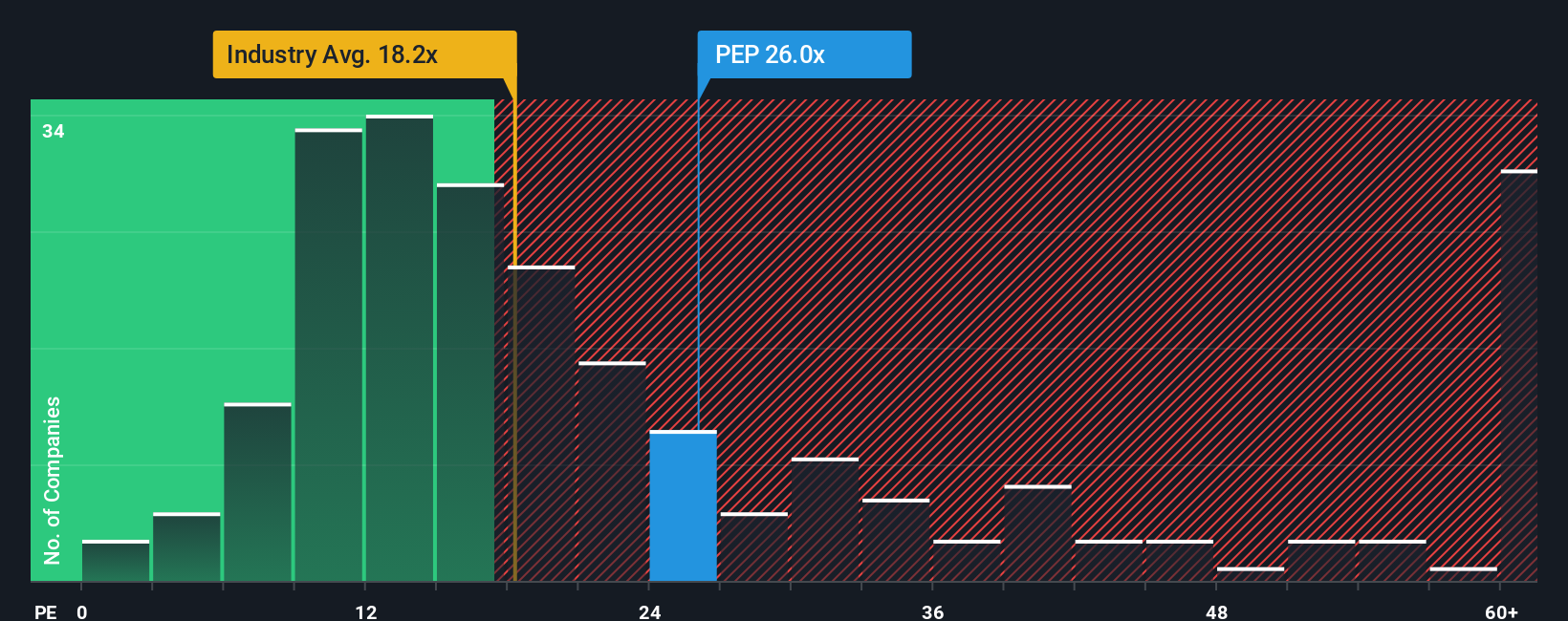

That 8.8% gap to fair value is grounded in earnings forecasts, but the current P/E of 27.2x tells a different story. It sits above both the Global Beverage industry at 18x and an estimated fair ratio of 24.9x, which leans toward PepsiCo being priced for a lot to go right. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PepsiCo Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete thesis in a few minutes with Do it your way

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If PepsiCo is on your radar, do not stop there. Use this momentum to scan for other opportunities that could fit your style and risk tolerance.

- Spot potential value setups by checking out these 870 undervalued stocks based on cash flows that might trade at discounts to their fundamentals.

- Consider major technology shifts by reviewing these 25 AI penny stocks that are tying artificial intelligence to business models.

- Explore higher income potential by filtering for these 14 dividend stocks with yields > 3% that can add yield-focused ideas to your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com