US stock outlook | Futures of the three major stock indexes have mixed ups and downs, and sudden changes in the situation in Venezuela disrupt oil market expectations! Oil stocks are booming

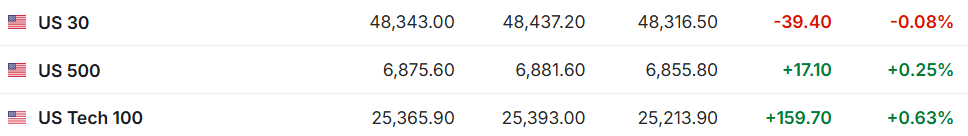

1. Before the US stock market on January 5 (Monday), futures for the three major US stock indexes had mixed ups and downs. As of press release, Dow futures were down 0.08%, S&P 500 futures were up 0.25%, and NASDAQ futures were up 0.63%.

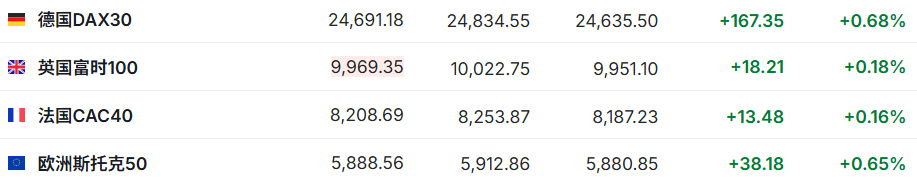

2. As of press release, the German DAX index rose 0.68%, the UK FTSE 100 index rose 0.18%, the French CAC40 index rose 0.16%, and the European Stoxx 50 index rose 0.65%.

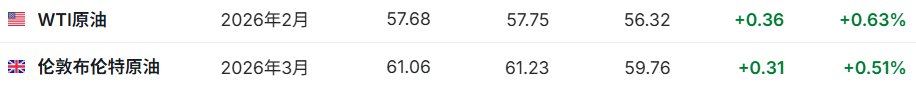

3. As of press release, WTI crude oil rose 0.63% to $57.68 per barrel. Brent crude rose 0.51% to $61.06 per barrel.

Market news

The changes in Venezuela triggered a dive in oil prices, and US debt rebounded across the board after concerns about inflation eased. US debt is expected to rise for the first time in a week. Earlier, oil prices fell due to the US military's arrest of Venezuelan President Nicolas Maduro, easing market concerns about continued inflation. The 10-year US Treasury yield fell 2 basis points to 4.17%, while the 2-year US Treasury yield, which is more sensitive to monetary policy, fell 1 basis point to 3.46%. The money market has fully absorbed the expectation that the Federal Reserve will cut borrowing costs by 25 basis points twice this year, and believes that the possibility of cutting interest rates for the third time is about 25%. Most global bonds rose on Monday as markets feared a drop in crude oil futures prices due to global oversupply. Even if Venezuela resumes oil production in the future, it will only make up for the sharp drop in production capacity over the past 20 years, and this year, as OPEC+ and other oil producers continue to increase production, the market will still face huge surpluses.

US Secretary of State Rubio: Western oil companies may return to Venezuela; US sanctions will continue until oil industry governance reforms are implemented. US Secretary of State Marco Rubio said on Sunday that the Trump administration expects Western energy companies to show strong interest in returning to Venezuela, but it is not clear whether the US will send troops to protect the oil infrastructure. Rubio said in an interview that the US government's focus is not on physical control of oil assets, but rather on enforcing sanctions related to the country's energy sector governance reforms. “It's not about ensuring the safety of oil fields,” Rubio said. It's about making sure that until the entire way the industry is governed is reformed, no sanctioned oil can go in or out.” Rubio said he himself hasn't talked to American oil executives in recent days, but said that if restrictions are relaxed, the White House expects Western companies to show “great interest.”

Goldman Sachs comments on the situation in Venezuela: the short-term impact on oil prices is expected to be limited, and production may rise in the long term. Goldman Sachs said that after the US arrests the Venezuelan leader, the room for long-term growth in the country's oil production may eventually put pressure on global crude oil prices. Last weekend, the United States shocked the world by attacking the South American nation of Venezuela, arresting Venezuelan President Nicolas Maduro, and claiming to “take over” the country. Venezuela used to be a major oil producer, but production has declined sharply over the past 20 years. Goldman Sachs analyst Daan Struyven and others pointed out in a Sunday report that any recovery “is likely to be gradual and incomplete, as infrastructure is aging and strong incentives are needed to attract significant upstream investment.” Goldman Sachs kept the average price expectations for Brent crude oil and WTI crude oil unchanged at 56 US dollars and 52 US dollars per barrel, respectively.

The first full trading week for US stocks in 2026: Non-agricultural enterprises are hitting hard, and investors are keeping an eye on the job market. Last Friday — the penultimate trading day in the “Santa Claus Market” cycle — US stocks closed. The Dow Jones index, which is mainly blue chips, led the way. The S&P 500 index also rose, while the NASDAQ index fell slightly. Looking ahead to the week ahead, the first full trading week of 2026 will usher in full resumption of the release of economic data. The US non-farm payrolls report for December, which will be released on Friday, is expected to show a slowdown in recruitment activity in the last month of 2025. Economists expect the number of non-farm workers to increase by 55,000 in December, lower than the increase of 64,000 in November; in terms of the unemployment rate, which rose to a four-year high of 4.6% in November, it is expected to fall 0.1 percentage points in December.

