3 Stocks Estimated To Be Up To 48.4% Below Intrinsic Value

As the U.S. stock market reaches new heights, driven by geopolitical events and a surge in energy shares, investors are increasingly looking for opportunities in undervalued stocks that may offer significant potential. In this environment, identifying stocks trading below their intrinsic value can be a strategic move for those seeking to capitalize on market inefficiencies and future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VTEX (VTEX) | $3.63 | $7.12 | 49% |

| Varonis Systems (VRNS) | $32.04 | $63.28 | 49.4% |

| Valley National Bancorp (VLY) | $11.69 | $22.99 | 49.2% |

| Perfect (PERF) | $1.73 | $3.44 | 49.7% |

| Investar Holding (ISTR) | $26.21 | $52.36 | 49.9% |

| Heritage Financial (HFWA) | $23.70 | $46.41 | 48.9% |

| Fifth Third Bancorp (FITB) | $47.71 | $93.83 | 49.2% |

| CNB Financial (CCNE) | $25.74 | $50.61 | 49.1% |

| Clearfield (CLFD) | $29.49 | $58.19 | 49.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $20.16 | $39.94 | 49.5% |

Let's explore several standout options from the results in the screener.

BillionToOne (BLLN)

Overview: BillionToOne, Inc. is a precision diagnostics company that focuses on quantifying biology to develop molecular diagnostics, with a market cap of $4.09 billion.

Operations: The company generates revenue of $254.14 million from its Medical Labs & Research segment.

Estimated Discount To Fair Value: 44.2%

BillionToOne, Inc. appears undervalued, trading at US$89.29 against a fair value estimate of US$160.13, suggesting a 44.2% discount based on discounted cash flow analysis. Recent revenue growth of 92.2% and forecasted annual revenue increase of 26% outpace the broader market's expectations, while earnings are projected to grow by 86.3% annually over the next three years. Despite high share price volatility and low future return on equity forecasts (9.4%), its inclusion in major indices may enhance visibility and investor interest.

- Our growth report here indicates BillionToOne may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of BillionToOne.

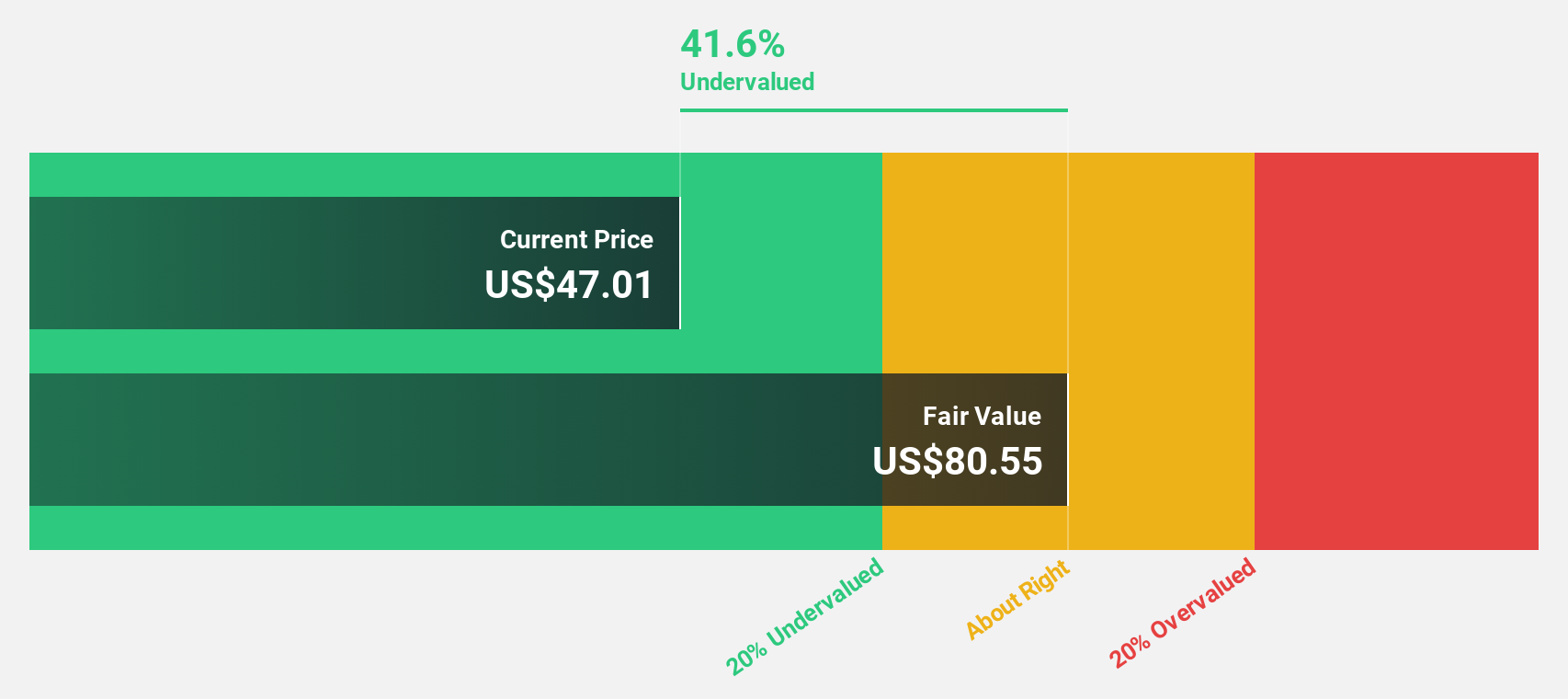

Century Aluminum (CENX)

Overview: Century Aluminum Company, along with its subsidiaries, is engaged in the production and sale of standard-grade and value-added primary aluminum products in the United States and Iceland, with a market cap of $3.82 billion.

