Assessing Workday (WDAY) Valuation After Sustainable Growth Advisers Fully Exits The Stock

Sustainable Growth Advisers’ decision to fully exit Workday (WDAY), citing tougher competition from SAP and expectations for slower revenue growth, has put the stock back in focus for investors assessing long term prospects.

See our latest analysis for Workday.

Workday’s recent share price weakness, including a 1 day share price return of 4.19% decline and a 90 day share price return of 11.74% decline to US$205.79, sits alongside a 1 year total shareholder return of 19.02% decline and a 3 year total shareholder return of 26.31%. This suggests shorter term momentum has faded even as longer term holders still see a positive net outcome.

If this shift in sentiment has you reassessing your tech exposure, it could be a good moment to broaden your watchlist with high growth tech and AI stocks.

So with Workday now trading well below some analysts’ estimated value and growth expectations reset lower, are you looking at an underappreciated compounder in enterprise software, or is the market already factoring in its future trajectory?

Most Popular Narrative: 25.4% Undervalued

With Workday’s fair value estimate around US$275.88 versus a last close of US$205.79, the most followed narrative sees a sizeable valuation gap that depends heavily on how earnings and margins develop over time.

Investments in global footprint (notably UK, Germany, Japan, and now India with local data centers and leadership) are unlocking new revenue pools while providing geographic diversification that can help stabilize and grow overall revenue. Continued focus on operational efficiency, ecosystem and marketplace development (Workday Extend, partner-driven ACV >20%), and scalable AI infrastructure is enabling operating leverage and margin expansion, driving long-term improvement in non-GAAP operating margin and free cash flow.

Curious what kind of revenue mix, margin profile, and future earnings multiple sit behind that gap to fair value? The full narrative spells out the growth rates, profitability lift, and valuation assumptions it takes for Workday to grow into that price tag, and why the discount rate still keeps those forecasts in check.

Result: Fair Value of $275.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case can unravel if newer AI first HCM and ERP rivals pressure pricing, or if heavier R&D and M&A spending fails to improve efficiency.

Find out about the key risks to this Workday narrative.

Another Angle On Valuation

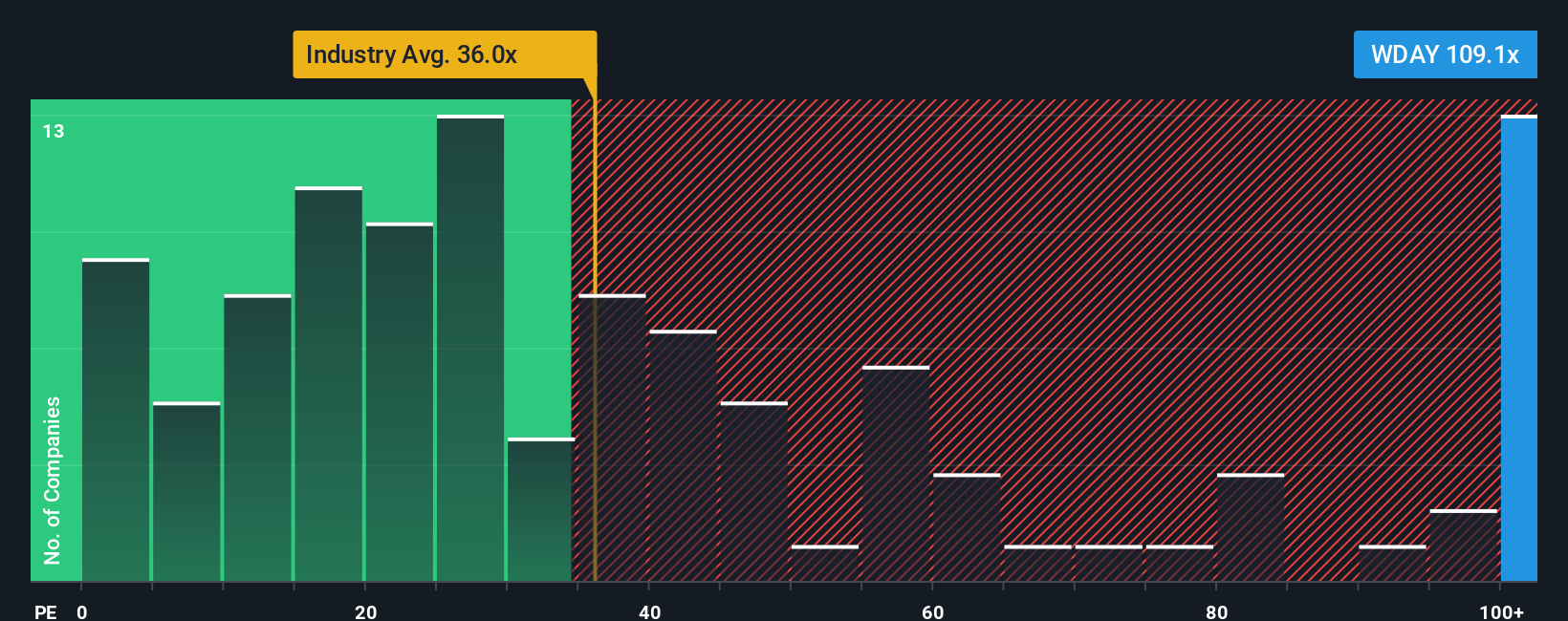

That 25.4% gap to fair value sits awkwardly next to Workday’s current P/E of 84.3x, which is higher than both the US Software industry at 31.7x and peers at 55.9x, and well above a fair ratio of 46.7x. Is that premium justified, or are you paying up for optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you see the numbers differently or want to stress test your own assumptions, you can quickly build a complete Workday view yourself in minutes: Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Workday has sharpened your focus, do not stop there, your next strong idea could be sitting in a corner of the market you have not checked yet.

- Scan for fast moving opportunities by zeroing in on these 3564 penny stocks with strong financials that pair smaller market caps with solid fundamentals and clear financial footing.

- Target potential future winners by filtering for these 25 AI penny stocks where artificial intelligence is central to the business model rather than a side project or marketing slogan.

- Focus on price versus cash flow by hunting through these 870 undervalued stocks based on cash flows that screen for companies trading below what their cash generation might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com