Intuitive Surgical (ISRG) Valuation Check After Strong Multi Year Returns And Premium P/E Multiple

Intuitive Surgical (ISRG) is on investors’ radar after recent trading, with the stock closing at $561.98 and showing mixed short term returns alongside strong multi year total return figures.

See our latest analysis for Intuitive Surgical.

Recent trading has been a little soft, with a 7 day share price return of 2.33% and a 30 day share price return of 2.32%. However, a 90 day share price return of 27.45% alongside a 3 year total shareholder return of 112.12% suggests longer term momentum has been much stronger than the latest moves imply.

If Intuitive Surgical has caught your attention, this can be a good moment to broaden your view of the sector and check out other healthcare stocks that might fit your watchlist.

Intuitive Surgical is a profitable, growing business with annual revenue of US$9.61b and net income of US$2.75b. However, with the stock near US$562, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 5.8% Undervalued

With a modeled fair value of about US$596.36 against a last close of US$561.98, the most followed narrative sees some upside still on the table.

Ongoing product innovation (including full launch of da Vinci 5, integrated force feedback, and digital/AI case insights), coupled with R&D to expand into adjacent specialties, enhances clinical outcomes and surgeon efficiency supporting future procedure growth, higher system ASPs, and increased recurring instrument and accessory revenues.

Curious what kind of revenue growth, profit margins, and future earnings multiple have to line up to support that valuation gap? The narrative spells it out in detail.

Result: Fair Value of $596.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points to watch, including tariff and mix driven margin headwinds, as well as tighter hospital budgets in key international markets that could hit system demand.

Find out about the key risks to this Intuitive Surgical narrative.

Another View: High P/E Puts More Pressure On Execution

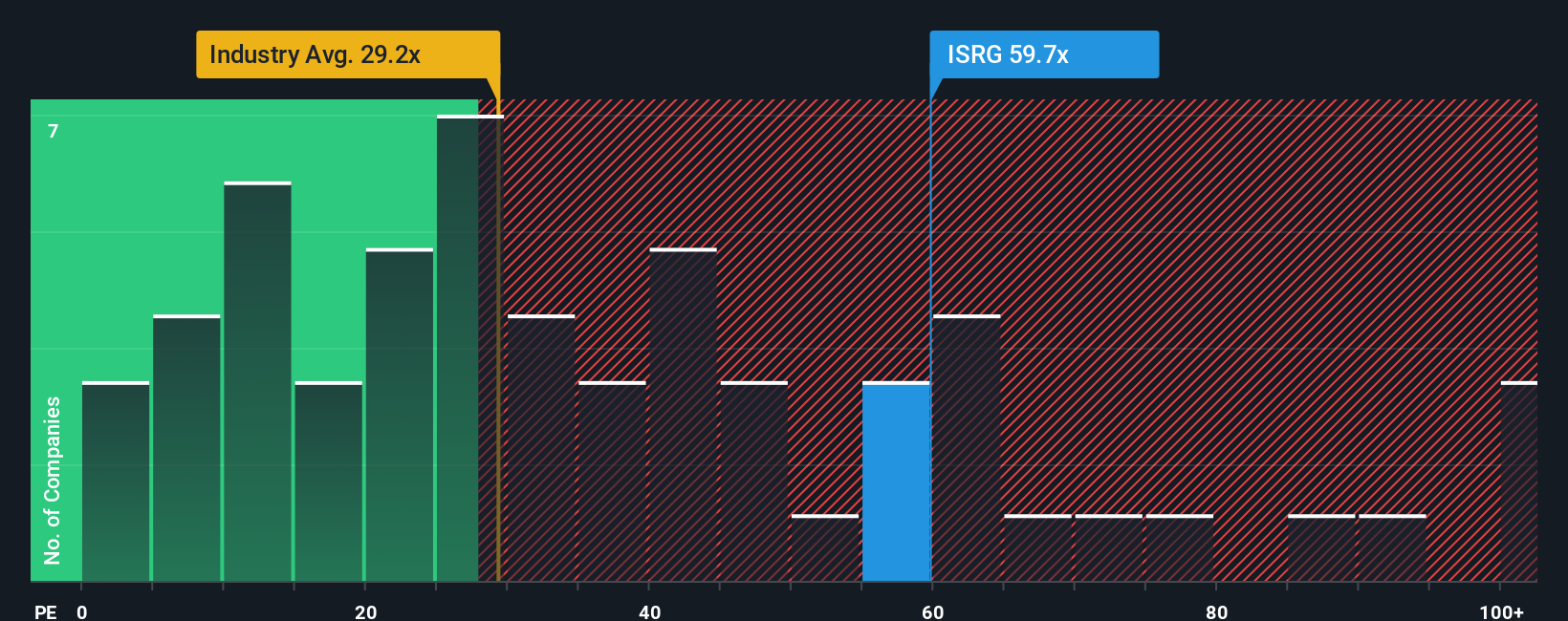

The most followed narrative sees Intuitive Surgical as about 5.8% undervalued, but the current P/E of 72.5x paints a different picture. That multiple is far above the US Medical Equipment industry at 29.5x, the peer average at 34.2x, and even the fair ratio estimate of 38.9x.

In practice, that means a lot of future growth and profitability is already baked into the price. This leaves less room for error if earnings or procedure volumes come in softer than expected. The question for you is whether that valuation gap feels like justified quality or a stretch that could compress.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Surgical Narrative

If parts of this view do not quite line up with your own thinking, or you prefer to test the assumptions yourself, you can review the numbers, frame your own story in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intuitive Surgical.

Looking for more investment ideas?

If Intuitive Surgical is already on your radar, do not stop there. Widen your search and let data led tools help you surface fresh opportunities.

- Spot potential high risk high reward ideas early by scanning these 3564 penny stocks with strong financials that already show stronger balance sheets and financial quality than many of their peers.

- Target possible mispriced opportunities by sorting through these 870 undervalued stocks based on cash flows that screen cheaply against their cash flow profiles and might warrant a closer look.

- Lean into long term themes by reviewing these 79 cryptocurrency and blockchain stocks that tie listed companies to blockchain, digital assets, and related infrastructure plays.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com