Assessing Hyatt Hotels (H) Valuation After Recent Share Price Strength

Hyatt Hotels (H) is back on investor radars after recent share price moves, with the stock last closing at US$165.57. That sets the stage for a closer look at its returns and fundamentals.

See our latest analysis for Hyatt Hotels.

That recent 3.27% 1 day share price return and a 6.13% 30 day share price return come on top of a 14.41% 90 day gain, while the 5 year total shareholder return of 128.66% points to strong longer term momentum.

If Hyatt’s move has you looking beyond a single stock, this could be a good moment to broaden your watchlist with: fast growing stocks with high insider ownership.

With Hyatt reporting annual revenue of US$3,339.0m and a net loss of US$88.0m, plus an estimated 11.78% intrinsic discount, the key question is whether today’s price reflects fair value or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 2.3% Undervalued

Against Hyatt’s last close at US$165.57, the most followed narrative pegs fair value a little higher, setting up a modest undervaluation story.

The analysts have a consensus price target of $156.947 for Hyatt Hotels based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $198.0, and the most bearish reporting a price target of just $140.0.

Curious how Hyatt’s projected revenue curve, shrinking margins and future earnings multiple all knit together into that fair value? The full narrative lays out the numbers driving this call.

Result: Fair Value of $169.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in booking behavior in key U.S. markets, along with economic volatility affecting travel budgets and financing, could both put pressure on Hyatt’s revenue and margins.

Find out about the key risks to this Hyatt Hotels narrative.

Another Angle On Valuation

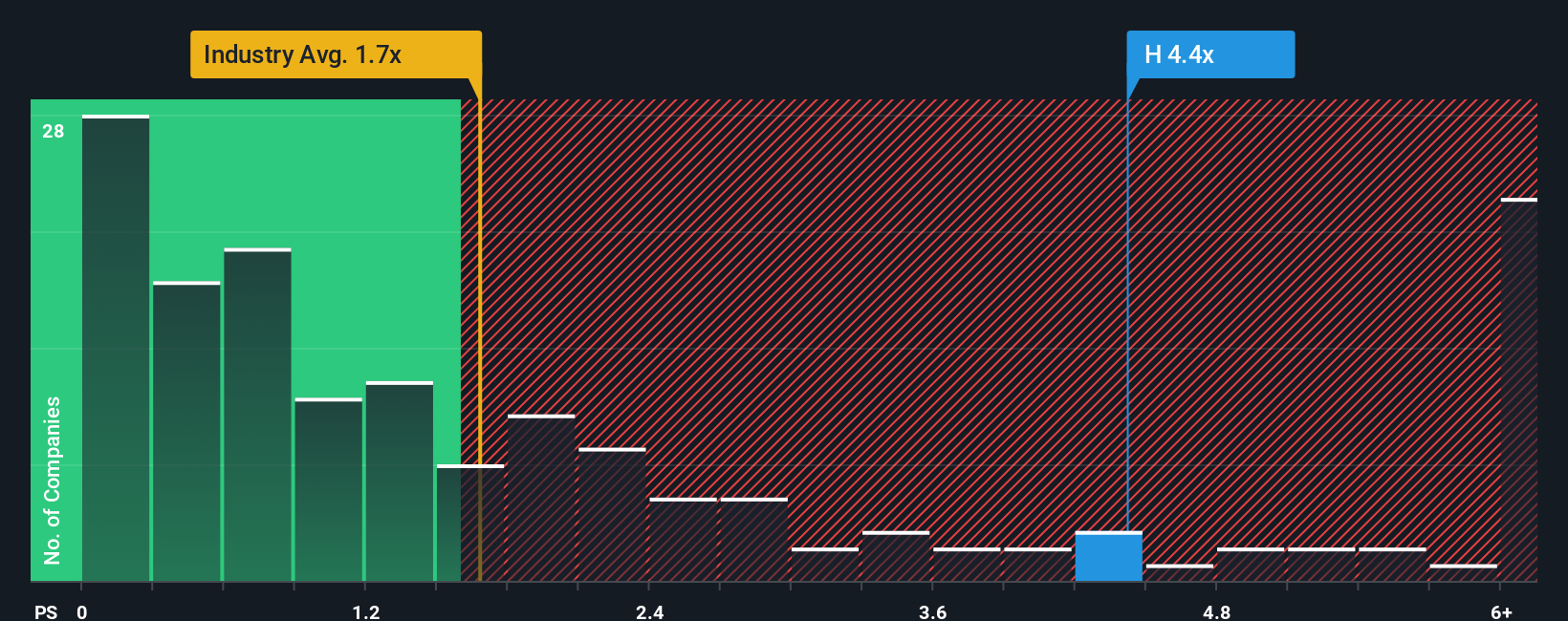

While the earlier fair value of US$169.43 comes from the analyst driven narrative, Hyatt’s P/S of 4.7x tells a different story. That multiple sits well above peers at 2.9x and the fair ratio of 3.3x, which points to richer pricing and less room for error. Which signal do you weigh more heavily?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hyatt Hotels Narrative

If you see the story differently, or simply want to stress test the assumptions with your own inputs, you can build a custom view in a few minutes, starting with Do it your way.

A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hyatt has sparked your interest, do not stop there. Widen your search with data driven stock ideas that match the way you like to invest.

- Spot potential early movers by scanning these 3564 penny stocks with strong financials that pair smaller share prices with solid underlying financials.

- Position yourself in the AI trend by checking out these 25 AI penny stocks aimed at companies tying artificial intelligence to real business models.

- Hunt for value focused ideas through these 875 undervalued stocks based on cash flows that highlight stocks priced below estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com