A Look At Church & Dwight (CHD) Valuation After Recent Share Price Weakness

Church & Dwight stock in focus after recent share price moves

Church & Dwight (CHD) has come back into focus for investors after recent share price weakness, with the stock down over the past week, month, and past 3 months.

With the shares also showing a negative 1 year total return, investors are reassessing what the current price implies for this household and personal care products group.

See our latest analysis for Church & Dwight.

At a share price of $82.64, Church & Dwight’s recent share price softness, including a 7-day share price return decline of 3.16%, sits against a 1-year total shareholder return decline of 17.69% and modestly positive 3- and 5-year total shareholder returns. This pattern suggests momentum has been fading as investors reassess growth prospects and risk.

Given this weaker recent momentum, it can be helpful to compare Church & Dwight with other consumer and healthcare names using healthcare stocks to see how different business profiles and price moves line up.

With Church & Dwight trading at $82.64, a discount to one set of analyst price targets and some intrinsic value estimates, the key question is whether recent weakness leaves mispricing on the table or if markets already reflect future growth.

Most Popular Narrative Narrative: 15% Undervalued

With Church & Dwight last closing at $82.64 against a narrative fair value of about $97.26, the valuation story hinges on modest growth and resilient profitability.

International growth remains robust, with Church & Dwight's international segment delivering mid single digit organic growth and successfully launching core U.S. brands abroad (e.g., HERO in 50 countries within 12 months), increasing geographic diversification and mitigating regional volatility, enhancing longer term revenue stability and earnings resiliency.

Want to see what kind of revenue curve and margin lift need to line up for that fair value to hold up? The narrative leans on steadier sales growth, fatter margins, and a future earnings multiple that assumes investors stay willing to pay up. Curious how those moving parts fit together across the next few years? Read on to see the assumptions that really drive this valuation call.

Result: Fair Value of $97.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can break if weaker household and personal care categories, or ongoing input cost and tariff pressure, reduce the margin gains that support this narrative.

Find out about the key risks to this Church & Dwight narrative.

Another View: What Earnings Multiples Are Signalling

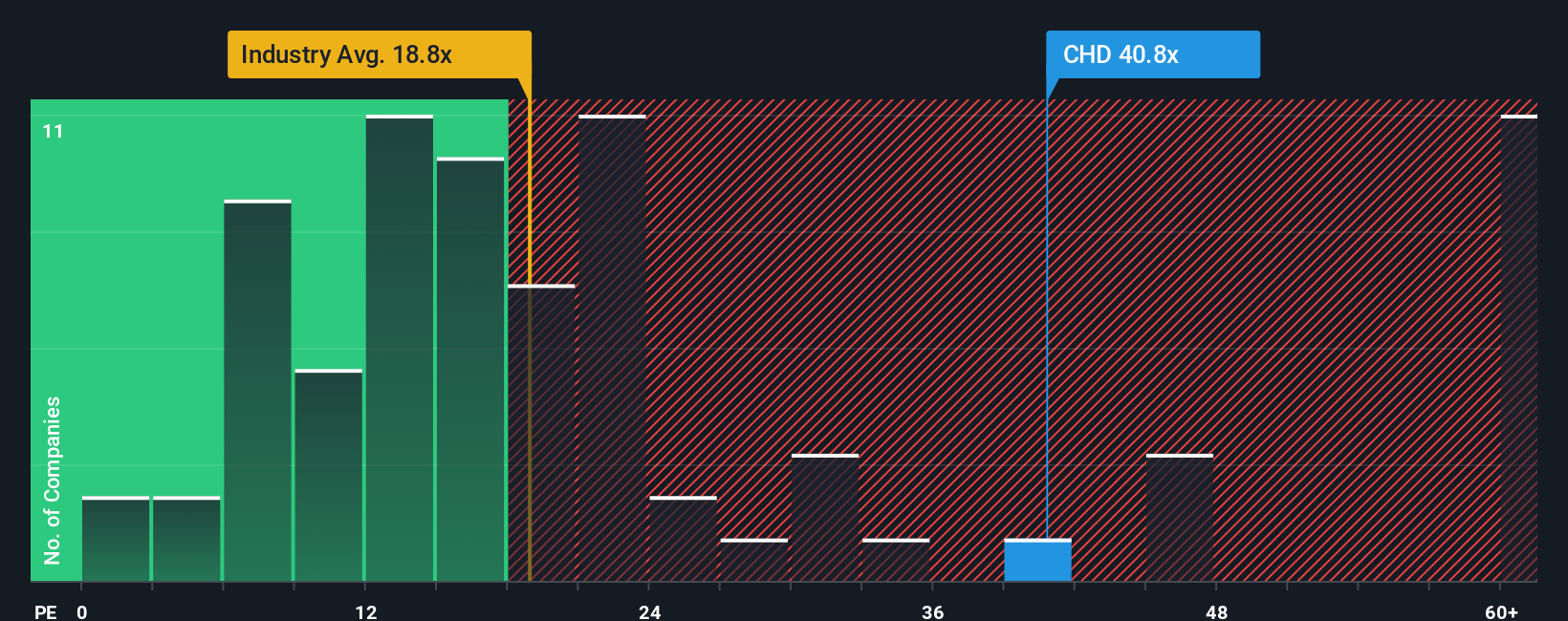

So far, the story leans on a fair value of about $97.26 that suggests Church & Dwight is undervalued. If you look instead at the current P/E of 25.4x versus a fair ratio of 17.4x and peer averages around 17x, the picture flips, pointing to a richer price tag and less margin for error.

That kind of gap can matter in practice, because it leaves less room if growth or margins come in below expectations. The question for you is simple: are you comfortable paying a premium multiple when other methods hint at value, or do you back the cheaper fair ratio that the market could move toward over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Church & Dwight Narrative

If you see the numbers differently or prefer to test your own assumptions, you can quickly build a personalised view and stress test it with Do it your way.

A great starting point for your Church & Dwight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Church & Dwight has you thinking about what else might be out there, now is the time to widen your watchlist and test a few fresh angles.

- Target potential value by checking out these 878 undervalued stocks based on cash flows that line up strong cash flows with prices that may not fully reflect them yet.

- Spot potential growth stories early by scanning these 25 AI penny stocks that are tying artificial intelligence to business models and financials.

- Refine an income-focused approach by reviewing these 14 dividend stocks with yields > 3% that combine higher yields with underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com