Assessing Okeanis Eco Tankers (OB:OET) Valuation After Recent Share Price Pullback And Mixed Signals

With no single headline event setting the tone, Okeanis Eco Tankers (OB:OET) has drawn attention after a recent negative 12.1% month return, which contrasts with a positive 16.5% move over the past 3 months.

See our latest analysis for Okeanis Eco Tankers.

The recent 12.1% 1 month share price decline and 4.1% 1 day drop, alongside a 16.5% 3 month share price return and strong 1 year and multi year total shareholder returns, suggest momentum is cooling after a powerful longer run.

If Okeanis Eco Tankers’ pullback has you reassessing opportunities in shipping and beyond, it could be a useful moment to broaden your search with fast growing stocks with high insider ownership.

So with Okeanis Eco Tankers trading at NOK 324.5, showing both a 48.7% estimated intrinsic discount and a 30% gap to analyst targets, is this a genuine value opportunity or is the market already pricing in future growth?

Most Popular Narrative: 23.1% Undervalued

At NOK 324.5, the most followed narrative sees Okeanis Eco Tankers trading below an estimated fair value of NOK 421.87, built on detailed earnings and margin assumptions.

The analysts have a consensus price target of NOK325.295 for Okeanis Eco Tankers based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $237.9 million, earnings will come to $141.1 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 10.5%.

Curious how a shrinking revenue line can still support higher earnings and a lower P/E than today, even with a higher discount rate baked in? The most followed narrative leans heavily on widening profit margins and a specific path for return on equity to justify that fair value. If you want to see exactly which assumptions carry the weight in this calculation and how tightly analysts cluster around them, the full narrative lays it out in black and white.

Result: Fair Value of NOK 421.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if a long term decline in crude demand or a period of weaker charter rates puts pressure on utilization and margins.

Find out about the key risks to this Okeanis Eco Tankers narrative.

Another View: Market Multiple Sends a Different Signal

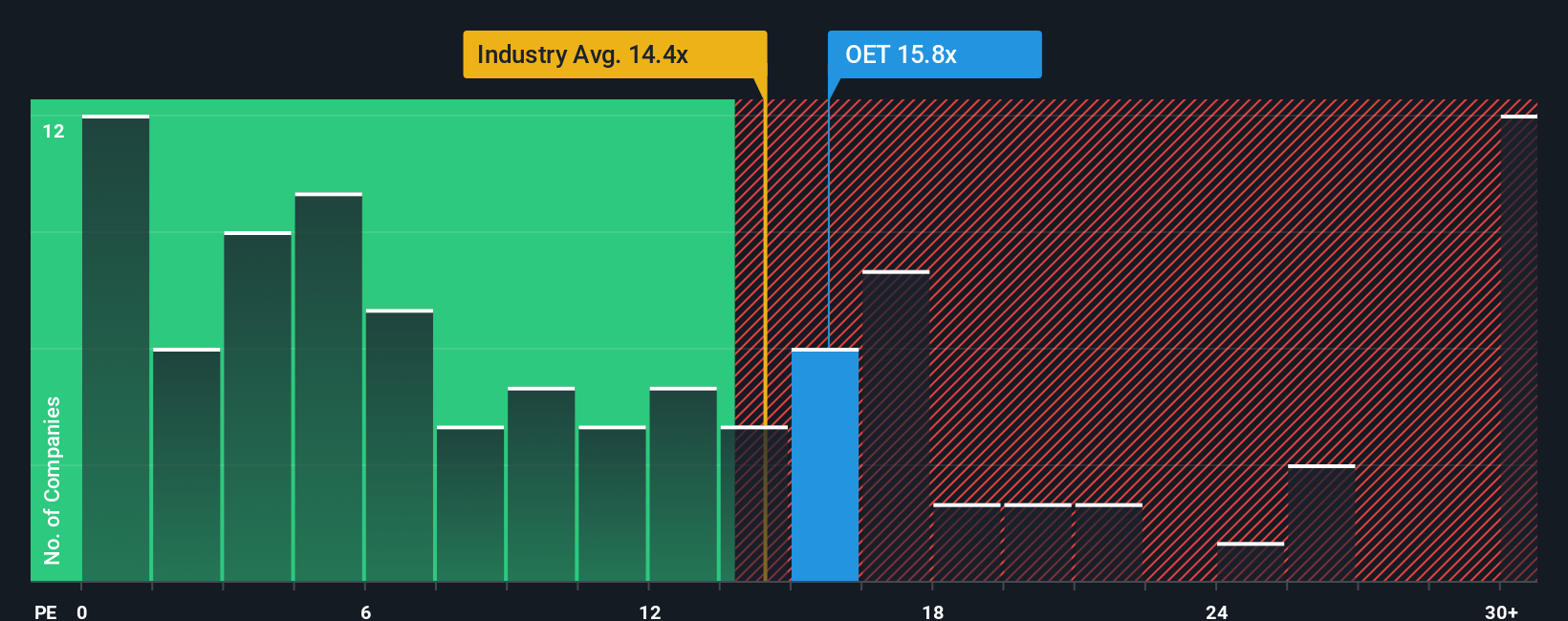

While the most popular narrative leans on a fair value of NOK 421.87, the current P/E of 14.9x tells a different story. That is higher than the European Oil and Gas industry at 11.7x, the peer average at 11.8x, and our fair ratio of 8.8x. This points to valuation risk if earnings or sentiment soften.

With such a clear gap between price targets, intrinsic value estimates, and where the market is currently pricing Okeanis Eco Tankers on earnings, which signal do you trust the most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okeanis Eco Tankers Narrative

If you are not fully on board with these assumptions or simply prefer to test the numbers yourself, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Okeanis Eco Tankers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Okeanis Eco Tankers has caught your attention, do not stop there. Widen your watchlist now so you are not relying on a single story.

- Target potential mispricings by scanning these 870 undervalued stocks based on cash flows that align with your view on quality and price.

- Ride powerful trends in automation and data by checking out these 25 AI penny stocks shaping how businesses use artificial intelligence.

- Tap into high income potential by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% plus supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com