Assessing Enphase Energy (ENPH) Valuation After Recent Share Price Momentum Shift

Enphase Energy (ENPH) has drawn fresh attention after its recent share price moves, with a 1 day return of 5.3% and a month gain of 8%. This has prompted investors to reassess the stock’s recent performance.

See our latest analysis for Enphase Energy.

That 5.3% 1 day share price return and 8% 30 day share price return come after a 6.95% decline over the last 90 days and a 52.72% 1 year total shareholder return decline. This indicates that recent momentum has picked up following a much weaker longer term experience.

If Enphase’s move has you rethinking your exposure to clean tech and chips, it could be a good moment to compare it with other high growth tech and AI stocks on Simply Wall St.

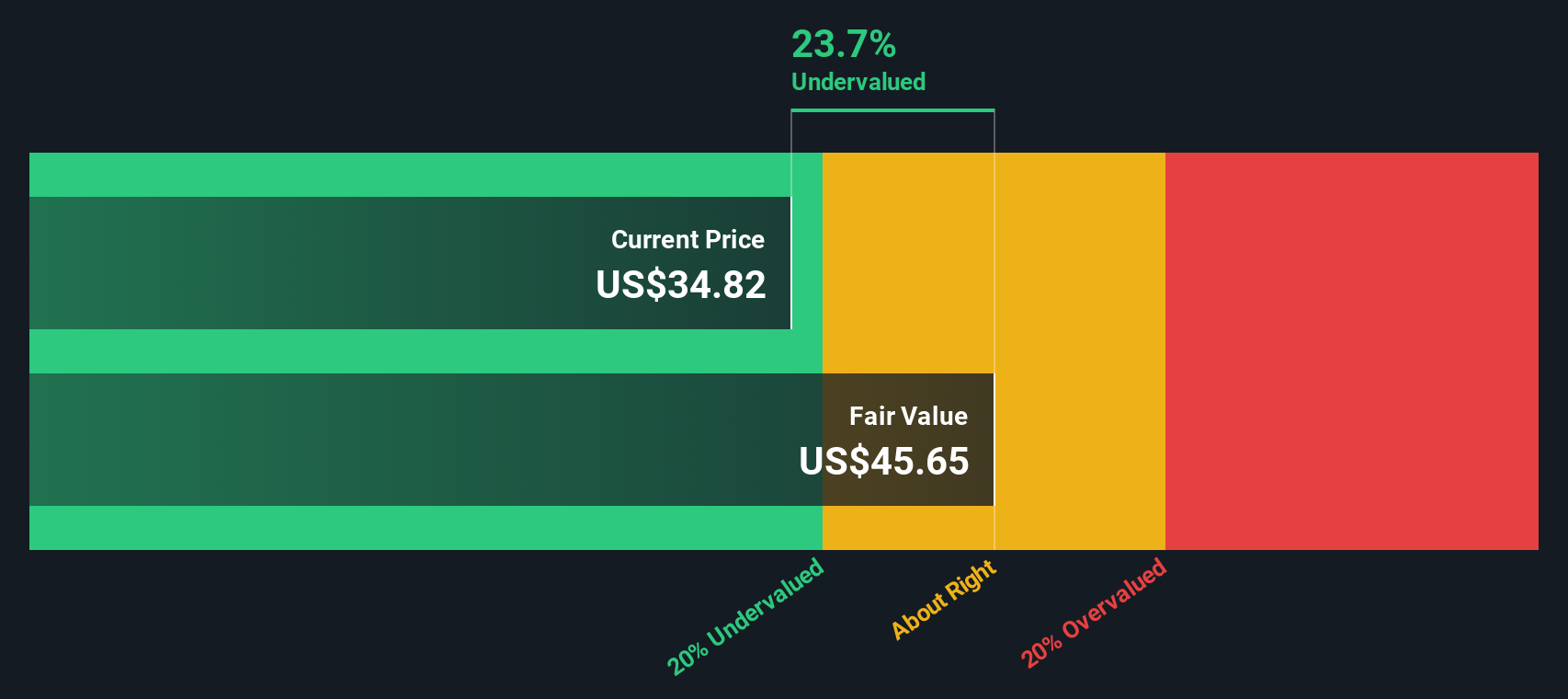

With the share price at US$33.75, a small discount to the US$38.49 analyst target and a slight premium to some intrinsic value estimates, you have to ask if this weakness is a chance to buy or if the market already expects future growth.

Most Popular Narrative Narrative: 11.4% Undervalued

Compared with the last close at US$33.75, the most followed narrative sees Enphase Energy’s fair value closer to the high US$30s, framing recent weakness differently.

Upcoming launches of next-generation products including the IQ9 microinverter with gallium nitride technology, the fifth-generation high-density battery, and bidirectional EV chargers position Enphase to capture new commercial, multi-phase, and EV‑oriented market segments, leading to a structurally lower cost base and improved gross margins.

Curious what kind of revenue path and margin profile need to line up for that valuation to work? The narrative leans heavily on earnings power, scale benefits, and a specific profit multiple that investors may want to stress test for themselves.

Result: Fair Value of $38.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this view only holds if U.S. residential solar avoids a deeper demand slump and if tariffs and potential inventory overhangs do not put sustained pressure on margins.

Find out about the key risks to this Enphase Energy narrative.

Another Angle On Value

Our SWS DCF model currently points to a fair value of about US$32.46 per share, compared with the recent price of US$33.75. That suggests Enphase is slightly overvalued on this view, in contrast to the narrative pointing to roughly 11% upside. Which set of assumptions do you find more realistic for the next few years?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enphase Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enphase Energy Narrative

If you see the data differently, or prefer to test your own assumptions, you can build a custom Enphase view in just a few minutes, starting with Do it your way.

A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about making your research count, do not stop at one company. Use the Simply Wall St screener to surface fresh opportunities now.

- Zero in on potential value opportunities by checking out these 870 undervalued stocks based on cash flows that line up with your preferred fundamentals and price discipline.

- Tap into the growth story around artificial intelligence through these 25 AI penny stocks that link real business models with this fast growing theme.

- Ride the ongoing shift toward digital assets by reviewing these 79 cryptocurrency and blockchain stocks that tie blockchain ideas to listed companies you can actually invest in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com