3 Penny Stocks With Market Caps Under $200M To Watch

The U.S. stock market has been experiencing a surge, with major indices like the Dow Jones hitting all-time highs, driven by geopolitical developments and strong performances in sectors such as energy. For investors willing to explore beyond the well-known giants, penny stocks—often representing smaller or emerging companies—can present intriguing opportunities. Despite being an older term, these stocks remain relevant for those seeking potential value in less-established firms with solid financials and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.66 | $570.05M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8438 | $144.31M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.235 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.32B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.32 | $560.81M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.66 | $381.59M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.9891 | $7.18M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $88.13M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AmpliTech Group (AMPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AmpliTech Group, Inc. designs, engineers, and assembles microwave component-based amplifiers with a market cap of $67.84 million.

Operations: The company generates revenue from international markets amounting to $13.63 million and $8.95 million from the United States.

Market Cap: $67.84M

AmpliTech Group, with a market cap of US$67.84 million, is gaining attention in the 5G telecommunications sector due to its recent breakthrough achievement in the O-RAN Global PlugFest Fall 2025. This milestone highlights AmpliTech's leadership in developing commercial-grade 64T64R radios for high-capacity networks. Despite being unprofitable and having less than a year of cash runway, AmpliTech's debt-free status and strategic advancements position it as a potential disruptor in the Open RAN market. The company forecasts significant revenue growth, anticipating at least US$50 million for FY2026, doubling from FY2025 projections.

- Get an in-depth perspective on AmpliTech Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into AmpliTech Group's future.

Rapid Micro Biosystems (RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the production of pharmaceuticals, medical devices, and personal care items across various countries, with a market cap of $139.17 million.

Operations: The company generates revenue from systems and related LIMS connection software, consumables, and services amounting to $30.52 million.

Market Cap: $139.17M

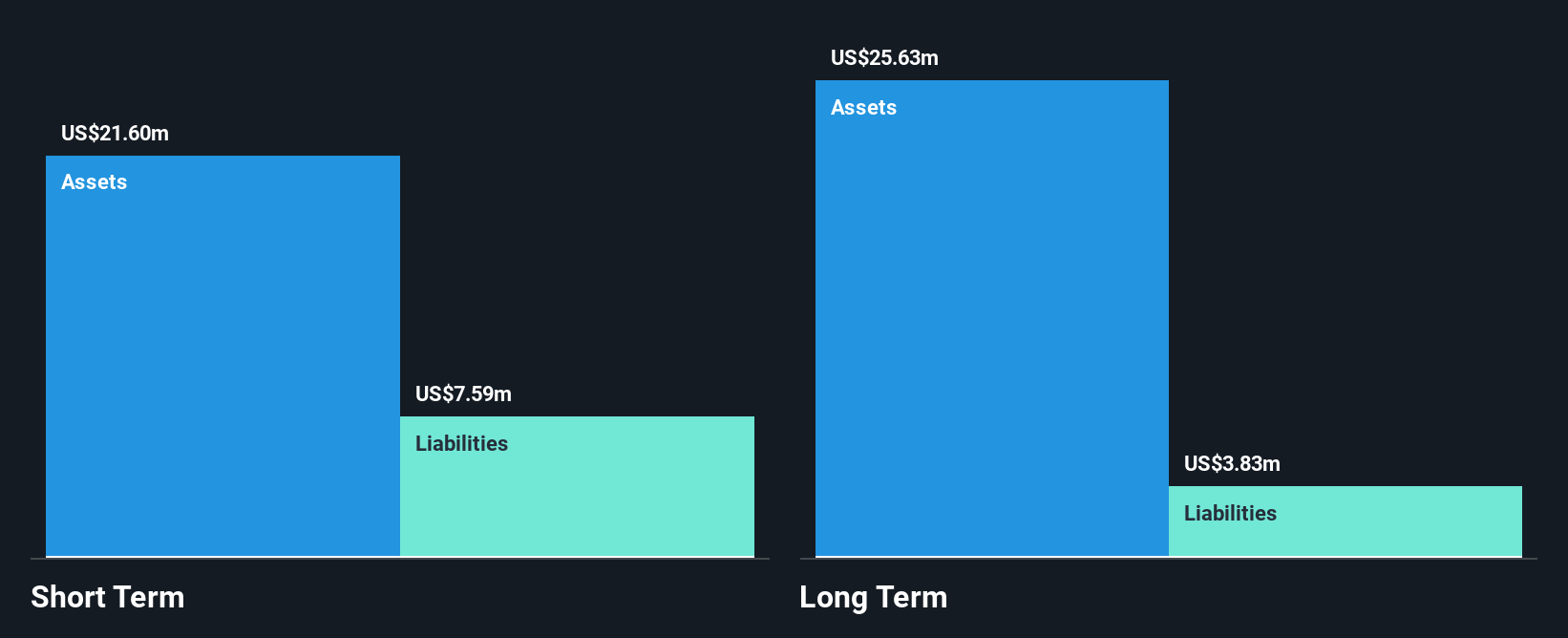

Rapid Micro Biosystems, with a market cap of US$139.17 million, remains a volatile yet intriguing option in the life sciences sector. Despite being unprofitable and having a negative return on equity (-99.91%), the company has no debt and maintains sufficient cash runway for over a year based on current free cash flow trends. Recent earnings reports show modest revenue growth to US$22.31 million for nine months ended September 2025, with reduced net losses compared to previous periods. The company raised its full-year revenue guidance to at least US$33 million, indicating potential future improvements despite ongoing challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Rapid Micro Biosystems.

