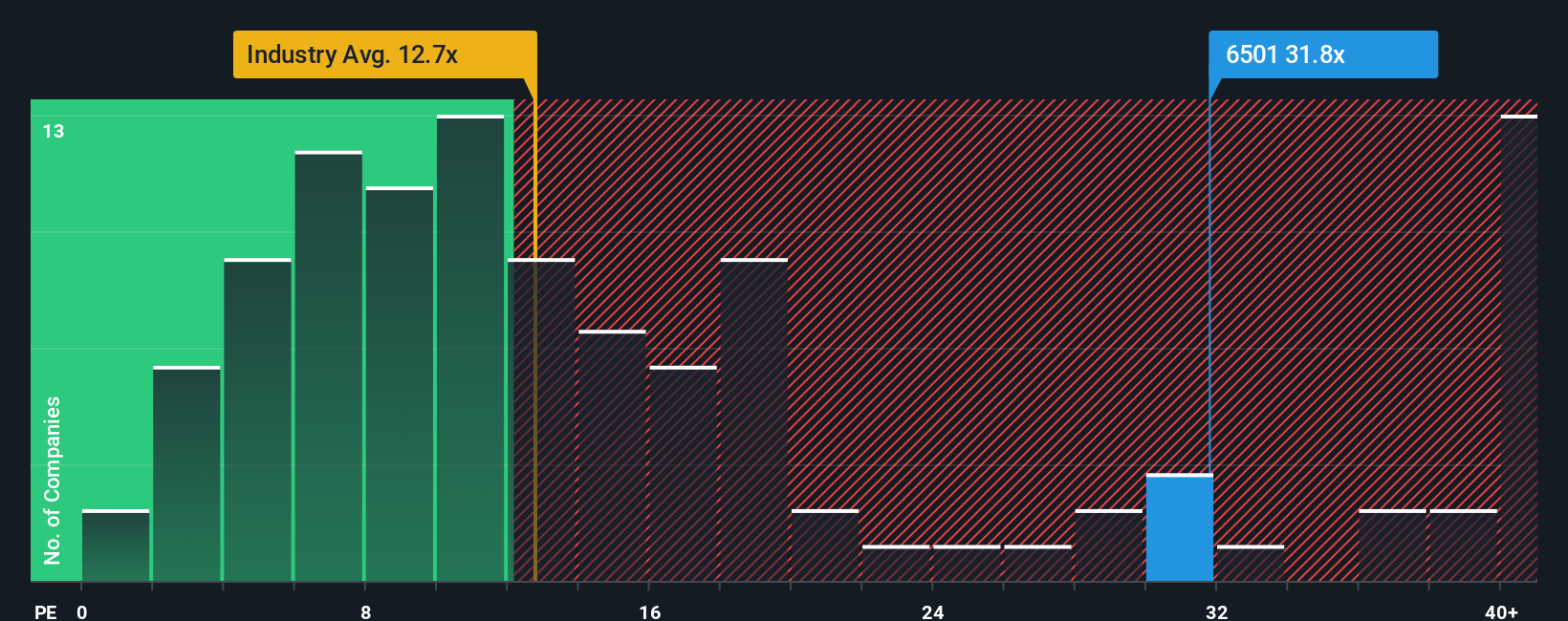

Assessing Hitachi (TSE:6501) Valuation As Transformer Shortage Threatens Grid Expansion Plans

Hitachi (TSE:6501) is back in focus after its UK leadership warned that shortages of high voltage transformers and other electrical equipment could slow grid expansion and complicate plans for clean electricity by 2030.

See our latest analysis for Hitachi.

The warning over transformer shortages lands after a strong run in the shares, with a 90 day share price return of 13.30% and a 1 year total shareholder return of 29.13%, while the 5 year total shareholder return of 537.60% points to momentum that has been sustained over a longer period.

If you are thinking about how grid investment and electrification could benefit other parts of the market, it may be worth scanning aerospace and defense stocks for companies exposed to large infrastructure and power projects.

With a value score of 1, an intrinsic value estimate that sits well above the current ¥5,068 share price, and only a modest discount to analyst targets, investors now have to ask whether there is still an opportunity to add shares at an attractive valuation or if the market is already pricing in the company’s future prospects.

Most Popular Narrative: 8.1% Undervalued

On this narrative, Hitachi’s fair value of ¥5,515 sits above the ¥5,068 last close, setting up a valuation story rooted in long term earnings power.

Expansion of the Lumada digital platform and related digital services, including synergies from recent acquisitions like GlobalLogic and the increasing adoption of generative AI solutions, are accelerating high-margin recurring revenues in IT and modernization projects, enhancing overall profit margins and long-term earnings growth.

Curious how recurring digital revenues, profit margins and a premium future P/E all tie together into that fair value? The narrative spells out the full earnings roadmap.

Result: Fair Value of ¥5,515 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh risks such as weaker demand from customers exposed to tariffs and higher project costs that could pressure margins and delay expected earnings progress.

Find out about the key risks to this Hitachi narrative.

Another View On Valuation

That 8.1% undervalued fair value hinges on long term earnings power, but the current ¥5,068 price also ties back to a P/E of 28.7x. That is more than double the Asian Industrials average of 11.3x, even though the fair ratio is 35.6x. Is this a quality premium you are comfortable paying, or a margin of safety that feels too thin?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hitachi Narrative

If you are not convinced by this view or prefer to work through the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Hitachi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are ready to widen your watchlist beyond Hitachi, the Simply Wall Street Screener can surface fresh ideas that fit the kind of opportunities you care about most.

- Target potential value opportunities by scanning these 878 undervalued stocks based on cash flows that may offer attractive pricing relative to their cash flow profiles.

- Ride the momentum in artificial intelligence by focusing on these 25 AI penny stocks that are directly exposed to this fast-moving theme.

- Position for income-focused returns by filtering for these 14 dividend stocks with yields > 3% that may suit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com