Assessing Sherwin-Williams (SHW) Valuation As Pricing Power And Cost Discipline Meet Key Earnings Test

Recent analyst commentary around Sherwin-Williams (SHW) has highlighted the company’s pricing power, brand strength, and cost discipline, with investors now looking to the upcoming earnings release as a key test of those themes.

See our latest analysis for Sherwin-Williams.

At a share price of $327.84, Sherwin-Williams has seen short term share price returns move slightly in both directions recently, while its 3 year total shareholder return of 42.72% contrasts with a slightly negative 1 year total shareholder return of 2.09%. This suggests momentum has cooled after a strong multi year run.

If the latest earnings will shape how you think about coatings and construction demand, it can also be a good time to cast the net wider and look at fast growing stocks with high insider ownership.

With shares at $327.84, a 3 year total return of 42.72% and a slightly negative 1 year move, the key question now is simple: is Sherwin-Williams quietly undervalued or is the market already pricing in future growth?

Most Popular Narrative: 15% Undervalued

With Sherwin-Williams last closing at US$327.84 against a narrative fair value of about US$385.81, the current setup leans in favour of upside according to that view.

The company's sustained focus on cost control, broad and deep restructuring (doubling annual savings targets to ~$80 million), and disciplined SG&A management is structurally improving fixed cost leverage and expected to yield improved net margins and earnings power as sales volumes recover.

Curious how modest sales growth assumptions combine with rising margins and a premium future P/E to get to that fair value? The earnings bridge behind this narrative leans heavily on efficiency gains, higher priced products and a rich profit multiple that is usually associated with faster growing sectors. Want to see exactly which revenue and earnings paths have to line up for that target to make sense?

Result: Fair Value of $385.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story can quickly fade if weak demand in key construction and DIY markets lingers, or if fixed manufacturing costs keep squeezing margins during softer volumes.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Earnings Multiple Flags Rich Pricing

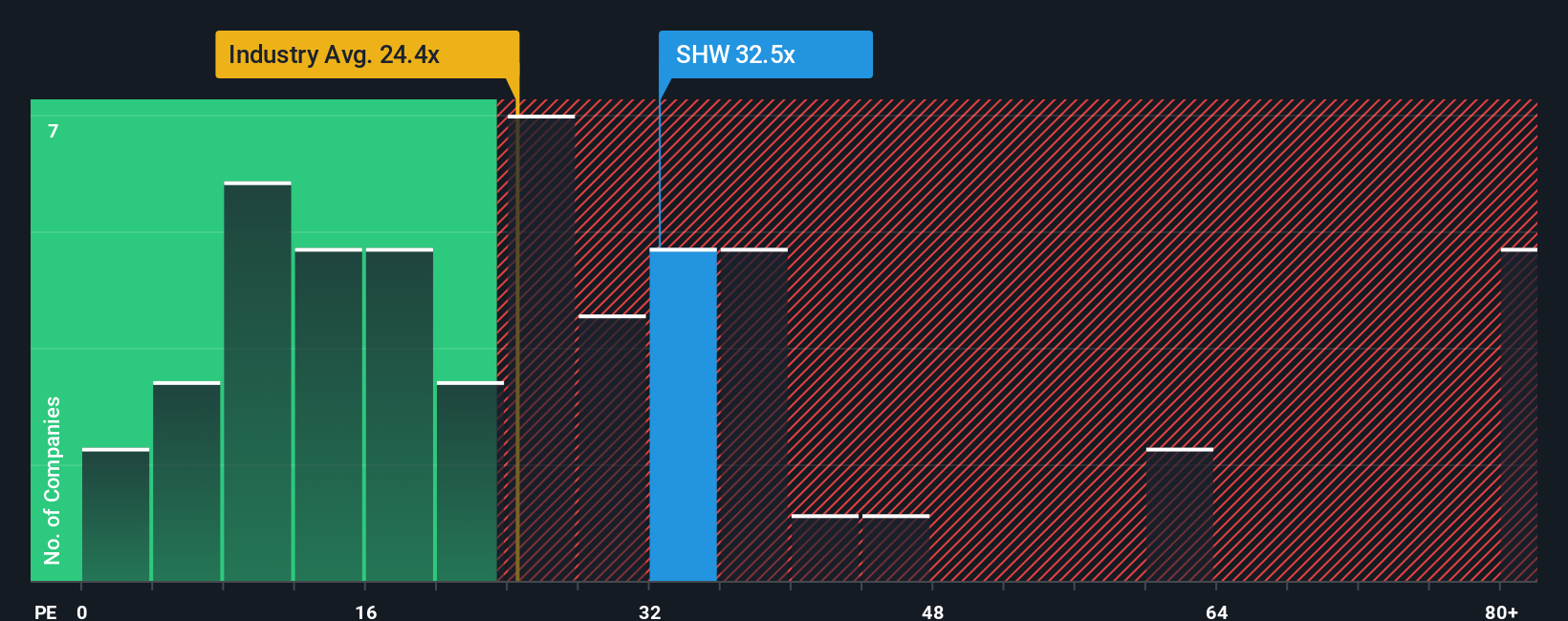

That 15% undervalued narrative sits awkwardly next to how the market is already pricing Sherwin-Williams. The shares trade on a P/E of 31.4x versus 23.7x for the US Chemicals industry, 24.7x for peers, and a fair ratio of 24.5x that the market could move toward.

In plain terms, you are paying a clear premium today, so the risk is that even solid execution does not stop a valuation reset if sentiment cools. The question is whether you think Sherwin-Williams has enough earnings resilience to keep that premium intact.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can create your own view in minutes, Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Sherwin-Williams has sharpened your thinking, do not stop there. Broaden your watchlist now so you are not late to the next opportunity.

- Target potential mispricings by scanning these 878 undervalued stocks based on cash flows that may offer more appealing cash flow based entry points.

- Tap into the AI trend early by checking out these 25 AI penny stocks that are linked to machine learning and automation themes.

- Zero in on income potential with these 14 dividend stocks with yields > 3% that offer yields above 3% for a more income focused watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com