Yum Brands (YUM) Valuation Check After Latest Annual Revenue And Earnings Update

Yum! Brands (YUM) continues to attract attention after posting annual revenue of US$8.1b and net income of US$1.4b, prompting investors to reassess the fast food group’s recent share performance and value score.

See our latest analysis for Yum! Brands.

Yum! Brands’ recent results come after a period where the share price has moved to US$150.49, with a 30 day share price return of 3.81%, while the 1 year total shareholder return stands at 17.85%, suggesting momentum has been broadly positive.

If Yum! Brands’ performance has you reassessing the sector, it could be a good time to scan other quick service peers and related consumer names using fast growing stocks with high insider ownership.

With Yum! Brands generating US$8.1b in revenue, US$1.4b in net income and a recent 1 year total return of 17.85%, is the stock still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 9.1% Undervalued

The most followed valuation narrative puts Yum! Brands’ fair value at US$165.56, compared with the last close of US$150.49, framing the stock as modestly undervalued.

The asset-light, heavily franchised operating model minimizes capital intensity and allows for recurring, predictable cash flows while enabling rapid global expansion. Improved franchisee economics via proprietary tech (Byte) are described as supporting long-term operating profit and EPS growth. The increasing digital mix and expansion of direct-to-consumer channels are expected to support greater efficiency, improved order accuracy, and higher-margin sales, which is ultimately viewed as benefiting net margin and free cash flow over time as digital penetration continues to rise.

Curious what kind of revenue, margin and earnings profile supports that valuation gap, and how a higher future P/E is being justified against the sector? The narrative lays out a detailed earnings path, share count assumptions and a discount rate that all have to line up for that fair value to make sense.

Result: Fair Value of $165.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Yum! converting its digital and Taco Bell momentum into higher earnings while avoiding prolonged Pizza Hut softness and potential volatility in key international markets.

Find out about the key risks to this Yum! Brands narrative.

Another View: DCF Points The Other Way

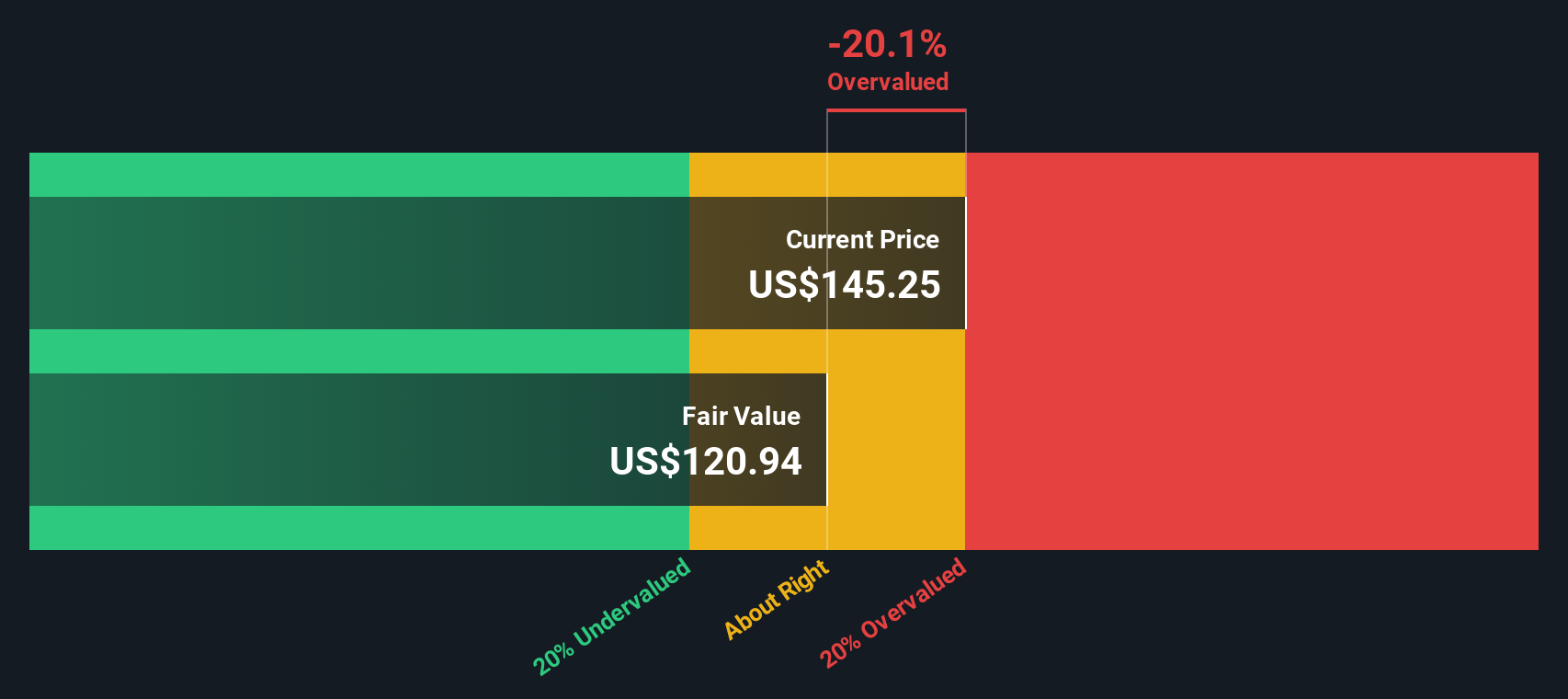

There is a twist when you look at Yum! Brands through our DCF model. On this basis, the estimated fair value sits at US$141.69, compared with the current price of US$150.49, which frames the shares as slightly overvalued rather than undervalued. It leaves you asking which story you trust more.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yum! Brands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yum! Brands Narrative

If you see the numbers differently, or simply prefer to weigh the data yourself, you can piece together a custom Yum! Brands view in minutes by starting with Do it your way.

A great starting point for your Yum! Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready to find your next idea?

If Yum! Brands has sharpened your focus, do not stop here. Widen your search and let the Simply Wall St Screener surface fresh, data driven opportunities.

- Spot potential value candidates early by scanning these 878 undervalued stocks based on cash flows that the market may be pricing conservatively based on their cash flows.

- Identify technology related opportunities by checking out these 25 AI penny stocks that are tied to artificial intelligence themes across different industries.

- Support an income focus by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% and can complement growth orientated holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com