IPO News | Zhongan Information Technology reports that the Hong Kong Stock Exchange ranks fourth among enterprise-level AI solution providers with large vertical model capabilities in China

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 5, Zhongan Information Technology (Shenzhen) Co., Ltd. (abbreviation: Zhongan Information Technology) submitted a listing application to the main board of the Hong Kong Stock Exchange, with ICBC International and Guolian Securities International as co-sponsors. According to the prospectus, according to Frost & Sullivan data, in terms of 2024 earnings, Zhongan Information Technology ranked fourth among enterprise-level AI solution providers with large vertical model capabilities in China.

Company profile

According to the prospectus, Zhongan Information Technology is an enterprise-level AI solution provider focusing on intelligent marketing and intelligent transportation management solutions.

The following figure shows the company's business model and full-stack solutions:

Zhongan Information Technology's growing customer base reflects its partnerships with various industries. The cumulative number of customers served by Zhongan Information Technology grew from 88 as of December 31, 2023 to 241 as of December 31, 2024, and further expanded to 338 as of September 30, 2025, with a compound annual growth rate of 63.1%.

Zhongan Information Technology provides intelligent marketing and intelligent transportation management solutions to help customers accelerate AI deployment, improve operation and marketing efficiency, expand business scale, and strengthen competitiveness. By combining advanced technology, including large-scale model-driven application capabilities, knowledge engineering and AI agent scheduling, and deep industry insight and commercial knowledge, the company provides solutions that combine technical excellence and operational efficiency to help customers achieve sustainable and scalable AI transformation.

Zhongan Information Technology's intelligent marketing business is centered around XK-QianAI, Qiannexus, and intelligent marketing systems to build a systematic intelligent customer operation framework that can be reused. The framework revolves around customer lifecycle management and integrates customer segmentation, strategy formulation, product matching, equity incentive operation, and multi-channel interaction to form an executable end-to-end workflow that drives continuous operation through data insight and marketing intelligence.

Zhongan Information Technology's intelligent transportation management solutions provide enterprises with AI-driven capabilities to improve operational efficiency in decision-making, business management, R&D and risk management. The solution helps enterprises transition from manual operation to intelligent management driven by AI. These solutions provide automated workflow execution, intelligent decision support, real-time monitoring, and predictive analytics.

XK-QianAI is the technical foundation for Zhongan Xinke's intelligent solutions. Through this platform, the company provides customers with technical support to transform raw data into structured assets and integrate AI functions into intelligent marketing and intelligent transportation management solutions. As of September 30, 2025, XK-Qianai has: more than 1,200 COT, more than 18,000 CoT nodes; and has deployed more than 1,000,000 knowledge bases in production environments.

Financial data

Earnings

In 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 226 million, RMB 309 million, and RMB 290 million, respectively.

Profit during the year

In 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual profit of RMB 1.082 million, RMB 33.231,000, and RMB 31655 million, respectively.

Mōri

The company recorded gross profit of RMB 309.24 million, RMB 83.984 million, and RMB 118 million in 2023, 2024, and 2025 for the nine months ending September 30, respectively.

