The Bull Case For Hammond Power Solutions (TSX:HPS.A) Could Change Following Rising AI And Electrification Demand

- Hammond Power Solutions recently reported that demand for its specialized transformers and power solutions has been supported by AI data centers, EV charging infrastructure and utility grid upgrades, reinforcing the role of its products in critical electrification and technology projects.

- This mix of data-center, transport electrification and grid-modernization exposure highlights how Hammond is tied to multiple long-term infrastructure spending themes rather than a single end market.

- Next, we’ll examine how this AI data center-driven demand pulse may reshape Hammond Power Solutions’ existing investment narrative and outlook.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hammond Power Solutions Investment Narrative Recap

To own Hammond Power Solutions, you need to believe that its role in transformers for AI data centers, EV charging and grid upgrades can support resilient demand despite its cyclical industrial roots. The latest update that these projects are driving orders does not radically change the story, but it does reinforce the key short term catalyst: keeping new and existing facilities running efficiently enough to protect margins while input costs, supply chains and end markets remain volatile.

Among recent announcements, the steady CA$0.275 quarterly dividend across 2024 and 2025 stands out in this context, because it points to a business that currently generates sufficient cash to return capital even as it invests in capacity and manages cost inflation and operational ramp up. For investors watching how AI and electrification translate into real, durable earnings, this mix of growth exposure and ongoing cash returns is an important piece of the puzzle, but it also raises questions about...

Read the full narrative on Hammond Power Solutions (it's free!)

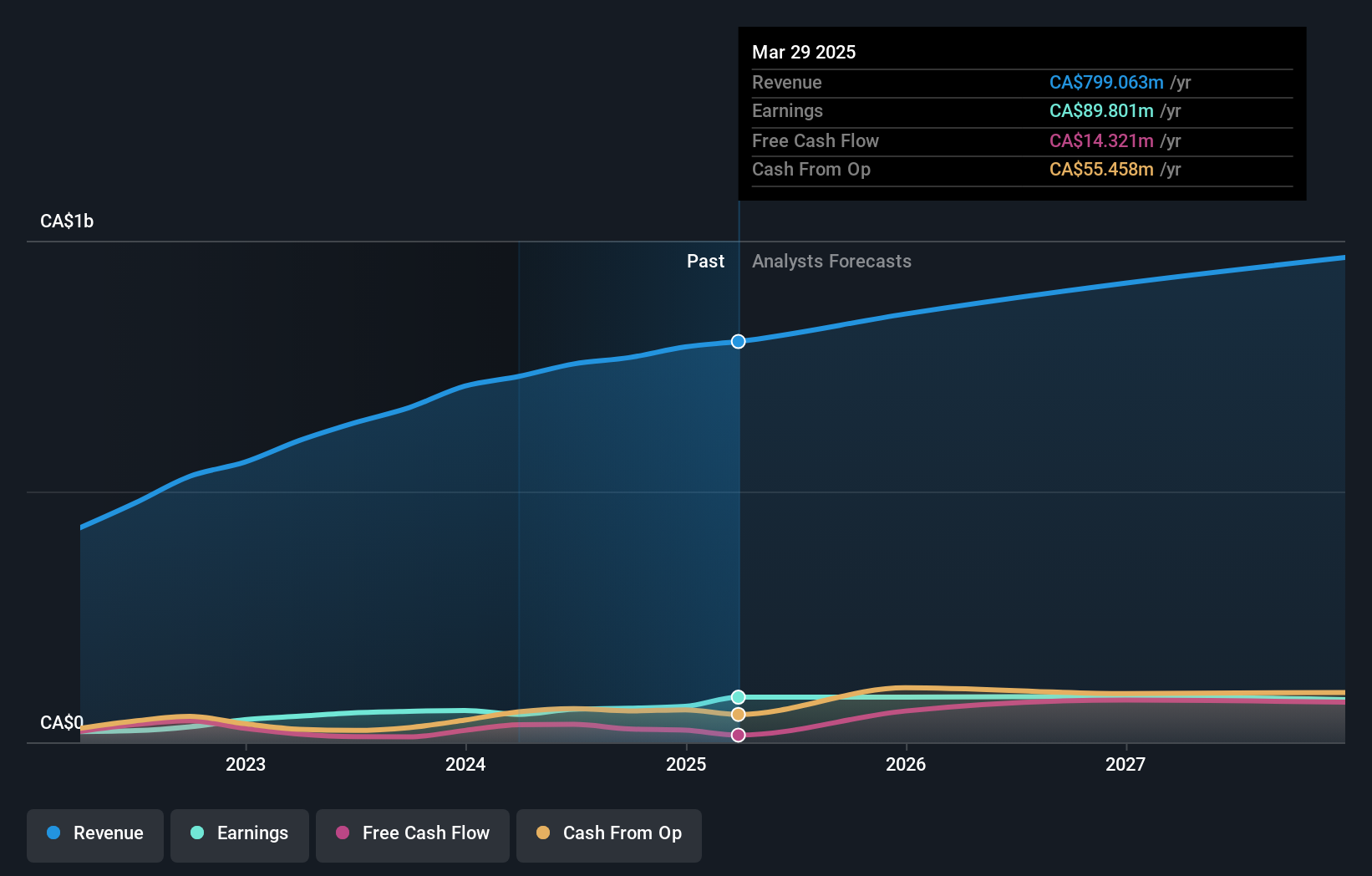

Hammond Power Solutions' narrative projects CA$1.0 billion revenue and CA$94.1 million earnings by 2028. This requires 6.7% yearly revenue growth and about a CA$14.5 million earnings increase from CA$79.6 million today.

Uncover how Hammond Power Solutions' forecasts yield a CA$215.25 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly CA$99 to CA$215 per share, so you are seeing very different views of Hammond Power Solutions. Against that wide range, Hammond’s dependence on cyclical end markets like data centers and grid projects reminds you that understanding both the upside from electrification and the risk of demand swings can be just as important as the headline numbers.

Explore 7 other fair value estimates on Hammond Power Solutions - why the stock might be worth 39% less than the current price!

Build Your Own Hammond Power Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hammond Power Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hammond Power Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hammond Power Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com