Klarna Group (KLAR) Valuation Checked After Class Action Lawsuits And Loss Reserve Concerns

Klarna Group (NYSE:KLAR) is under pressure after multiple law firms launched securities class action lawsuits tied to its September 2025 IPO. The suits focus on alleged disclosure issues around loss reserves on its buy now, pay later loans.

See our latest analysis for Klarna Group.

The legal headlines arrive after a weak run for the stock, with a 30.9% decline in the 90 day share price return and an 8.8% decline in the 1 month share price return, suggesting momentum has been fading even before the latest class action announcements.

If this kind of volatility has you looking further afield, it could be a useful moment to compare Klarna with other digital finance names and check out high growth tech and AI stocks.

With Klarna posting US$3,209.0m in revenue, a net loss of US$224.0m and the share price now well below some analyst targets, you have to ask: is the legal overhang creating a discount, or is the market already pricing in future growth?

Price-to-Sales of 3.4x: Is it justified?

Klarna is trading on a P/S ratio of 3.4x, which sits between a peer average of 3.7x and a US Diversified Financial industry average of 2.5x.

The P/S multiple compares the company’s market value to its revenue, so it is often used for high growth or loss making businesses where earnings based ratios are less useful.

Compared with similar peers, the current 3.4x P/S suggests the market is not assigning a premium multiple across the board. However, it is also not pushing Klarna to a clear discount relative to that peer group.

Set against the broader US Diversified Financial industry, the same 3.4x P/S looks materially richer than the 2.5x average, which implies investors are accepting a higher revenue multiple than the sector overall.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 3.4x (ABOUT RIGHT)

However, you still have to weigh the ongoing class action risk and Klarna’s recent share price declines, which could keep sentiment around the stock fragile.

Find out about the key risks to this Klarna Group narrative.

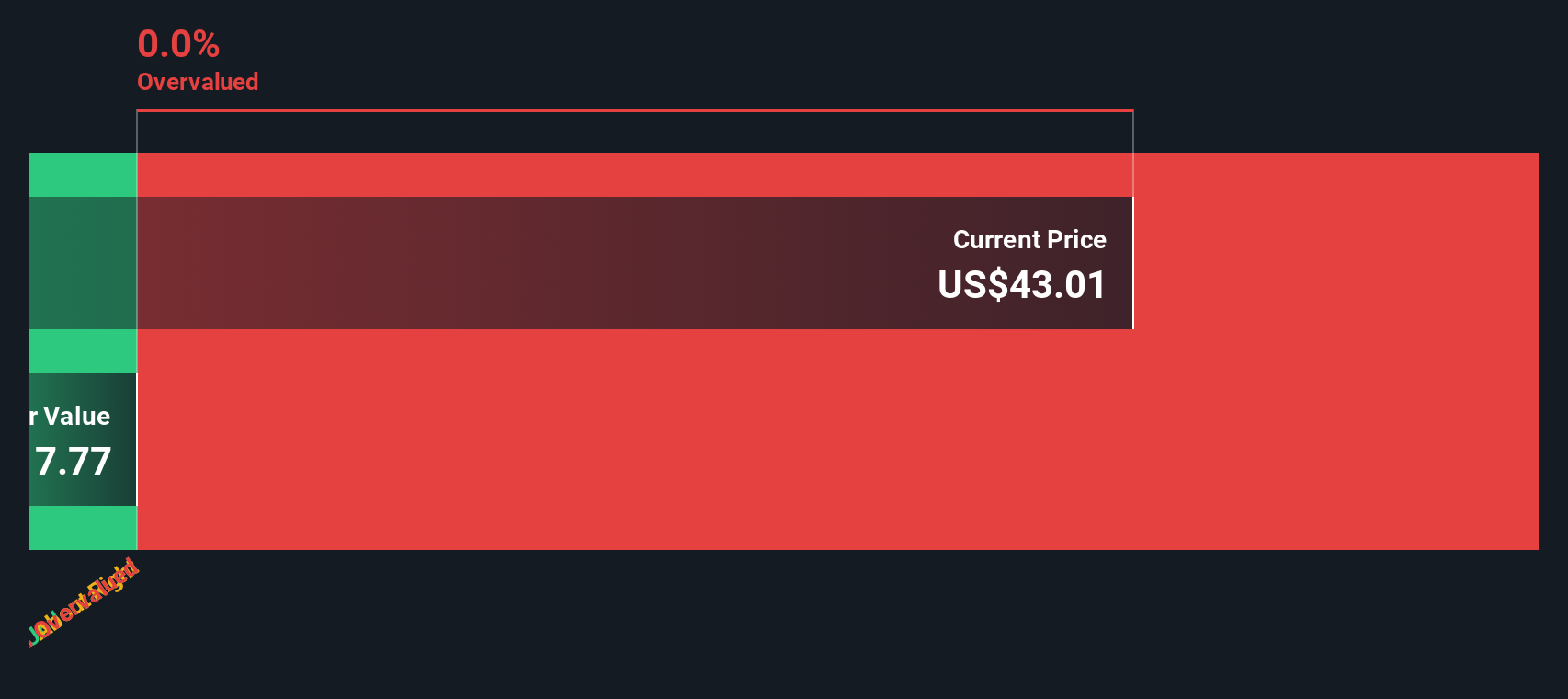

Another View: Our DCF Model Flags Klarna as Expensive

While the 3.4x P/S ratio looks roughly in line with peers, our DCF model points in a different direction. On that framework, Klarna at US$28.57 sits above an estimated fair value of US$15.27, which signals potential downside if markets lean back toward cash flow based pricing.

Look into how the SWS DCF model arrives at its fair value.

That leaves you with a simple question: do you put more weight on revenue based peer comparisons, or on the SWS DCF model’s view of future cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klarna Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klarna Group Narrative

If you see these figures differently, or prefer digging into the numbers yourself, you can shape your own Klarna view in a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klarna Group.

Looking for more investment ideas?

If Klarna has caught your attention, do not stop here. The next move could come from a completely different corner of the market.

- Spot potential value gaps by reviewing these 876 undervalued stocks based on cash flows that align more closely with your preferred pricing discipline.

- Target early stage growth themes by scanning these 3564 penny stocks with strong financials that already show solid underlying financials.

- Position yourself in a fast evolving theme by monitoring these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com