Industry Overview

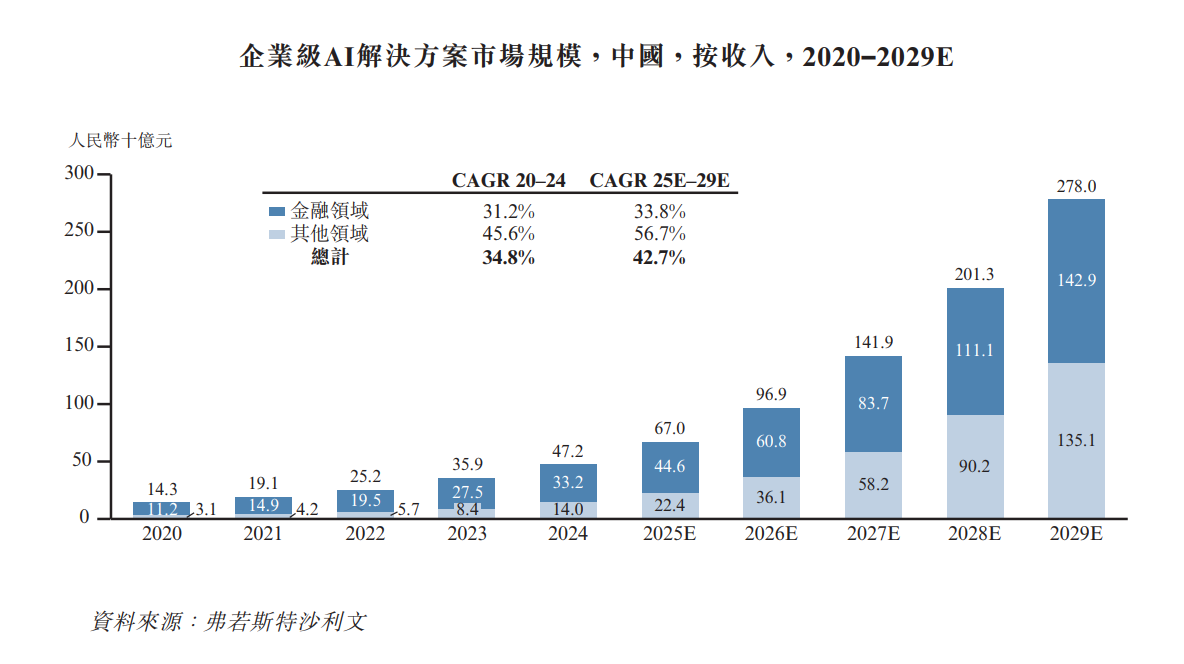

The enterprise AI solution market in China is undergoing a period of rapid development. The market size is growing from RMB 14.3 billion in 2020 to RMB 47.2 billion in 2024, with a compound annual growth rate of 34.8%. The market size is expected to expand to RMB 278 billion by 2029, and the compound annual growth rate from 2025 to 2029 is 42.7%. This growth is due to the technological iteration of AI machine learning and the need for digital transformation of enterprises. The future growth rate declined slightly and entered a period of steady growth. As technology advances, Chinese enterprise-grade AI solutions can serve a target market (SAM) of nearly 10 trillion yuan, reflecting the market segment that a specific product or service can actually cover or service.

In terms of segmentation, China's market for enterprise-grade AI solutions in the financial sector continues to grow, with a compound annual growth rate of 31.2% from 2020 to 2024, and is expected to grow to 33.8% from 2025 to 2029. The future growth rate will slow down, and the market size is expected to reach RMB 142.9 billion by 2029.

Driven by the trend of deep iteration of AI technology and the accelerated penetration of enterprise digital transformation, the market size of enterprise AI solutions with large vertical modeling capabilities in China has reached RMB 5 billion in 2024. It is expected to maintain a high growth trend in the future, and the market penetration rate and commercialization efficiency will continue to improve.

The AI agent system is equipped with diverse functional modules such as risk control, compliance, and intelligent marketing. Relying on multi-agent coordination mechanisms, it can achieve cross-system task orchestration and integration of internal and external intelligent resources. The market for enterprise-grade AI agents in China is growing rapidly. China's enterprise-grade AI smart device market reached RMB 2.48 billion in 2024, and will explode to RMB 38.91 billion by 2029, with a compound annual growth rate of 73.4% from 2024 to 2029. In 2024, the penetration rate of enterprise-level AI agents in the enterprise AI solutions market reached 5.3%, and is expected to grow to 14.0% by 2029. This growth is mainly due to significant enhancements in AI agents' ability to make autonomous decisions, call tools, and adapt scenarios brought about by advances in AI big model technology, driving the continuous enrichment of application scenarios for AI agents in various industries.

Board Information

The board of directors of Zhongan Information Technology consists of eight directors, including three executive directors, two non-executive directors and three independent non-executive directors. The term of office of directors is three years and can be re-elected; however, according to relevant Chinese laws and regulations, the cumulative term of office of independent non-executive directors shall not exceed six years.

Shareholding structure

On the last practical date, the controlling shareholder of Zhongan Information Technology, Zhongbank Youmi, along with Zhongbank Youhai, ZBC Youchen, ZBC Youxu, Zhongxing Tiger, Mr. Yu Feng, Mr. Zhou Zhengyu, Mr. Mao Yifeng, Mr. Wang Min, and Mr. Niu Chenghao, have the right to exercise voting rights incidental to about 38.93% of the company's total issued share capital through their shares.

Zhongxing Hu Xian is a limited company and is also the general partner of Zhongxing Youmi. Its largest shareholder is Mr. Yu Feng, who holds 90% of its shares. Mr. Yu Feng is the executive director of Zhongan Information Technology.

Zhongxing Youhai is a limited partnership, and its general partner is Zhongxing Hujiao. Mr. Niu Chenghao and Mr. Zhou Zhengyu are limited partners of Zhongxing Youhai. They hold about 53.92% and 46.08% of ZBC Youhai's partnership interests respectively. Mr. Zhou Zhengyu is the executive director of Zhongan Information Technology.

Intermediary team

Co-sponsors: ICBC International Finance Co., Ltd., Guolian Securities International Capital Markets Limited

The company's legal advisors: Jiayuan Law Firm, Shanghai Chengming Zezheng Law Firm

Co-sponsor's legal adviser: A recent law firm, Jingtian Gongcheng Law Firm

Reporting Accountant: PricewaterhouseCoopers

Industry Advisor: Frost & Sullivan