Assessing RH (NYSE:RH) Valuation After Tariff Delay Eases Pressure On Costs And Margins

The Trump administration’s decision to delay planned tariff hikes on furniture imports has eased some pressure on RH (RH), which had been dealing with higher costs and supply chain disruptions.

See our latest analysis for RH.

That relief has coincided with a sharp 20.09% 1 month share price return to US$193.41 and a 7.96% 1 day jump. However, the 1 year total shareholder return of 53.39% decline and 5 year total shareholder return of 60.40% decline show that longer term momentum has been fading.

If tariff headlines have you rethinking where growth could come from next, it might be a good moment to broaden your search with fast growing stocks with high insider ownership.

With RH trading near US$193.41 and an estimated intrinsic value suggesting roughly a 50% discount, yet only a small gap to analyst targets, you have to ask yourself: is there a genuine opportunity here, or is future growth already fully priced in?

Most Popular Narrative: 3.6% Undervalued

RH’s most followed narrative pegs fair value close to US$200.65, only slightly above the last close at US$193.41, which frames a relatively tight valuation gap.

The analysts have a consensus price target of $262.25 for RH based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $436.0, and the most bearish reporting a price target of just $179.0.

Want to see how modest top line expansion, much higher margins, and a lower future earnings multiple still point to upside? The full narrative lays out the cash flow math behind that conclusion.

Result: Fair Value of $200.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that potential upside sits alongside tariff uncertainty and a fragile housing market, either of which could pressure RH’s margins and invalidate the current narrative.

Find out about the key risks to this RH narrative.

Another View: Earnings Power Versus Price Tag

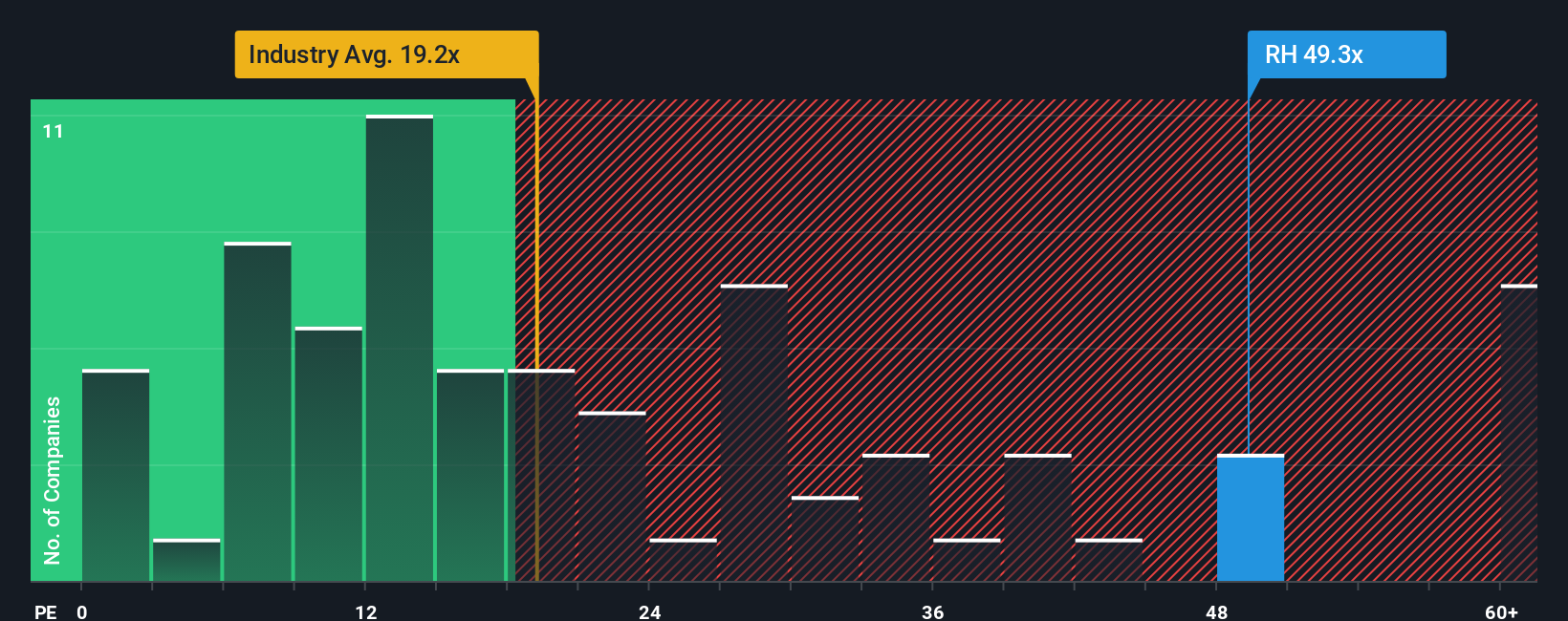

So far you have seen a fair value anchored around US$200.65, only slightly above the current US$193.41. Yet on a simple P/E lens, RH looks expensive, trading on 33x earnings compared with 19.8x for the US Specialty Retail industry and 17.7x for peers.

The fair ratio for RH is 30.2x, which is below the current 33x. That gap may not look huge, but it suggests the market is already assigning a richer price than both the broader group and the level our fair ratio points to. This raises the question: how much room is really left if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you think the data tells a different story, or simply want to test your own assumptions, you can build a personalised view in minutes: Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If RH has sharpened your thinking, do not stop here. Widening your search now could be the difference between spotting opportunity early and reacting late.

- Target potential mispricing by scanning these 876 undervalued stocks based on cash flows that appear attractively priced relative to their cash flows and fundamentals.

- Tap into artificial intelligence themes by reviewing these 25 AI penny stocks that are building real businesses around machine learning and data driven products.

- Strengthen your income watchlist by checking out these 14 dividend stocks with yields > 3% that may offer yields above 3% alongside established payout records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com