A Look At First Quantum Minerals (TSX:FM) Valuation After Cobre Panamá Political Uncertainty

Event driven uncertainty around Cobre Panamá

Recent political developments around First Quantum Minerals (TSX:FM)'s flagship Cobre Panamá copper mine have pushed operational risk to the forefront for investors, raising questions about future production reliability and business stability.

See our latest analysis for First Quantum Minerals.

Those headlines around Cobre Panamá have arrived alongside a 30 day share price return of 11.95% and a 90 day share price return of 18.68%, while the 1 year total shareholder return sits at 92.32%. This suggests momentum has been strong even as risk perceptions shift.

If political risk around a single asset feels concentrated, you might want to balance it with other ideas in resources and beyond, including fast growing stocks with high insider ownership.

With a CA$37.29 share price, mixed signals on intrinsic value, and political risk front and center, the real question is whether this copper producer is trading at a discount or if the market is already pricing in future growth?

Price-to-Sales of 4.5x: Is it justified?

At a CA$37.29 share price, First Quantum Minerals is trading on a P/S of 4.5x, which screens cheaper than both its peers and the wider Canadian metals and mining group.

P/S compares the company’s market value to its revenue, so for a miner like FM, it effectively tells you how much investors are paying for each dollar of current sales, regardless of whether profits are still settling after a return to profitability.

FM is described as good value on this basis, with its 4.5x P/S sitting just under the peer average of 4.6x and well below the Canadian metals and mining industry average of 7.3x. It is also described as expensive relative to an estimated fair P/S ratio of 4x, a level the market could shift toward if sentiment cools. Explore the SWS fair ratio for First Quantum Minerals

Result: Price-to-Sales of 4.5x (ABOUT RIGHT)

However, this hinges on two big swing factors: how political decisions affect Cobre Panamá, and whether current revenue and net income growth prove sustainable.

Find out about the key risks to this First Quantum Minerals narrative.

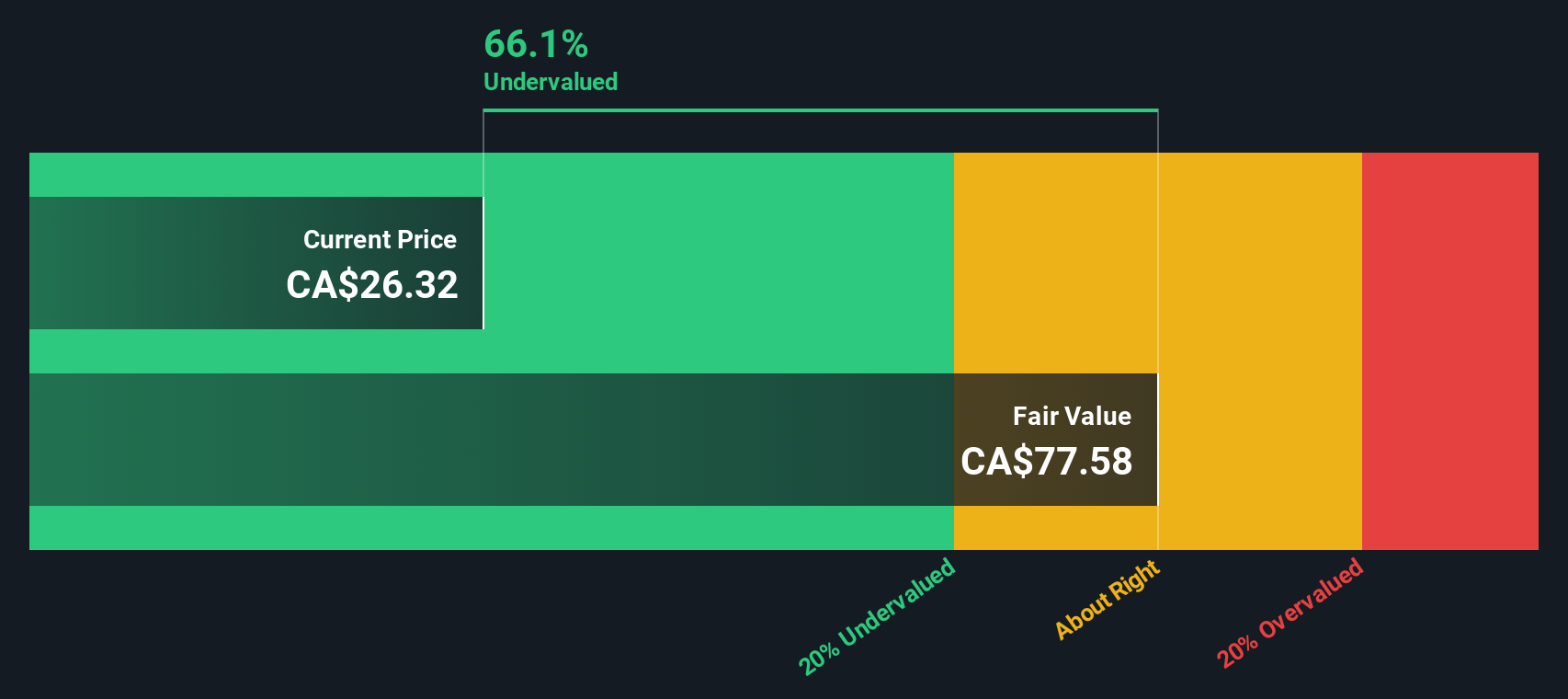

Another View: Our DCF model points to a much higher value

While the 4.5x P/S suggests First Quantum Minerals is roughly in line with peers, our DCF model paints a very different picture. On that approach, the CA$37.29 share price sits about 64.6% below an estimated fair value of CA$105.42, which points to a large gap between market price and modelled cash flows.

That kind of mismatch can reflect real risk, conservative assumptions in the market, or optimism in the model, so it is worth asking which side of that debate you feel more comfortable with.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Quantum Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Quantum Minerals Narrative

If the story here does not quite match your view, or you would rather work from the raw numbers yourself, you can build a custom thesis in just a few minutes and Do it your way

A great starting point for your First Quantum Minerals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company. Use the screeners below to widen your opportunity set fast.

- Spot potential turnaround stories early by scanning these 3562 penny stocks with strong financials that already have stronger financials behind them.

- Target future facing themes by focusing on these 25 AI penny stocks that sit at the intersection of artificial intelligence and market growth.

- Put value first by filtering for these 878 undervalued stocks based on cash flows that may offer more cash flow for every dollar you commit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com