Operations: The company's revenue is generated from the production and sale of standard-grade and value-added primary aluminum products in both the United States and Iceland.

Estimated Discount To Fair Value: 48.4%

Century Aluminum is trading at US$40.94, significantly below its estimated fair value of US$79.36, highlighting a substantial undervaluation based on discounted cash flow analysis. Despite recent operational disruptions and declining profit margins from 14.6% to 3.2%, the company forecasts robust annual earnings growth of over 61%. However, debt coverage by operating cash flow remains inadequate, posing potential financial challenges amidst efforts to restart idle capacity and increase production by 50,000 metric tons at Mt. Holly smelter through a new power agreement extension with Santee Cooper until 2031.

- Our earnings growth report unveils the potential for significant increases in Century Aluminum's future results.

- Unlock comprehensive insights into our analysis of Century Aluminum stock in this financial health report.

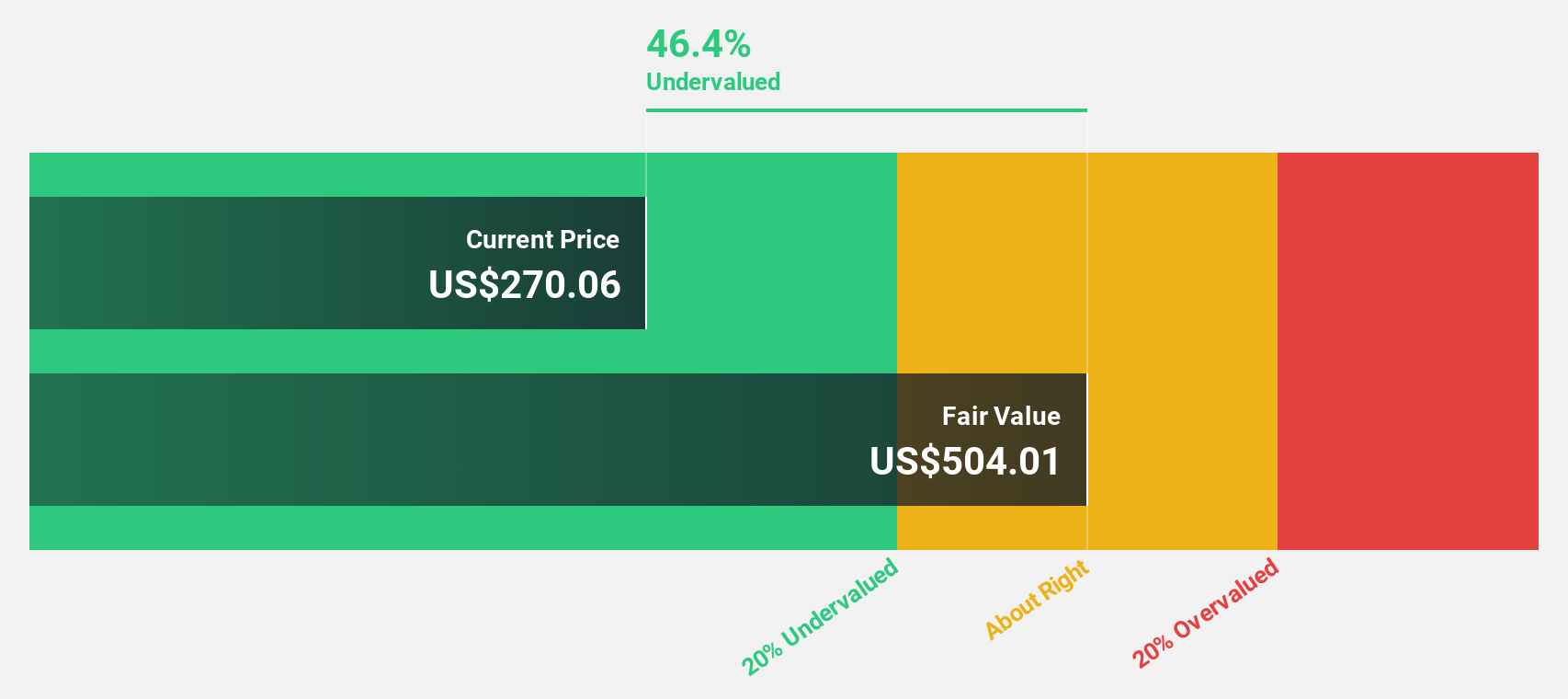

Flutter Entertainment (FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and other international markets; it has a market cap of approximately $38.19 billion.

Operations: The company's revenue is primarily derived from its operations in the US ($6.44 billion) and UKI ($3.63 billion).

Estimated Discount To Fair Value: 43.7%

Flutter Entertainment, trading at US$218.27, is significantly undervalued with an estimated fair value of US$387.37 based on discounted cash flow analysis. Despite a net loss of US$690 million for Q3 2025 and goodwill impairment charges of US$517 million, the company is forecast to achieve profitability within three years with earnings growth projected at 43.38% annually. Recent share buybacks totaling 1.89% reflect strategic financial management amidst revenue guidance adjustments to a midpoint of $16.69 billion for 2025.

- The analysis detailed in our Flutter Entertainment growth report hints at robust future financial performance.

- Get an in-depth perspective on Flutter Entertainment's balance sheet by reading our health report here.

Make It Happen

- Access the full spectrum of 186 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com