Assessing NXP Semiconductors (NXPI) Valuation As Weak Sentiment And Margin Pressures Weigh On The Stock

Recent commentary around NXP Semiconductors (NXPI) has zeroed in on weaker short and medium term sentiment, as postponed customer orders, revenue declines over the past two years, and tighter free cash flow margins pressure the stock.

See our latest analysis for NXP Semiconductors.

That softer sentiment is showing up in the tape, with a recent 30 day share price return of 2.93% and a modest 1 year total shareholder return of 5.64%. The 3 year total shareholder return of 45.42% hints that longer term holders have seen stronger gains even as near term momentum looks more muted around the current US$221.28 share price.

If chip demand cycles and order pushouts are front of mind, it can help to widen the lens to other semiconductor names and see how they compare across high growth tech and AI stocks.

So with revenue under pressure, thinner free cash flow margins, and the share price around US$221.28 after a softer year, is NXP quietly offering value here, or are markets already pricing in all the future growth?

Most Popular Narrative: 14.3% Undervalued

Against NXP Semiconductors' last close of US$221.28, the most followed narrative lands on a higher fair value, built on detailed earnings and margin assumptions.

The industrial & IoT business is seeing a broad-based cyclical recovery across all geographies, now extending beyond consumer IoT and into core industrial applications. This, combined with growing customer engagements around higher performance and Edge AI-capable MCU/MPU platforms, is setting the stage for a return to NXP's historical 8 to 12% annual growth rate in this segment, benefitting top-line performance.

Curious what kind of revenue lift, margin expansion, and future earnings multiple are baked into that fair value? The narrative leans on compounding growth, rising profitability and a valuation multiple that steps down from today. The full set of assumptions shows exactly how those pieces are stitched together.

Result: Fair Value of $258.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points here, including modest end demand recovery in automotive and intense China competition that could squeeze both growth and margins.

Find out about the key risks to this NXP Semiconductors narrative.

Another View: Our DCF Signals Less Upside

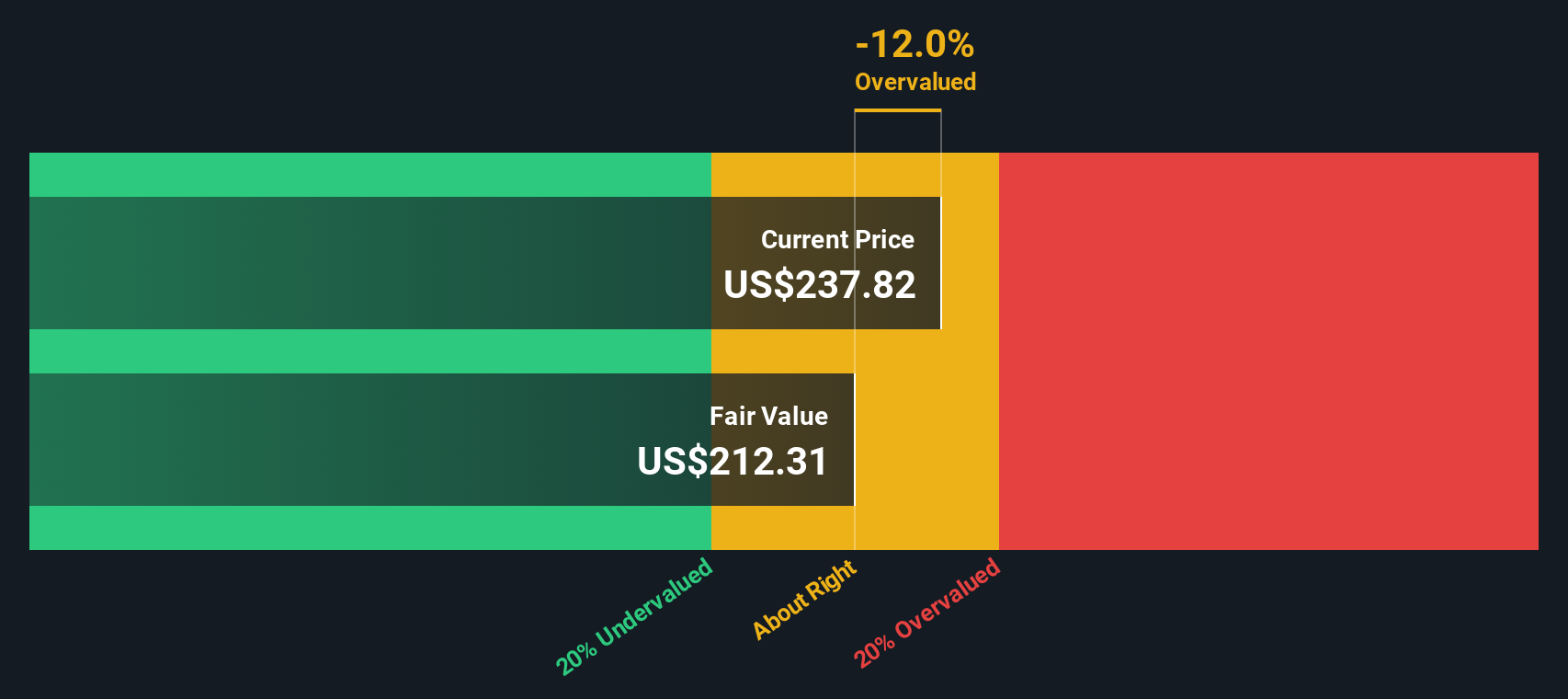

While the consensus narrative points to a fair value of US$258.19 and calls the shares undervalued, the Simply Wall St DCF model lands in a different place. In that framework, NXP at US$221.28 is trading above an estimated fair value of US$204.11, which indicates a degree of overvaluation instead. Which perspective do you feel more comfortable relying on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If you see the assumptions differently, or prefer to work through the numbers yourself, you can build a custom view of NXP in minutes with Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If NXP has you thinking more broadly about your portfolio, do not stop here. Fresh ideas often come from comparing a few different angles side by side.

- Target reliable income streams by scanning these 14 dividend stocks with yields > 3% that might help balance more growth focused positions.

- Spot potential growth stories early by reviewing these 3564 penny stocks with strong financials that pair smaller size with stronger fundamentals.

- Tap into long term technology themes by checking out these 29 quantum computing stocks that are working on next generation computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com