Assessing NETSTREIT (NTST) Valuation As Undervaluation Narrative Meets Richer Revenue Multiple

Why NETSTREIT is on investors’ radar today

NETSTREIT (NTST) has been drawing attention after recent share performance and valuation metrics put the real estate investment trust back in focus for income oriented investors seeking net lease retail exposure.

See our latest analysis for NETSTREIT.

The share price sits at US$17.77, with a 1 month share price return of 1.78% and a 3 month share price return of a 2.52% decline. The 1 year total shareholder return of 35.88% and 3 year total shareholder return of 8.50% suggest earlier momentum has been stronger than more recent trading.

If NETSTREIT has you rethinking your income ideas, it could be a good moment to scan other real estate names and stronger balance sheets via solid balance sheet and fundamentals stocks screener (None results).

With NETSTREIT trading at US$17.77 and appearing to be at a sizeable intrinsic discount on some models, the key question is simple: are you looking at an undervalued net lease REIT, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 13% Undervalued

With NETSTREIT last closing at US$17.77 and the most followed narrative pointing to fair value near US$20.42, the gap comes down to growth, margins and required return assumptions.

Conservative balance sheet management, ample liquidity, and an improving cost of capital position NETSTREIT to pursue attractive external growth opportunities, enabling the company to accelerate accretive acquisitions that should positively impact AFFO per share and long-term earnings.

Curious how rent checks, acquisition pacing and margin targets add up to that valuation gap? The narrative leans on higher revenue, fatter margins and a richer earnings multiple. Want to see exactly how those moving parts are stitched together into a single fair value number?

Result: Fair Value of $20.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if tenant credit weakens or acquisition deals fail to deliver the earnings and cash flow that current assumptions rely on.

Find out about the key risks to this NETSTREIT narrative.

Another Angle: Multiples Tell a Different Story

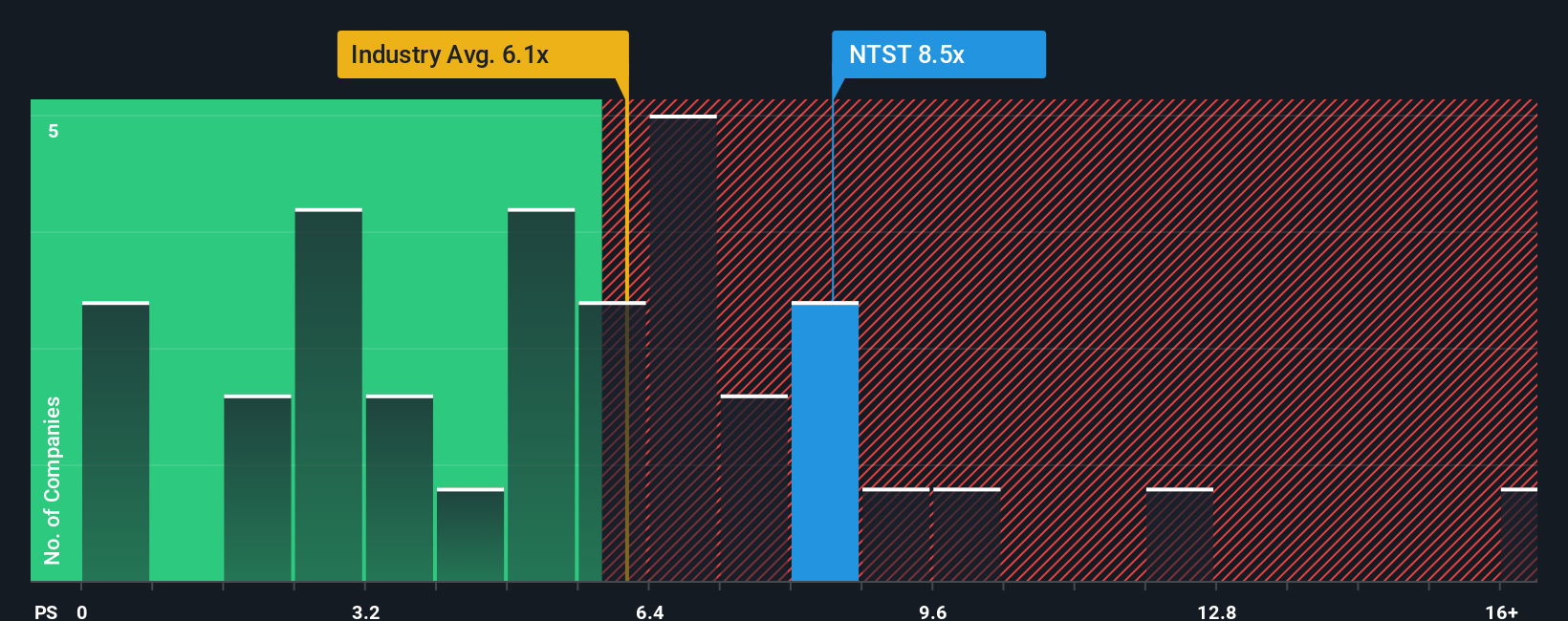

While the most popular narrative labels NETSTREIT as undervalued, its current P/S of 8x sits above both peers at 7.6x and the US Retail REITs average of 6.1x, and above a fair ratio of 7.5x. That richer pricing can mean less cushion if expectations slip. Where do you think the market adjusts first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NETSTREIT Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a personalised NETSTREIT view in minutes by starting with Do it your way.

A great starting point for your NETSTREIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If NETSTREIT has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Spot potential value ahead of the crowd by scanning these 870 undervalued stocks based on cash flows that look attractively priced based on their underlying cash flows.

- Tap into the growth story around artificial intelligence through these 25 AI penny stocks that are tied to real business models, not just headlines.

- Add diversification and high income potential with these 14 dividend stocks with yields > 3% that offer yields above 3% while still passing basic quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com