Guardant Health (GH) Valuation Check After Strong Recent Share Price Momentum

Guardant Health (GH) has drawn investor attention recently as its share price performance over the past 3 months and year sits alongside a business that reports US$902.569m in revenue and a net loss of US$398.789m.

See our latest analysis for Guardant Health.

The recent 90 day share price return of 60.37% and a 1 year total shareholder return of 183.56% suggest momentum has been strong, although the 5 year total shareholder return of a 34.18% loss highlights longer term volatility.

If Guardant Health has caught your eye, it can help to widen the lens and compare it with other healthcare stocks that may also be reshaping the sector.

With Guardant Health trading at US$101.74, an intrinsic discount of about 42% and a value score of 2 raise a key question: is this a genuine opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 9% Undervalued

Compared with Guardant Health's last close of US$101.74, the most followed narrative points to a fair value of about US$111.82, implying some upside based on its assumptions.

Significant improvements in operational scale, evidenced by material reductions in cost of goods sold and sharply improving gross margins in both Shield and Reveal, are fueling operating leverage, accelerating the path toward profitability and cash flow breakeven, and enhancing long-term margin expansion as test volumes scale.

Curious what kind of revenue run rate, margin shift, and earnings profile sit behind that valuation gap? The full narrative spells out a tight set of growth, profitability, and multiple assumptions that need to line up for that fair value to hold.

Result: Fair Value of $111.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Guardant reining in heavy R&D and SG&A spend, as well as securing broader payer coverage for Shield, where delays or setbacks could quickly challenge that upside story.

Find out about the key risks to this Guardant Health narrative.

Another View: Price To Sales Flags Richer Expectations

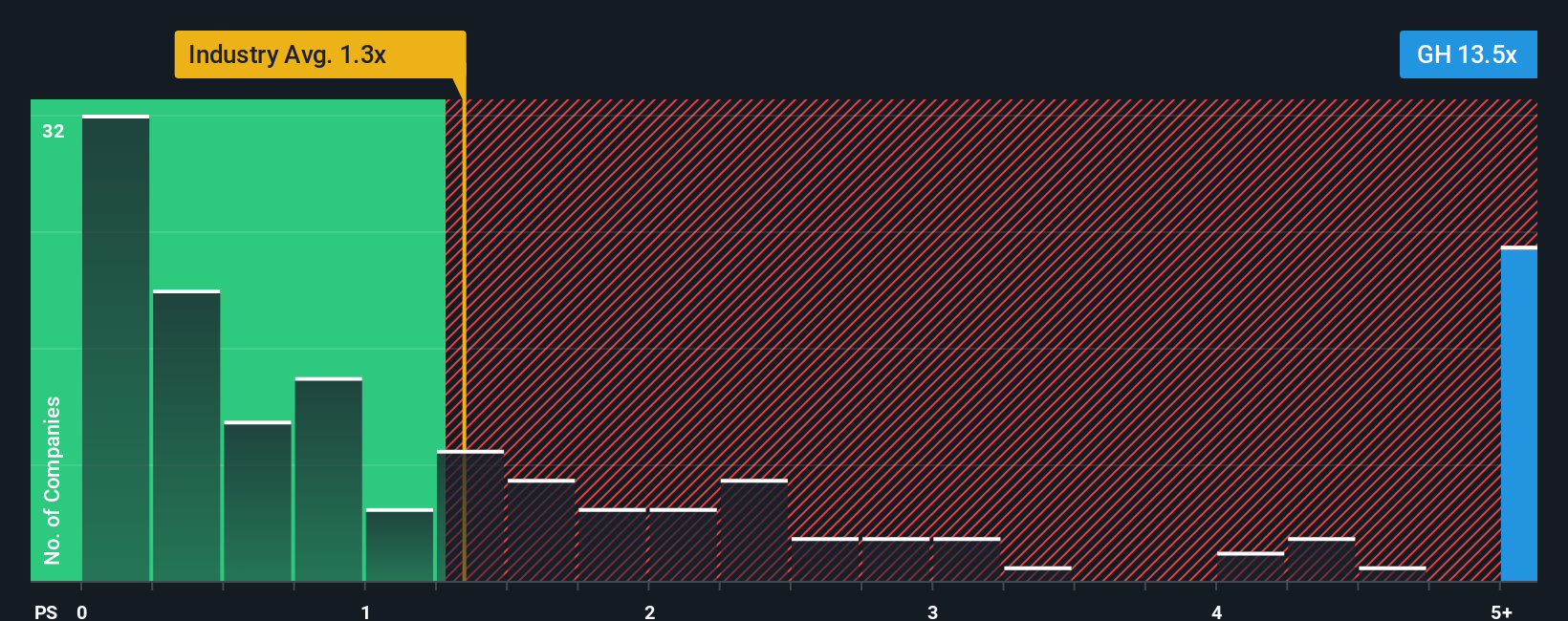

That 9% undervalued narrative sits alongside a very different signal from the market. Guardant Health trades on a P/S of 14.5x, compared with 1.2x for the wider US Healthcare industry and 1.1x for peers, while our fair ratio sits at 6.5x. That is a wide gap, which could either close through stronger fundamentals or a reset in the share price. Which outcome do you think is more realistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Guardant Health Narrative

If you see the numbers differently, or simply want to stress test these assumptions with your own inputs, you can build a custom Guardant view in a few minutes: Do it your way.

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Guardant Health is on your radar, do not stop there. The real edge often comes from lining up a few strong ideas side by side.

- Spot potential high risk high reward names early by scanning these 3564 penny stocks with strong financials that already show stronger financial footing than many of their peers.

- Target future facing themes by tracking these 29 quantum computing stocks that are building exposure to quantum computing before it becomes mainstream.

- Prioritise income and stability by reviewing these 14 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com