Woodward (WWD) Valuation Check After Strong Growth And Supportive Sales Outlook

Strong recent growth puts Woodward in focus

Woodward (WWD) is drawing fresh attention after two years of organic revenue growth averaging 11.1%, alongside earnings per share growth of 38.1% a year and a supportive 12‑month sales outlook.

See our latest analysis for Woodward.

Woodward’s recent 90 day share price return of 22.15% and 1 year total shareholder return of 76.39% indicate that momentum has been building around its growth story and perceived risk profile.

If Woodward’s run has caught your eye, this could be a good moment to look across aerospace and defense stocks and see how other aerospace names are shaping up.

With Woodward trading at $310.86 against an analyst price target of $331.63 and an intrinsic value estimate that is around 32% higher, the question is whether there is still a buying window or the market is already incorporating the next leg of growth.

Most Popular Narrative: 2% Undervalued

The most followed narrative sets Woodward’s fair value at $317.13, slightly above the last close of $310.86, and frames a modest upside case.

The analysts have a consensus price target of $285.875 for Woodward based on their expectations of its future earnings growth, profit margins and other risk factors.

However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $245.0.

Want to see what sits behind that near term earnings climb, higher margin profile, and premium P/E assumption on 2028 profits, and why analysts think it holds together? The full narrative lays out the revenue build, margin path, and valuation multiple in a way you can line up against your own expectations.

Result: Fair Value of $317.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh heavy capital spending on new facilities and acquisitions, as well as supply chain and free cash flow pressures that could challenge the current earnings path.

Find out about the key risks to this Woodward narrative.

Another View: Earnings Multiple Sends A Different Signal

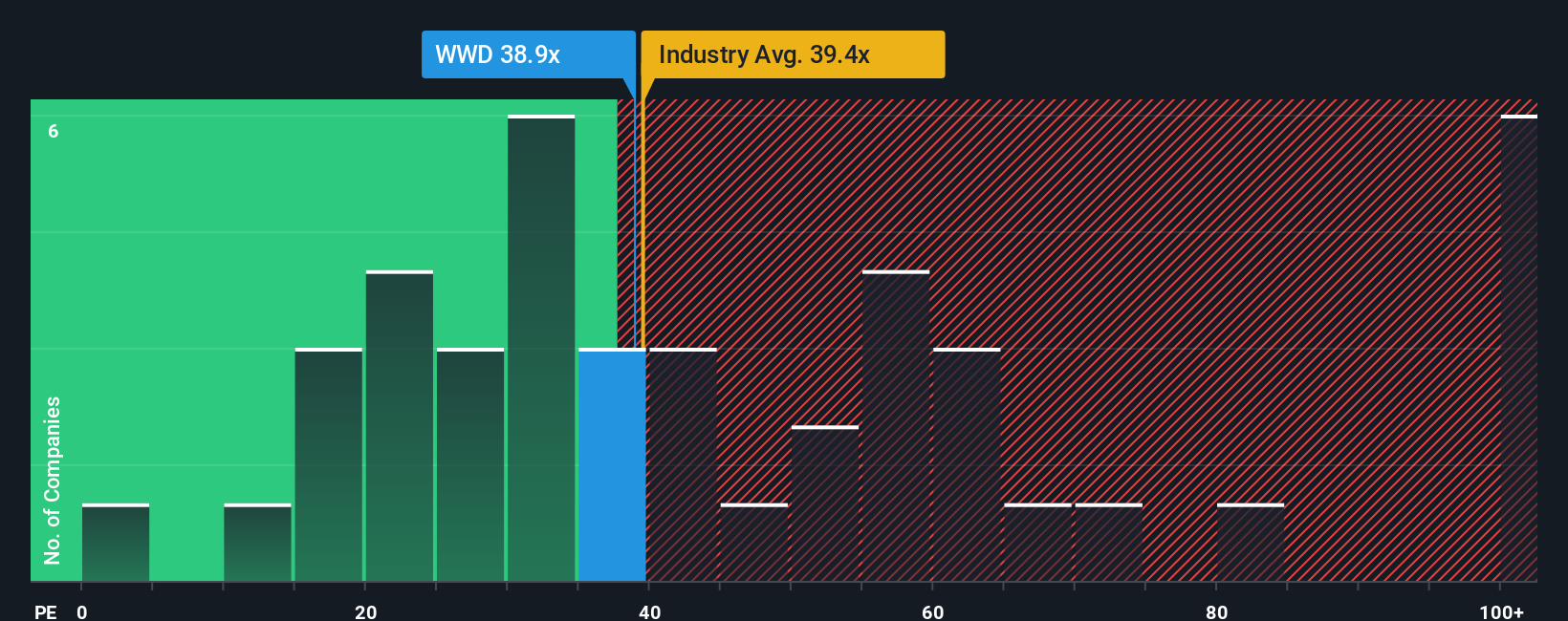

Those fair value narratives suggest a modest upside, but the current price tells a tougher story. Woodward trades on a P/E of 42.2x, compared with a fair ratio of 27.4x and an industry average of 39.3x, even though it scores just 1 out of 6 on our value checks.

That premium is not extreme versus immediate peers at 44.2x, but it still implies the market is paying up for execution and growth that are not forecast to outrun the broader US market. If sentiment cools or expectations soften, how much cushion do you really have at this level?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woodward Narrative

If you are not fully on board with this view or prefer to work from your own assumptions, you can test the numbers yourself and build a personalized thesis in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

Looking for more investment ideas?

If Woodward has sharpened your focus, do not stop here. Use the Simply Wall Street Screener to uncover fresh ideas that match what you care about most.

- Spot potential value opportunities early by checking out these 870 undervalued stocks based on cash flows that line up with your return and risk preferences.

- Zero in on income-focused ideas through these 14 dividend stocks with yields > 3% that could complement a long term wealth building plan.

- Lean into future facing themes by scanning these 79 cryptocurrency and blockchain stocks tying traditional markets to digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com