A Look At Spotify Technology (SPOT) Valuation As Momentum Cools After Strong Multi Year Run

Spotify Technology (SPOT) is back in focus for investors after recent trading left the stock with a mixed return profile, including a small gain over the past month alongside a sharper negative move over the past 3 months.

See our latest analysis for Spotify Technology.

At a latest share price of US$575.0, Spotify Technology’s 1-year total shareholder return of 22.62% and very large 3-year total shareholder return suggest momentum has cooled recently after a stronger multi year run, as investors reassess growth potential and risks.

If Spotify’s moves have you thinking about what else is happening in tech, it could be a good moment to scan high growth tech and AI stocks for other ideas.

With Spotify trading at US$575.0 and some measures suggesting a possible intrinsic discount and gap to analyst targets, you have to ask yourself whether there is still upside left here or whether the market is already pricing in future growth.

Most Popular Narrative: 18.2% Undervalued

According to MichaelP, the narrative fair value for Spotify Technology sits meaningfully above the recent US$575 share price, which puts a lot of weight on long term cash generation and margin expansion.

“As the business ramps up monetization of content, achieves better deals with the labels, reduces growth expenditure and relies less on music, I expect its gross and net margins will improve considerably, which will also change the way investors value the stock.”

Curious what kind of revenue growth, margin profile and earnings multiple are reflected in that view? The narrative relies on significant free cash flow expansion and a premium future P/E to support its fair value target.

Result: Fair Value of $703.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Spotify maintaining its competitive position and improving ad monetization. Setbacks in either area could quickly challenge that underpriced narrative.

Find out about the key risks to this Spotify Technology narrative.

Another Angle: Earnings Multiple Sends A Different Signal

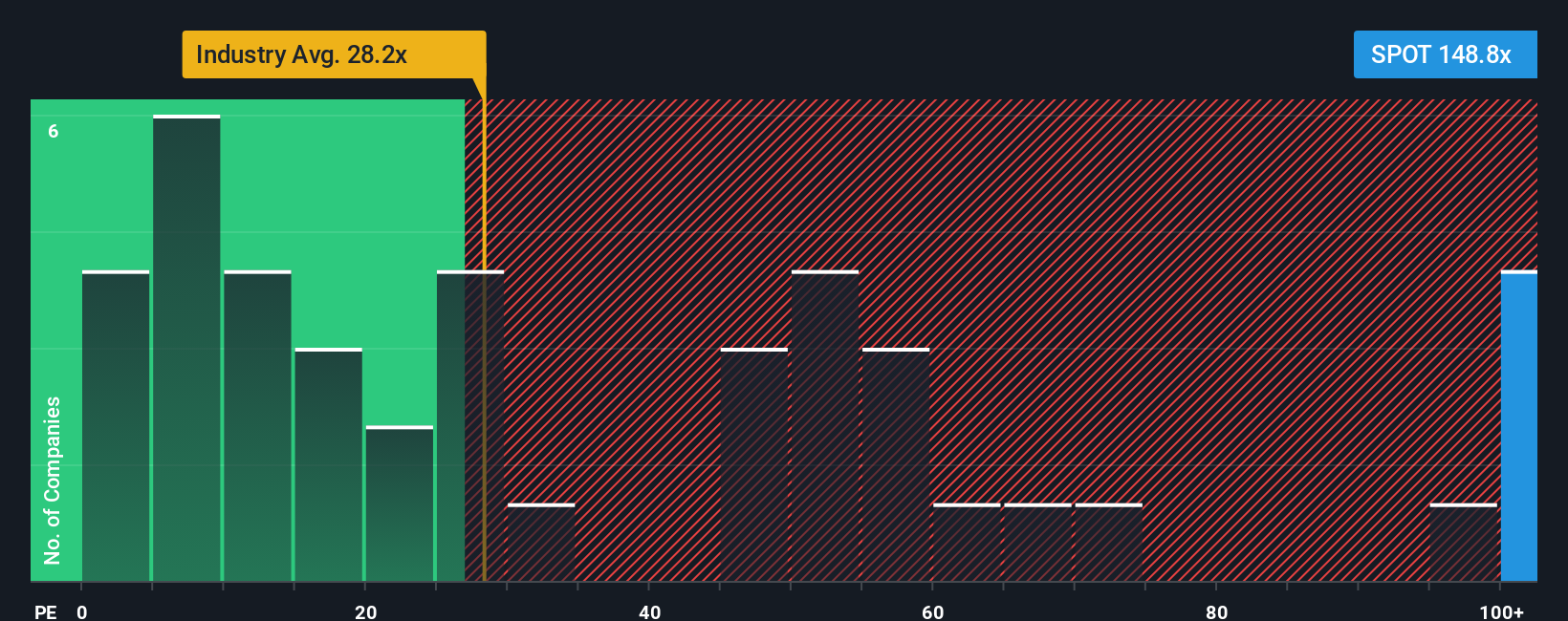

That 18.2% undervalued narrative stands in clear tension with how the market is currently pricing Spotify on earnings. At a P/E of 72x, the stock sits far above the US Entertainment industry average of 18.3x and also above its own estimated fair ratio of 35.3x.

Peers on average trade around 76.3x, so the stock is roughly in line with that group, yet still a long way from the fair ratio level the data suggests the market could move toward over time. For you, that gap can look like upside if earnings keep scaling smoothly, or valuation risk if expectations cool faster than profits grow. Which way do you think it breaks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you think the story looks different once you dig into the numbers yourself, you can stress test every assumption and build your own view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Spotify Technology.

Looking for more investment ideas?

If Spotify has you thinking harder about your next move, this is the moment to widen your watchlist and pressure test fresh ideas before the crowd catches up.

- Scan for possible mispriced opportunities by checking out these 870 undervalued stocks based on cash flows that may not fully reflect their underlying cash flows yet.

- Zero in on recurring income potential by reviewing these 14 dividend stocks with yields > 3% that could support more consistent shareholder returns.

- Get ahead of niche themes by tracking these 29 quantum computing stocks that sit at the intersection of advanced computing and listed markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com