Assessing Datadog (DDOG) Valuation After Recent Share Price Weakness

Datadog stock snapshot

Datadog (DDOG), a US based observability and security platform provider, has drawn attention after recent share price weakness, with returns negative over the past week, month and past 3 months.

See our latest analysis for Datadog.

That recent share price weakness sits against a mixed backdrop, with Datadog’s 1 year total shareholder return of an 8.4% decline contrasting with a 3 year total shareholder return of about 2x. This suggests momentum has faded in the short term as investors reassess growth expectations and risk.

If Datadog’s move has you rethinking your watchlist, it could be a good moment to look across other high growth tech and AI names using high growth tech and AI stocks.

With Datadog shares under pressure despite reported annual revenue and net income growth, the key question is simple: is the current price a discount to future potential, or has the market already priced in that growth?

Most Popular Narrative: 36.9% Undervalued

Compared to the last close of $133.77, the most widely followed narrative points to a higher fair value, built on specific growth and margin assumptions.

Ongoing product innovation (e.g., autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins.

Curious what kind of revenue curve and margin profile need to hold up to support that higher fair value? The narrative leans on ambitious top line expansion, rising profitability and a rich future earnings multiple that is usually reserved for market leaders. Want to see exactly how those ingredients are combined into one valuation story?

Result: Fair Value of $211.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if heavy reliance on large AI customers or rising competition from cloud providers and security vendors starts to affect growth or margins.

Find out about the key risks to this Datadog narrative.

Another lens on valuation

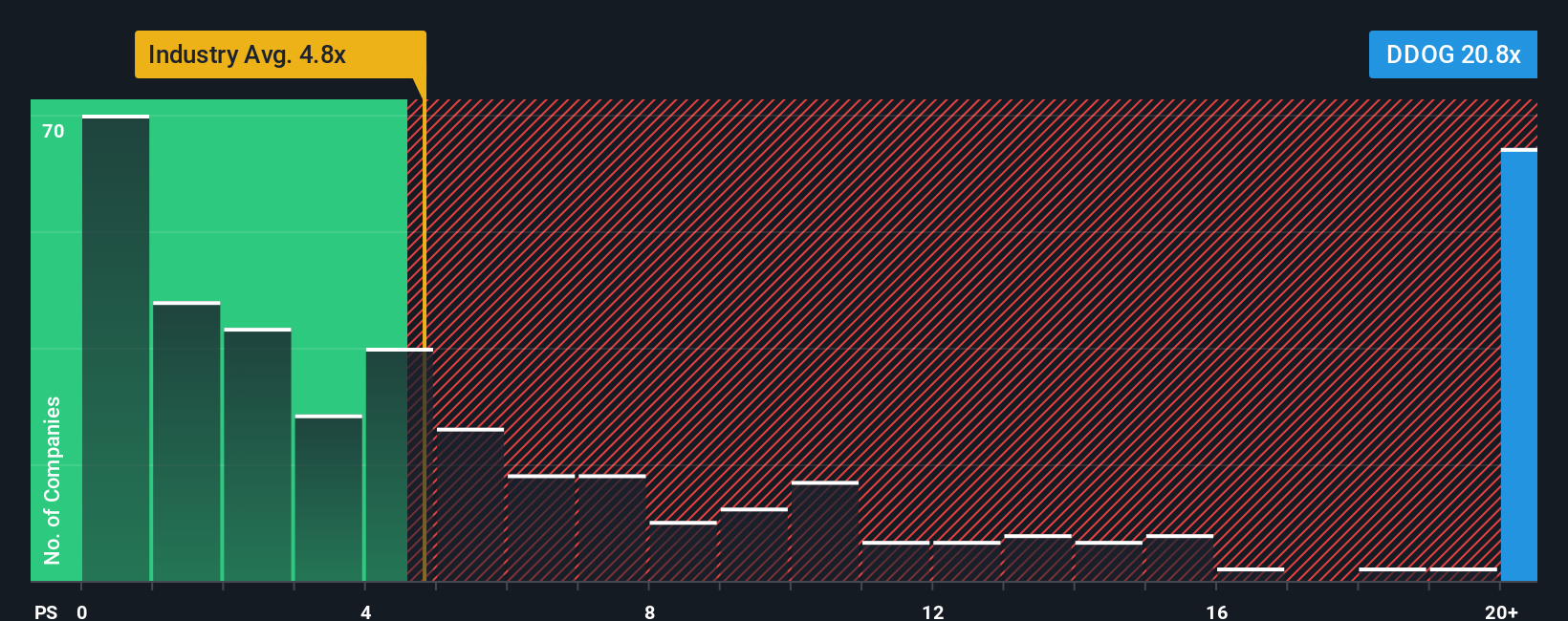

That 36.9% undervalued narrative contrasts with how the market is pricing Datadog’s revenue today. The current P/S of 14.6x sits well above the US Software industry at 4.7x, above peers at 9.7x, and even above the fair ratio of 12.7x that the market could move toward. Is this a premium you are comfortable paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If this version of the Datadog story does not quite match your own view, you can quickly test your assumptions and build a custom narrative in minutes using Do it your way.

A great starting point for your Datadog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Datadog is on your radar, do not stop there. The next smart move is to widen your search and let the data surface fresh opportunities.

- Target potential mispricings by reviewing these 870 undervalued stocks based on cash flows that may offer a more attractive entry point based on current cash flow expectations.

- Spot the next wave of growth stories by scanning these 25 AI penny stocks that are harnessing artificial intelligence to build scalable business models.

- Boost your income focus by checking out these 14 dividend stocks with yields > 3% that currently yield above 3% and might complement a growth oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com