FTAI Aviation (FTAI) Is Up 14.3% After Launching CFM56-Powered Data Center Turbine Platform

- FTAI Aviation has launched FTAI Power, a new platform that converts widely used CFM56 aircraft engines into 25-megawatt aeroderivative gas turbines to supply flexible, cost-efficient power for data centers and other electricity-intensive users, with production targeted to start in 2026.

- By repurposing one of the world’s most common engine types and leveraging its own fleet of over 1,000 CFM56 units, FTAI is seeking to extend the engine’s life into the power market and address multi-year backlogs for reliable grid solutions.

- We’ll now examine how FTAI’s push to repurpose CFM56 engines for data centre power could reshape its existing engine-centric investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FTAI Aviation Investment Narrative Recap

To own FTAI Aviation, you need to be comfortable with a business built around monetizing mid‑life aircraft engines and expanding higher‑margin services. The launch of FTAI Power adds a new use case for CFM56 engines and could become a meaningful short term catalyst if early commercial traction appears, but it also heightens concentration risk around a single legacy platform and execution risk in an adjacent power market.

The recent earnings update, with revenue up 43.2% year on year and higher full year EBITDA guidance, is particularly relevant here because it shows the core Aerospace Products engine business already carrying higher expectations. Against that backdrop, the sharp share price move following the FTAI Power announcement suggests investors are treating this new platform as an add‑on to an already high‑growth narrative, rather than a replacement for existing engine maintenance and leasing catalysts.

Yet investors should be aware that heavier reliance on legacy CFM56 economics could become a double edged sword if...

Read the full narrative on FTAI Aviation (it's free!)

FTAI Aviation's narrative projects $3.7 billion revenue and $1.1 billion earnings by 2028. This requires 19.8% yearly revenue growth and about a $683.5 million earnings increase from $416.5 million today.

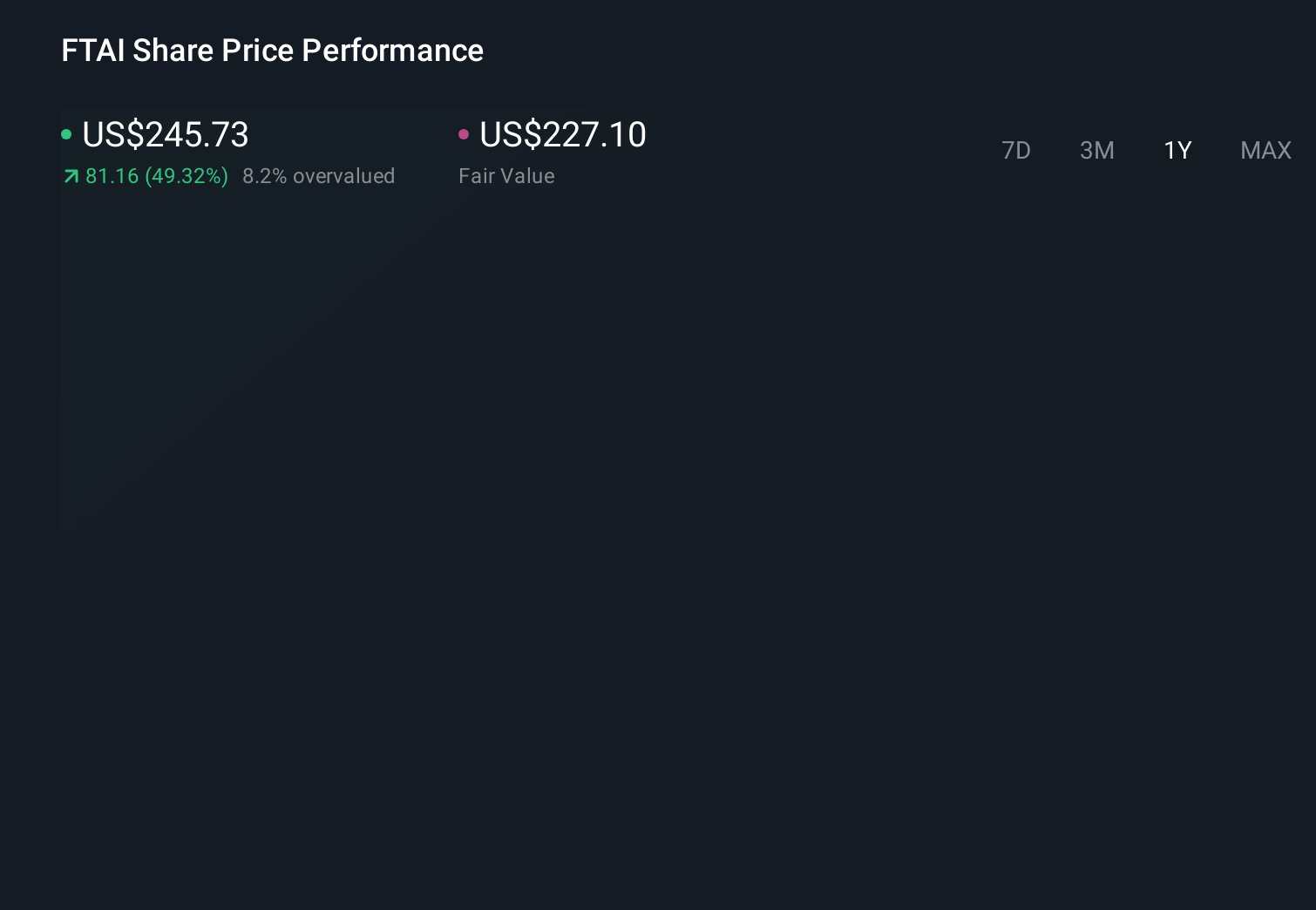

Uncover how FTAI Aviation's forecasts yield a $227.10 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range widely, from US$16.83 to US$227.63 per share, underscoring how far apart individual views can be. When you set that against FTAI’s growing dependence on legacy engine platforms and the new FTAI Power initiative, it highlights why many investors may want to weigh several different assessments of how durable those engine economics really are.

Explore 4 other fair value estimates on FTAI Aviation - why the stock might be worth less than half the current price!

Build Your Own FTAI Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTAI Aviation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FTAI Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTAI Aviation's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com