Assessing Digital Realty Trust (NYSE:DLR) Valuation After Recent Share Price Weakness

Why Digital Realty Trust Is On Investors’ Radar

Digital Realty Trust (NYSE:DLR) has been drawing attention after a period of mixed share performance, with the stock showing a 0.2% move over the past day but a weaker month and past 3 months.

For investors watching data center real estate, those recent returns sit alongside a business that reports US$5.8b in revenue and US$1.4b in net income. This has prompted fresh questions about how the market is currently valuing this cash generating REIT.

See our latest analysis for Digital Realty Trust.

While the latest move has been muted, the 30 day share price return of a 5.9% decline and an 11.0% total shareholder return decline over the past year suggest momentum has been fading, even after a strong three year total shareholder return of 69.9%.

If you are comparing Digital Realty Trust with other data focused names, it could be useful to see which tech and AI names are catching attention in high growth tech and AI stocks.

With Digital Realty Trust reporting US$5.8b in revenue, US$1.4b in net income and trading at US$155.03, the key question is whether that recent share price weakness signals a potential opportunity or if the market is already fully reflecting expectations for the company.

Most Popular Narrative Narrative: 21.6% Undervalued

Compared with the last close of US$155.03, the most followed narrative sees fair value closer to US$197.78, built on detailed revenue and margin assumptions.

“The analysts have a consensus price target of $195.44 for Digital Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $140.0.”

Curious how steady revenue expansion, shifting profit margins and a rich future earnings multiple can still back a higher value than today’s price? The full narrative lays out the growth runway, the earnings trajectory and the valuation math that ties those moving parts together, step by step. It is all built around detailed forecasts for top line, profitability and share count that you will want to see for yourself before you decide what looks reasonable.

Result: Fair Value of $197.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view still depends on power constraints easing and today’s demand pipeline actually converting into profitable leases rather than stalling or being repriced.

Find out about the key risks to this Digital Realty Trust narrative.

Another Take: Multiples Flag A Richer Price

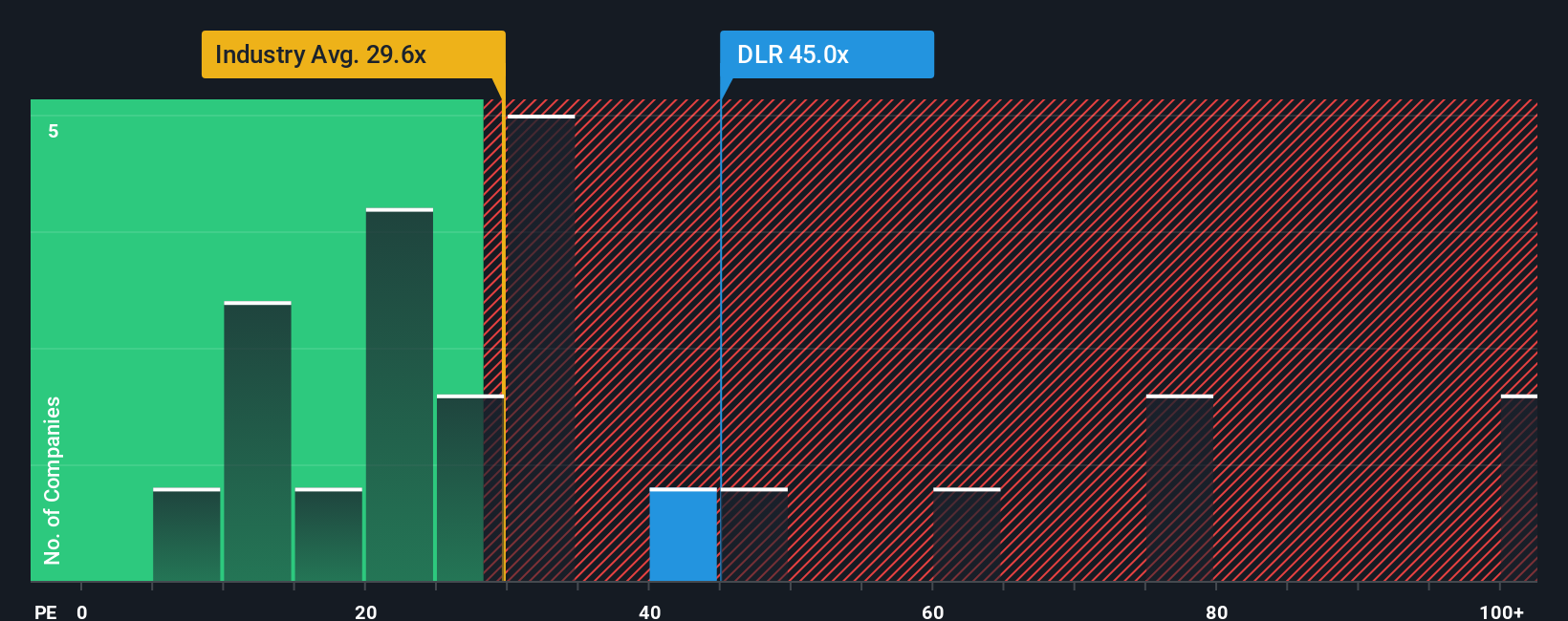

That 21.6% discount to fair value from the narrative sits against current valuation markers that look quite full. Digital Realty Trust trades on a P/E of 39.2x, compared with 27.3x for US Specialized REITs, 33.9x for peers, and an estimated fair ratio of 31.3x. Put simply, the shares already carry a premium, so the question is whether you are comfortable paying above both the sector and that fair ratio in the hope the long term AI and data center story plays out as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you see the numbers differently, or simply want to stress test these assumptions with your own inputs, you can spin up a custom view in just a few minutes: Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing opportunities that better match your goals, so consider broadening your watchlist with a few focused screens.

- Target potential bargains by scanning these 870 undervalued stocks based on cash flows to see how price and fundamentals line up in ways that may merit a closer look.

- Explore technology-driven changes by checking out these 25 AI penny stocks that are connected to artificial intelligence trends in data and automation.

- Support an income-focused approach by reviewing these 14 dividend stocks with yields > 3% that may offer yields above 3% along with business models you find comfortable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com