- Examine Rapid Micro Biosystems' earnings growth report to understand how analysts expect it to perform.

Tile Shop Holdings (TTSH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tile Shop Holdings, Inc. is a specialty retailer in the United States that focuses on man-made and natural stone tiles, setting and maintenance materials, and related accessories with a market cap of $163.21 million.

Operations: The company's revenue is primarily generated from its retail segment focused on building products, totaling $338.79 million.

Market Cap: $163.21M

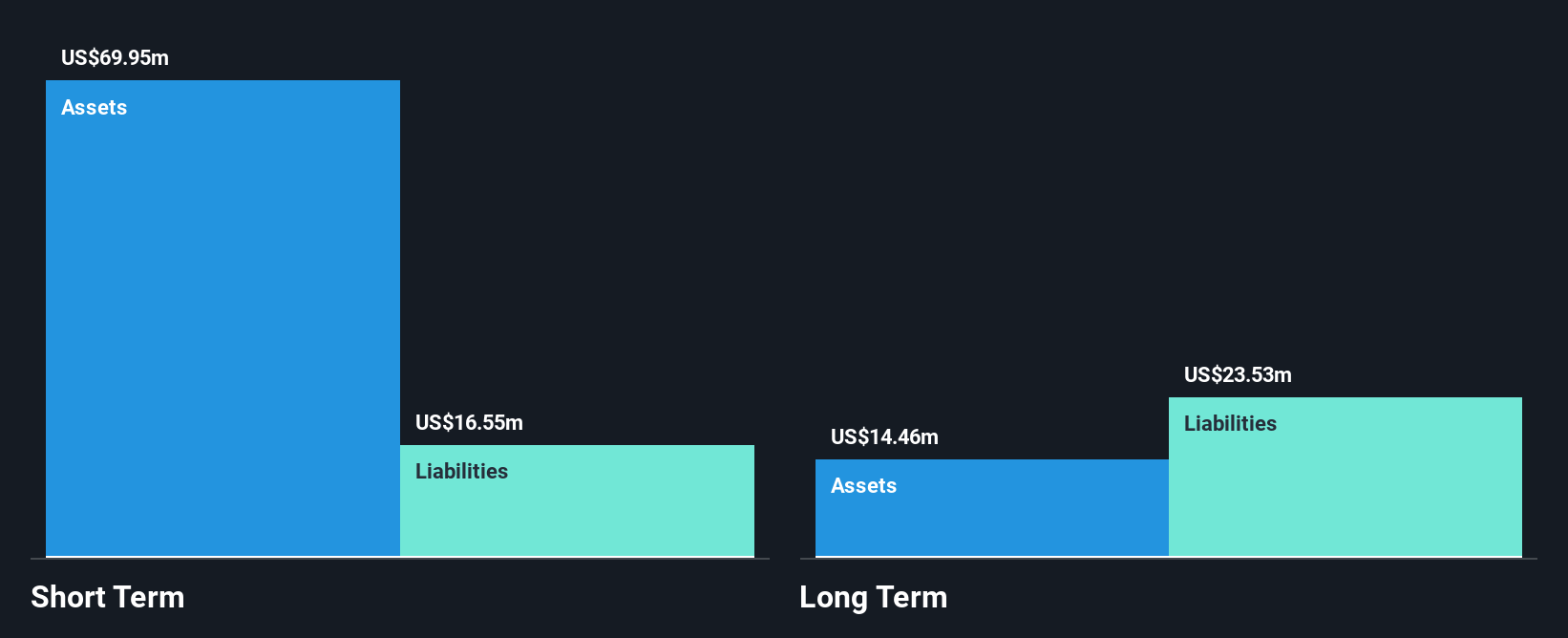

Tile Shop Holdings, Inc., with a market cap of US$163.21 million, has faced significant challenges recently, including voluntary delisting from Nasdaq and multiple index removals. Despite generating US$338.79 million in revenue primarily from its retail segment, the company remains unprofitable with a net loss of US$1.05 million for the nine months ended September 2025. The stock splits and subsequent deregistration aim to reduce costs by over US$2.4 million annually while focusing on long-term growth initiatives. The management team is experienced, and the company operates debt-free with sufficient short-term assets covering liabilities.

- Navigate through the intricacies of Tile Shop Holdings with our comprehensive balance sheet health report here.

- Understand Tile Shop Holdings' track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 345 US Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com