Assessing Taiwan Semiconductor Manufacturing (NYSE:TSM) Valuation After Recent Share Price Momentum and AI Demand Expectations

Why Taiwan Semiconductor Manufacturing has investors’ attention

Taiwan Semiconductor Manufacturing (NYSE:TSM) is back on many watchlists after a strong 1 year total return of 46.8%, paired with reported annual revenue growth of 15.9% and net income growth of 15.8%.

See our latest analysis for Taiwan Semiconductor Manufacturing.

The recent 1 day share price return of 5.2% and 30 day share price return of 8.5% suggest momentum is building again. The 3 year total shareholder return above 3x hints at a longer term compounding story that has already rewarded patient holders.

If TSM’s move has you thinking about where else chip demand and AI spending might show up, it could be a good time to scan high growth tech and AI stocks for other candidates.

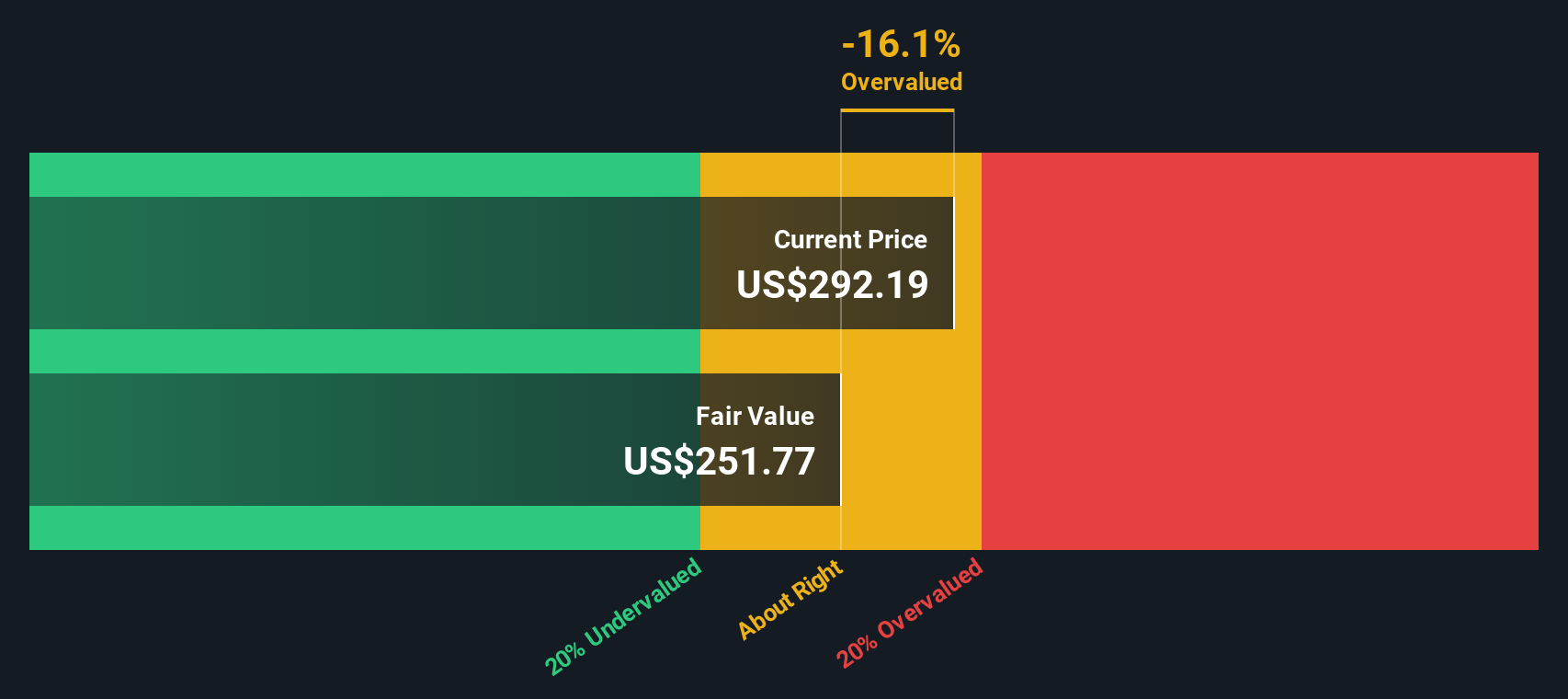

With TSM trading at $319.61, a reported intrinsic value gap of over 50%, and only an 8.4% discount to the average analyst target, investors may ask whether there is still a buying opportunity here or if future growth is already reflected in the current price.

Most Popular Narrative Narrative: 3.1% Overvalued

According to oscargarcia, the narrative fair value of Taiwan Semiconductor Manufacturing sits at US$310, slightly below the last close of US$319.61, setting up a mild premium story that rests heavily on earnings power and AI infrastructure demand.

“TSMC is the central pillar of the global semiconductor ecosystem, powering the AI revolution with unmatched scale, cutting-edge process technology, and disciplined execution. With record profits, dominant client base, and massive expansion underway, both in Taiwan and abroad, it stands as a low-risk way to own the AI infrastructure wave.”

Curious how this narrative gets to that fair value without going overboard on growth? The engine is robust profitability, rich margins, and a future earnings multiple that assumes AI demand stays intense but not limitless. Want to see exactly how those building blocks fit together in the model?

Result: Fair Value of $310 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on AI demand remaining strong, as well as on TSM successfully managing geopolitical tensions and the higher costs of building fabs outside Taiwan.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: Market Ratios Tell a Different Story

Our DCF model marks TSM at a fair value of about US$208.12 per share, which puts today’s US$319.61 price in clearly overvalued territory. That is a much harsher view than the US$310 narrative fair value. Which signal do you trust more: cash flows or story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If parts of this story don’t quite fit your view, or you would rather test the numbers yourself, you can spin up a fresh thesis in just a few minutes. Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If TSM has sharpened your interest in semiconductors and AI, you may want to continue exploring. Fresh ideas across sectors can help round out your research.

- Spot potential rebound candidates early by scanning these 3564 penny stocks with strong financials that pair smaller market caps with solid balance sheets and cash generation.

- Consider the AI theme more broadly by checking out these 25 AI penny stocks involved in areas such as data centers and automation, all filtered for you in one place.

- Focus on price and fundamentals by reviewing these 870 undervalued stocks based on cash flows that screen for companies where cash flows and current valuations may be out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com