Goldman Sachs warns: The wave of AI layoffs is approaching 2026, and “decoupling” employment from the economy will become the new normal. According to a new Goldman Sachs report, although investors are no longer rewarding companies for layoffs, artificial intelligence will trigger another wave of layoffs in 2026 as companies speed up automation processes to reduce costs. While this warning is issued, the global economy is expected to remain generally stable, highlighting the growing disconnect between economic conditions and job security. Although financial markets have begun to view large-scale layoffs as a sign of weak growth prospects rather than a move to improve efficiency, companies are still expected to push ahead with automation-led restructuring. Goldman Sachs said that companies are increasingly using artificial intelligence to automate routine and repetitive tasks, thereby controlling the growth in the number of employees or even directly reducing the size of employees.

Individual stock news

Sudden changes in the situation in Venezuela disrupt oil market expectations! US oil stocks surged on the news, and Chevron (CVX.US) rose 6% before the market. American oil company shares were generally higher in Monday's pre-market trading. Earlier, US President Trump said that after arresting Nicolas Maduro last weekend, the US plans to “take over” Venezuela. Under special US permission, Chevron (CVX.US), the only US oil giant still operating in Venezuela, rose 6%. ConocoPhillips (COP.US) and ExxonMobil (XOM.US) shares rose at the same time. This rise in stock prices is due to market expectations that US sanctions against the Venezuelan leadership may ease restrictions on the country's crude oil, allowing more crude oil to flow to US buyers. This is critical for refiners — when supply is tight or discounted, crude oil categories and production locations can quickly impact costs and profit margins.

AI and robots have big dreams, but the reality of electric cars is boring: Tesla (TSLA.US)'s market in China has been shrinking for two consecutive years. Despite a slight recovery in the volume of shipments in December, the Chinese factory volume of the global electric vehicle leader Tesla still declined significantly in the full year of 2025 compared to 2024. The world's largest car company, led by Elon Musk, the richest man in the world, is struggling at a time when global sales are slowing down significantly, and has lost its dual position as the number one electric vehicle market share in the world and the number one electric vehicle market share in China. As China's most famous electric vehicle manufacturers such as BYD, “Wei Xiaoli”, and Xiaomi continue to launch new models with novel features, competition in the Chinese electric vehicle market is becoming increasingly fierce. Tesla has lost the double title of the Chinese market and the world's largest electric vehicle manufacturer, and has been surpassed by BYD.

Novo Nordisk (NVO.US) Wegovy oral medication is marketed in the US, starting at $149 per month for patients at their own expense. Novo Nordisk said on Monday that starting January 5, it will launch two versions of the oral weight loss drug Wegovy to patients at their own expense in the US. The 1.5 mg and 4 mg dosage forms are priced at $149 per month. According to the company's official website, there are also two high-dose oral dosage forms — 9 mg and 25 mg — on the market on the same day, with a monthly price of $299. The announcement also stated that the price of the 4 mg dosage will be raised to $199 per month starting April 15. According to information, the US Food and Drug Administration (FDA) approved the launch of this oral medication on December 22 last year. This move injected new impetus into Novo Nordisk regaining an advantage in market competition with LLY.US (LLY.US).

This private equity giant is betting on commercial aerospace! It wants to take over L3 Harris (LHX.US) space assets to focus on the “Golden Dome” and the wave of satellite deployments. L3Harris Technologies, a major US defense technology and aerospace project contractor, is close to reaching a major deal to sell 60% of its portfolio of aerospace and promotion business assets to AE Industrial Partners, one of the world's leaders in private equity. L3Harris Technologies, a major defense and military company headquartered in the US, is actively divesting part of NASA's business lines to further focus on the development of US national security technology and missile-priority strategies. People familiar with the matter said the deal could be announced as early as Monday local time. The deal linked to L3Harris will also be one of the largest deals in the global space industry in recent months.

The $6 billion merger and acquisition deal spawned a “long and short showdown”! Trump Media (DJT.US) has become the new target of the underdog hunt. According to S3 Partners LLC, Trump Media Technology Group's short positions surged last month after US President Trump's social media company announced a merger agreement with private energy company TAE Technologies and triggered a sharp rise in stock prices. The financial data provider said DJT's short position climbed 31% to 15.8 million shares after reaching a merger agreement with TAE Technologies, which focuses on nuclear fusion energy technology, on December 18. The full stock deal was valued at over $6 billion. According to the terms of the agreement, Trump Media Technology Group and TAE will merge, and the existing shareholders of both sides will each hold approximately 50% of the new company's shares on a fully diluted basis.

Key economic data and event forecasts

23:00 Beijing time: US ISM manufacturing PMI for December.

23:00 Beijing time: The UN Security Council holds an emergency meeting on the US military action against Venezuela.

The next day at 04:30 a.m. Beijing time: The CFTC released the weekly position report.