Assessing Welltower (WELL) Valuation After Strong Long Term Returns And Premium Earnings Multiple

Why Welltower is on investors’ radar today

Without a single headline event setting the tone, interest in Welltower (WELL) is being driven by its role in seniors and wellness housing and how its recent share performance compares with its longer term track record.

See our latest analysis for Welltower.

The share price is at $186.94 after a recent 8.5% 1 month share price return decline. However, a 90 day share price return of 8.06% and a 1 year total shareholder return of 53.34% show that longer term momentum has been strong.

If Welltower has you looking closer at healthcare real estate, it can be useful to compare it with a wider set of healthcare stocks that focus on similar demand drivers.

With the shares near $186.94 and long term returns already strong, the key question is whether Welltower’s exposure to the silver economy is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 9.9% Undervalued

With Welltower closing at $186.94 against a narrative fair value near $207, the current share price sits below what this widely followed view suggests.

The analysts have a consensus price target of $180.368 for Welltower based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $146.0.

Want to see what kind of revenue climb and profit margin shift could justify that high earnings multiple? The narrative leans on punchy earnings growth, richer margins and a premium valuation that looks more like a high growth story than a typical REIT.

Result: Fair Value of $207.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher inflation or weaker senior housing occupancy could pressure margins, while large acquisitions and equity issuance may weigh on earnings per share.

Find out about the key risks to this Welltower narrative.

Another angle: rich multiples instead of a bargain tag

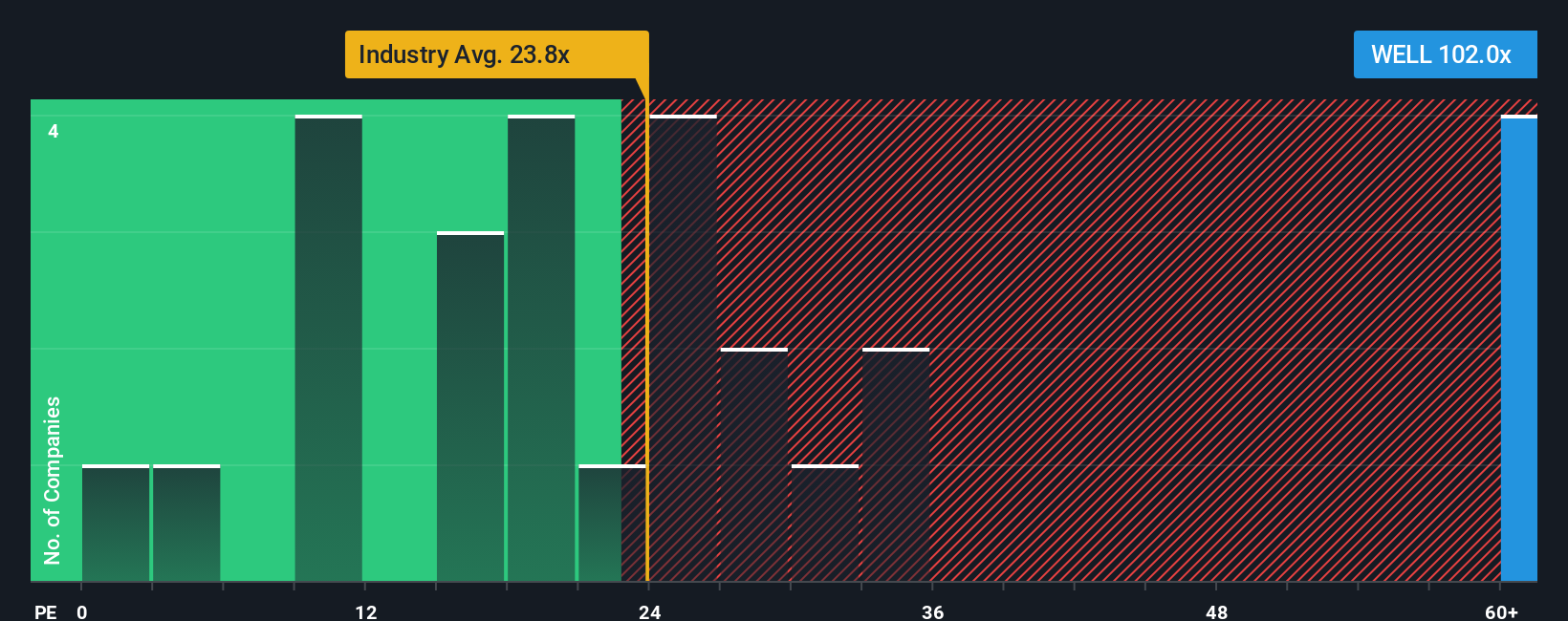

That 9.9% “undervalued” narrative sits awkwardly with how the market is actually pricing Welltower. The shares trade on a P/E of 133.6x, compared with 59.1x for peers and 25.9x for the wider Global Health Care REITs group. Our fair ratio sits at 39.5x. That gap points to a lot of optimism already in the price, so the real question is which story you trust more: the premium multiple or the optimistic growth path.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you are not convinced by this view or prefer to lean on your own work, you can build a data driven Welltower story yourself in minutes, starting with Do it your way.

A great starting point for your Welltower research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Welltower has sharpened your thinking, do not stop here. Widen your watchlist with a few focused idea lists that can keep fresh opportunities on your radar.

- Hunt for smaller names with stronger balance sheets and fundamentals using these 3564 penny stocks with strong financials that could offer a very different risk and reward profile.

- Target companies using artificial intelligence in healthcare through these 29 healthcare AI stocks and see which businesses pair medical expertise with data driven decision making.

- Zero in on cash flow focused opportunities by scanning these 876 undervalued stocks based on cash flows that currently screen as cheaper relative to their estimated cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com