A Look At Lindsay (LNN) Valuation After Mixed Earnings And International Irrigation Growth

Mixed earnings reaction puts Lindsay in focus

Lindsay (LNN) recently reported quarterly results, with revenue slightly ahead of analyst expectations but a significant shortfall on adjusted operating income, alongside strong international irrigation performance and a subsequent decline in the share price.

See our latest analysis for Lindsay.

At a share price of $121.15, Lindsay has seen short term price weakness reflected in a 90 day share price return of a 12.94% decline, while the 1 year total shareholder return of 4.15% points to modest longer term progress. This suggests momentum has softened recently as investors weigh earnings quality against international irrigation growth.

If the mixed reaction to Lindsay has you reassessing ideas, it could be a good moment to widen your search with fast growing stocks with high insider ownership.

With Lindsay trading at $121.15 alongside an indicated 26% intrinsic discount and an 8% gap to analyst targets, the key question is whether recent weakness offers value or whether the market already reflects future growth.

Most Popular Narrative: 7.5% Undervalued

With Lindsay closing at US$121.15 versus a narrative fair value of about US$131, the current setup hinges on how you view future earnings power.

The analysts have a consensus price target of $153.0 for Lindsay based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $136.0.

Curious what underpins that gap between fair value and the market price? Revenue stepping up, margins edging higher, and a future earnings multiple that needs to hold. The most followed narrative lays out the full earnings and valuation blueprint. The details might challenge how you think about this machinery name.

Result: Fair Value of $131 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still leans heavily on large FY25 irrigation and infrastructure projects landing on time, while softer North American irrigation demand could unsettle earnings.

Find out about the key risks to this Lindsay narrative.

Another Way To Look At Value

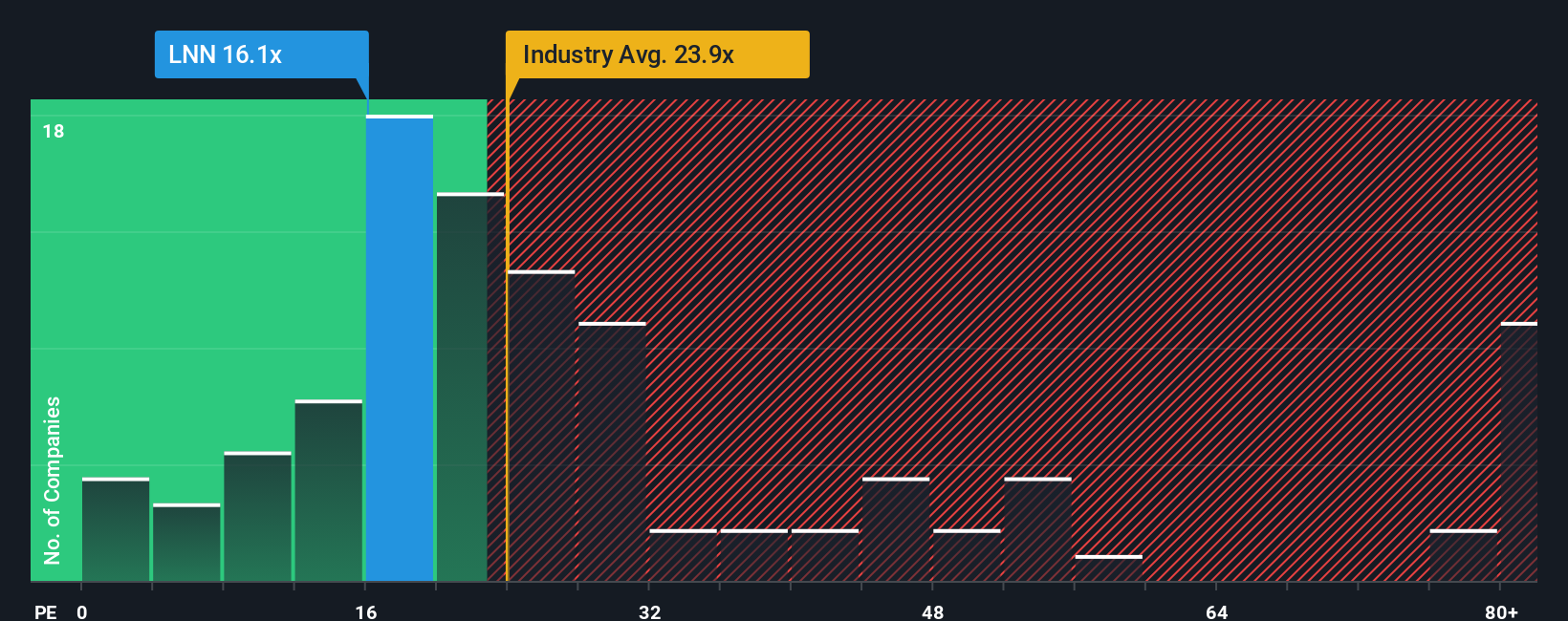

So far, the story leans on an intrinsic and narrative fair value that suggest upside. On plain earnings, though, Lindsay trades on a P/E of 17.3x versus a fair ratio of 16.3x. That gap implies the market is paying a bit above the level our fair ratio points to.

At the same time, Lindsay's 17.3x P/E sits below both direct peers at 20.8x and the wider US Machinery industry at 25.1x. On peers it looks cheaper, while on the fair ratio it looks a touch rich. Which reference point do you trust more when you think about risk and potential reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lindsay Narrative

If you look at these numbers and come to a different conclusion, or prefer your own interpretation based on the data, you can build a custom thesis in a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lindsay.

Ready for more investment ideas?

If Lindsay has sharpened your thinking, do not stop here. Broaden your watchlist with focused screens that surface fresh opportunities in just a few minutes.

- Target potential mispricing by scanning these 878 undervalued stocks based on cash flows that align with your view on quality, cash flows, and price.

- Ride major technology shifts by reviewing these 25 AI penny stocks that are building tools and platforms around artificial intelligence.

- Strengthen your income focus by checking these 14 dividend stocks with yields > 3% offering yields above 3% that might fit a cash return driven approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com